Key Takeaways

- A crypto whale transferred 20 million XRP worth $58.22 million from Upbit, hinting at potential accumulation.

- Price action suggests a quick fall if the price fails to hold the $2.75 support level.

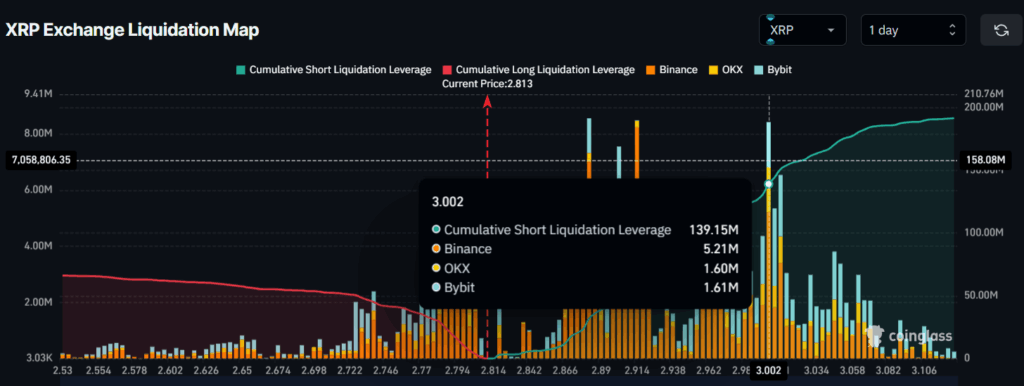

- Trader sentiment appears bearish, with $139.15 million worth of short positions recorded at the $3.002 level.

The sentiment shift in the crypto market has dragged XRP to a support level of $2.75, a make-or-break point. Despite the price being at this key level, whales appear to be accumulating the token as they appear to be following a buy-the-dip strategy.

Whale Adds 20 Million XRP

Crypto transaction tracker Whale Alert shared a post on X, noting that a crypto whale transferred a significant 20 million XRP worth $58.22 million from Upbit. However, the wallet address remains unknown.

Such transactions in the crypto landscape typically hint at whale accumulation and reflect growing interest in the asset.

Current Price and Experts’ Comment

Today, the overall crypto market recorded a dip of 1.69%, pulling XRP down by 2.45%. Following the decline, the asset is currently trading near the $2.80 level. However, investor and trader participation has soared amid the drop, with trading volume rising 37% to $7.2 billion.

Rising trading volume during a price decline suggests that the majority of market participants are interested in pushing the price downward.

Despite the asset’s price decline, several optimistic posts have appeared on X. Some suggest that XRP is consolidating below its all-time high, similar to 2017 before it witnessed a parabolic move.

Others shared posts with charts, noting that XRP appears to be setting up for a massive move as it forms a triple-bottom pattern on the daily chart.

Price Action and Upcoming Level

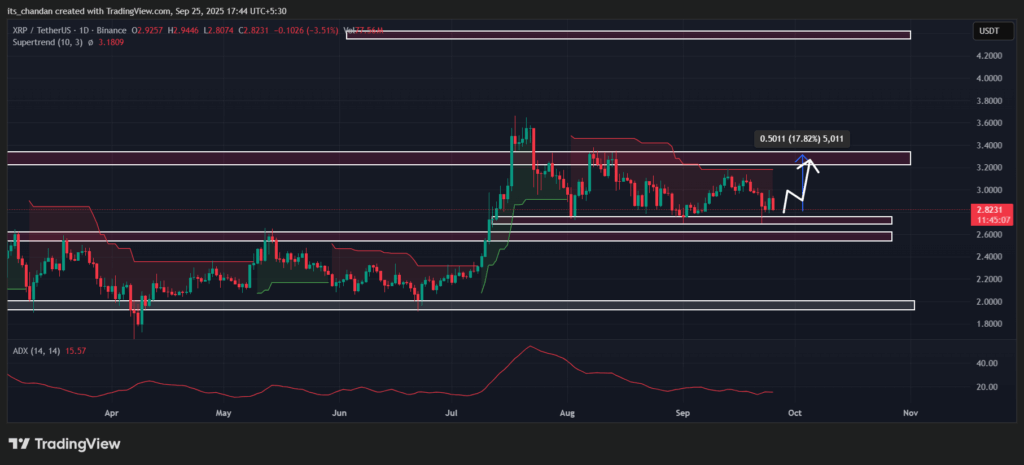

According to TimeCrypto’s technical analysis, XRP is currently at a key support level of $2.70, a make-or-break point. On the daily chart, the asset has tested this level more than five times since mid-July 2025, and each time it has shown upside momentum.

Based on the current price action, if the asset holds this support level, there is a strong possibility that history may repeat and the price could see a 17% upside rally. On the other hand, if XRP fails to hold this support, it may face a sharp sell-off and a quick downside move.

The technical indicators Supertrend and Average Directional Index (ADX) are flashing bearish signals.

On the daily timeframe, the Supertrend remains in red and hovers above the current price, indicating the asset is in a downtrend. Meanwhile, the ADX has dropped to 15, well below the threshold of 25, signaling weak momentum and the absence of a strong trend direction.

XRP’s Major Liquidation Level

Amid market uncertainty, traders are following the current trend and appear to be strongly betting on the bearish side.

Coinglass, an on-chain analytics tool, reveals that XRP’s major liquidation levels stand at $2.794 on the lower side and $3.002 on the upper side. At these levels, traders are over-leveraged, with $15.20 million worth of long positions and $139.15 million worth of short positions.

This metric indicates that trader sentiment toward XRP is bearish, and a quick fall could be possible if the asset drops below the $2.79 level.