Key Takeaways

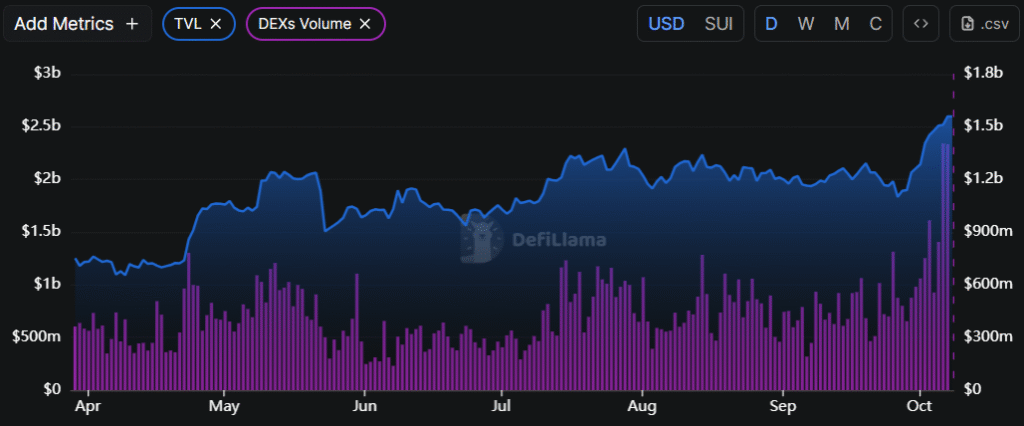

- Sui’s TVL and DEX volume have reached new all-time highs of $2.644 billion and $1.399 billion, respectively.

- Price action suggests that SUI is at a make-or-break point; a rally would only be possible if it closes a daily candle above the $3.71 level.

- Traders have built $29.30 million worth of short positions at $3.738, believing that SUI’s price won’t cross this level anytime soon.

Sui blockchain has seen strong DeFi activity; however, its price action tells a different story. According to DeFi aggregator DeFiLlama, the total value locked (TVL) on the Sui blockchain has reached a record high, along with its DEX trading volume.

Sui’s Rising TVL and DEX Volume

According to the data, Sui’s TVL has now reached $2.644 billion, marking its highest level to date. At the same time, its DEX volume has also surged significantly, increasing from $307.73 million to $1.399 billion since the beginning of 2025.

The massive surge in DeFi activity hints at Sui’s strong adoption and ecosystem growth, while also pointing to potential upside for its native token.

At press time, SUI is trading at $3.472, reflecting a 4.10% price dip over the past 24 hours. The notable decline appears to be driven by a shift in market sentiment, as Bitcoin (BTC) and Ethereum (ETH) have dropped 2.60% and 4.10%, respectively, during the same period.

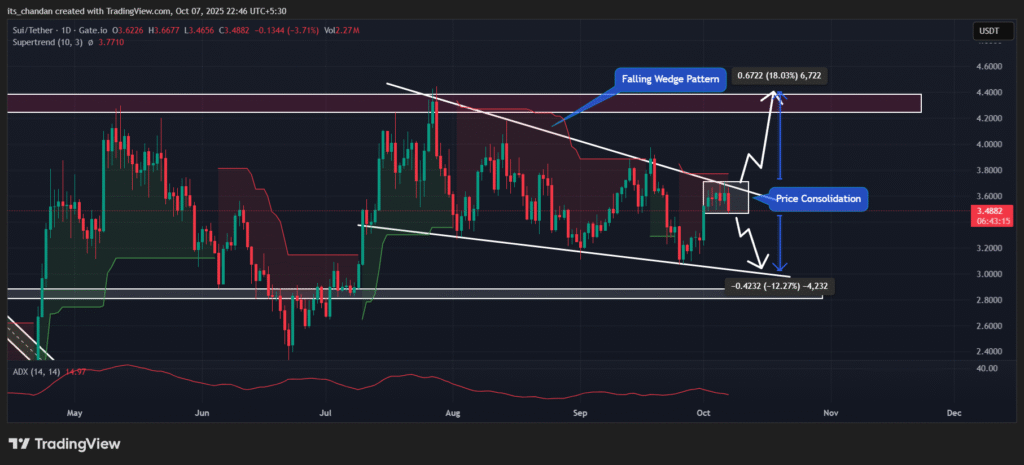

Technical Outlook For Sui Price

According to TimesCrypto’s technical analysis, SUI is in an uptrend but is currently consolidating within a tight range between $3.467 and $3.71 over the past six trading days.

In addition, the asset’s daily chart reveals that the ongoing consolidation is occurring near the upper boundary of a falling wedge pattern, which remains a red flag for the asset.

Based on the current price action, if the ongoing momentum continues and the price falls below the lower boundary of the consolidation, a massive dip could occur. In that case, SUI could experience another 13% decline and may reach the $3 level in the future.

However, a price rally for the asset could only occur if it breaks above the upper boundary of the consolidation and closes a daily candle above the falling wedge pattern. If that happens, SUI could witness an 18% price rally and may reach the $4.40 level in the future.

At press time, the Supertrend indicator continues to hold its red trend and remains above the asset’s price, indicating that SUI is in a downtrend. Meanwhile, the Average Directional Index (ADX) value has reached 14.97, below the key threshold of 25, signaling a lack of directional strength in the asset.

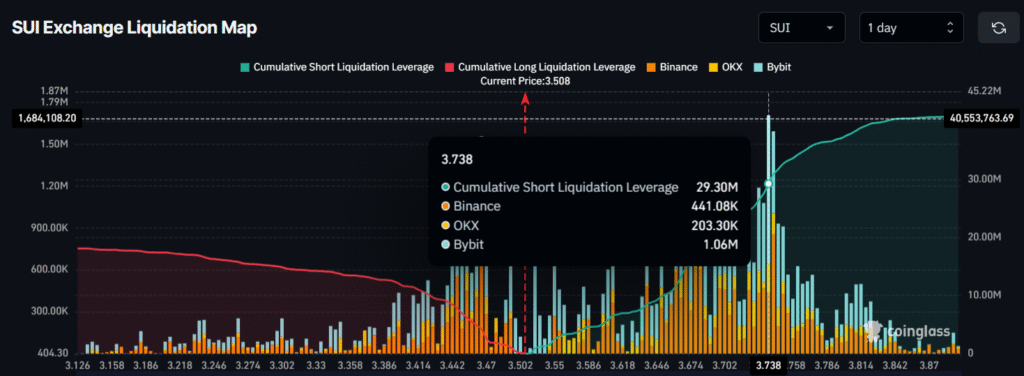

SUI’s Major Liquidation Levels

Despite the unclear direction, traders appear to strongly believe that SUI’s price could decline in the coming days. Data from Coinglass reveals that SUI’s major liquidation levels stand at $3.466 on the lower side (support) and $3.738 on the upper side (resistance).

At these levels, traders are over-leveraged, holding $4.22 million in long positions and $29.30 million in short positions. This metric indicates bearish dominance over the asset, which appears to be a red flag for SUI.

Read More: Giant Whale Disposes $138M Ethereum, Will ETH Price Take A Hit?