Key Takeaways

- The current price action hints that Solana (SOL) is back in an uptrend and is poised to hit the $270 level.

- $91.11 million worth of short positions could be liquidated if the price crosses the $231.50 level.

- Experts have shared several bold predictions, with some targeting $320 to $360, while others expect a range of $650 to $1,000.

Solana’s (SOL) 3.5% price jump is putting millions of dollars in short positions at risk, sparking panic among bearish traders. It has not only triggered fears but also moved SOL back into a bullish pattern, suggesting a potential major rally on the horizon.

Solana (SOL) Current Price Momentum

Today, SOL reclaimed the $230 level, which it had lost in September 2025, with a 3.5% gain. As the asset’s price continues to rise, fear among short holders is mounting.

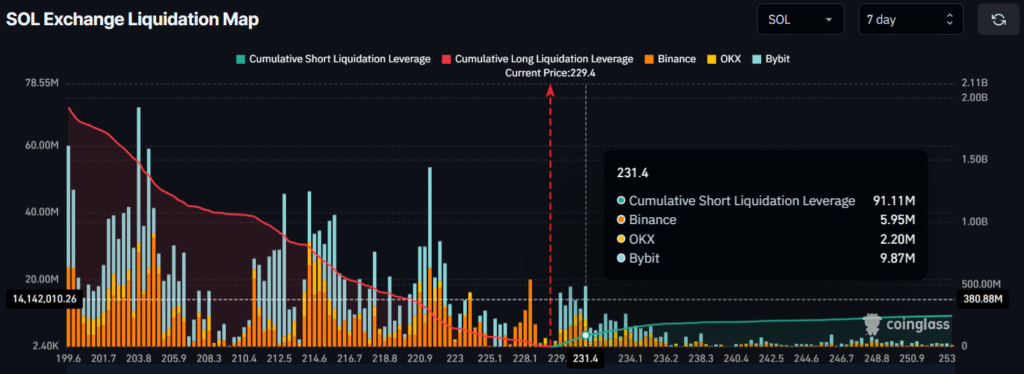

Major Liquidation Levels

Coinglass reveals that the recent jump in SOL has already cleared major hurdles, liquidating $15.92 million worth of short positions. At press time, SOL’s key liquidation levels, built by traders over the past seven days and still active, stand at $221.5 on the lower side and $231.4 on the upper side.

At these levels, traders have built $287.78 million worth of long positions, compared to $91.11 million in short positions. This data clearly shows that bulls have strong dominance in the asset, while bears appear to be exhausted.

If the current sentiment continues and the price crosses the $231.5 level, $91.11 million worth of short positions built over the past seven days will be liquidated. Additionally, it could also clear another hurdle, potentially triggering a quick rally in SOL’s price.

Also Read: Cboe Pushes for SEC Approval of Invesco Galaxy Spot Solana ETF

Solana (SOL) Price Action and Technical Analysis

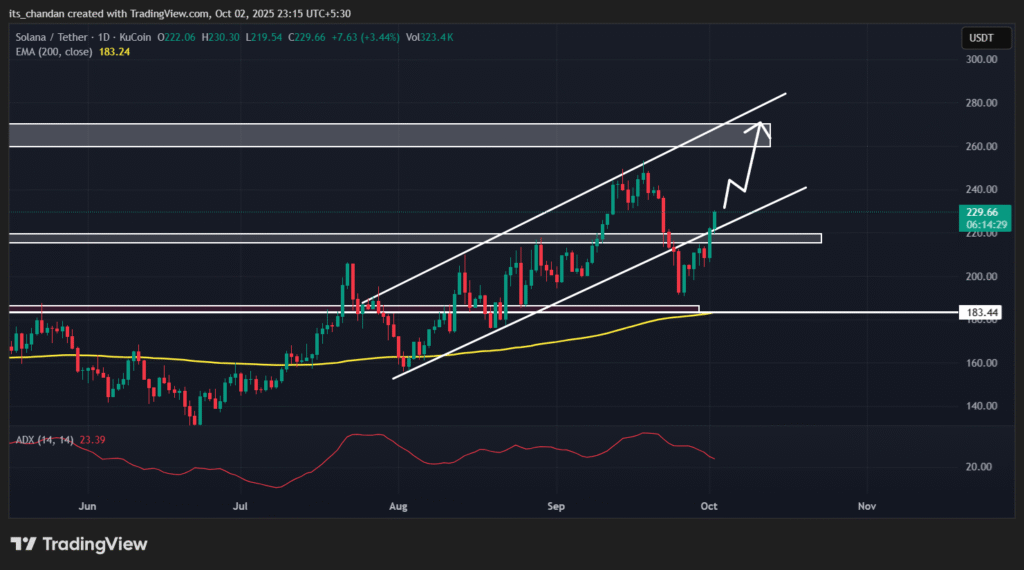

TimesCrypto technical analysis reveals that SOL is back in an uptrend, hovering within a bullish ascending channel pattern on the daily chart. The price action shows that the asset has been moving in this pattern since the beginning of August 2025.

Based on the current price action, if the upside momentum continues and SOL clears the $231.50 hurdle, it could see a price surge of 16.5% and may reach the $270 level or even higher.

Expert Price Prediction for SOL

Given the current market sentiment, several bold predictions have surfaced on X. Some shared price targets, while others suggested when to sell.

The targets shared by experts range from $320 to $360, with some predicting SOL could reach $650 to $1,000. However, one expert noted that a SOL sell wall stands at the $250 level.

Technical Analysis Signal Short Correction

Despite bullish price action, SOL’s technical indicator, Supertrend, continues to hold a red trend above the asset price, indicating that the asset remains in a downtrend, and a pullback could occur.

Meanwhile, the Average Directional Index (ADX) has reached 23, close to the threshold of 25, suggesting that the current trend is gaining strength but hasn’t fully confirmed a strong move yet.