Key Takeaways

- The US SEC decision on the spot Solana (SOL) ETF is scheduled for October 10, 2025.

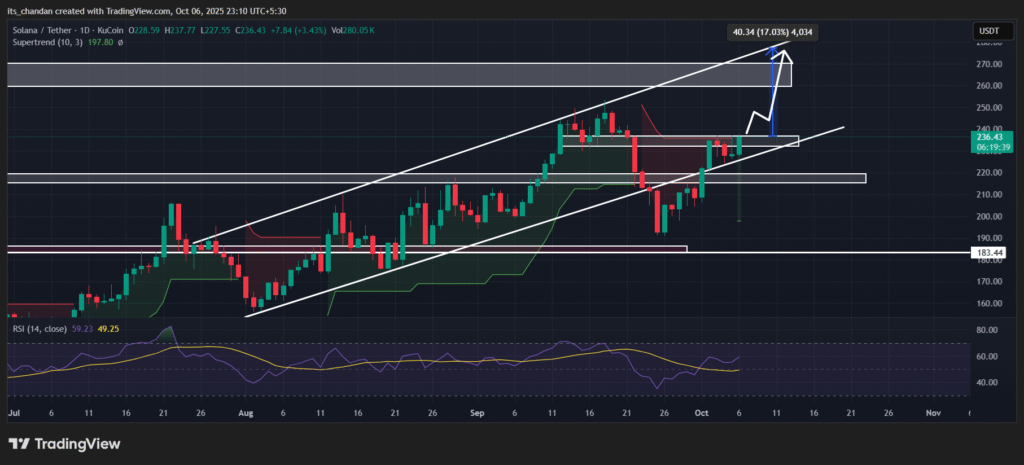

- Solana’s price action suggests that if SOL clears the $237 level, it could rise over 17% and potentially reach $275.

- Experts have made bold predictions, noting that SOL could reach $500 by the end of the year.

Solana (SOL) price action hints at a major rally as anticipation builds ahead of the United States Securities and Exchange Commission’s (SEC) decision on its spot Exchange-Traded Fund (ETF). The final deadline for the SEC’s ruling is set for October 10, 2025, just four days away, fueling bullish sentiment among traders.

SEC Decision for Solana (SOL) ETF Nears

Several asset management firms, including Grayscale, VanEck, 21Shares, Fidelity, Bitwise, and Franklin, are awaiting approval for the spot SOL ETF applications. Reports indicate the odds of approval have reached 95%, indicating a huge week ahead for Solana. Amid this, an expert noted that if the SOL ETF gets the green light, Solana could enter a new chapter of institutional adoption.

Adding to the bullish momentum, crypto transaction tracker Whale Insider shared a post on X revealing that Nasdaq-listed “Solana Company” has purchased $530 million worth of SOL for its treasury.

Current Price Momentum

As per TradingView data, SOL appears strong, having jumped 3.50% over the past 24 hours to trade at the $237.20 level. During this period, investors and traders have shown strong interest in the token, resulting in a 17% surge in trading volume to $6.90 billion, as per CoinMarketCap data.

Solana (SOL) Price Action and Upcoming Levels

According to TimesCrypto’s technical analysis, SOL is in an uptrend but is currently trading at a level that has a history of price reversals. On the daily chart, $237 acts as a strong resistance level, marking the fifth retest since October 2, 2025. In the past five instances, whenever the price reached this level, it faced selling pressure followed by downside momentum.

Based on the current price action, market sentiment appears bullish as Bitcoin (BTC) hits new all-time highs and Ethereum (ETH) breaks out of its prolonged descending channel pattern. If this sentiment remains unchanged, SOL could successfully break above the $237 resistance level and see a 17% price uptick, potentially reaching the $275 level in the near future. On the other hand, if SOL fails to breach this level, history may repeat once again, and the price could continue to move sideways.

Expert Predictions and Technical Indicators

Meanwhile, several bold predictions have recently surfaced. In a post on X, one expert predicted that SOL could reach the $500–$600 level before the end of the year.

Similarly, another expert shared a similar prediction, noting that $500 per Solana token in Q4 isn’t just possible, it’s looking increasingly likely. At press time, the Supertrend indicator has turned green and is hovering below the asset’s price, indicating that SOL remains in an uptrend with strong buying pressure. Meanwhile, the Relative Strength Index (RSI) has reached a value of 59, suggesting that the asset is nearing overbought territory but still has enough room to continue its upward momentum.