Key Takeaways

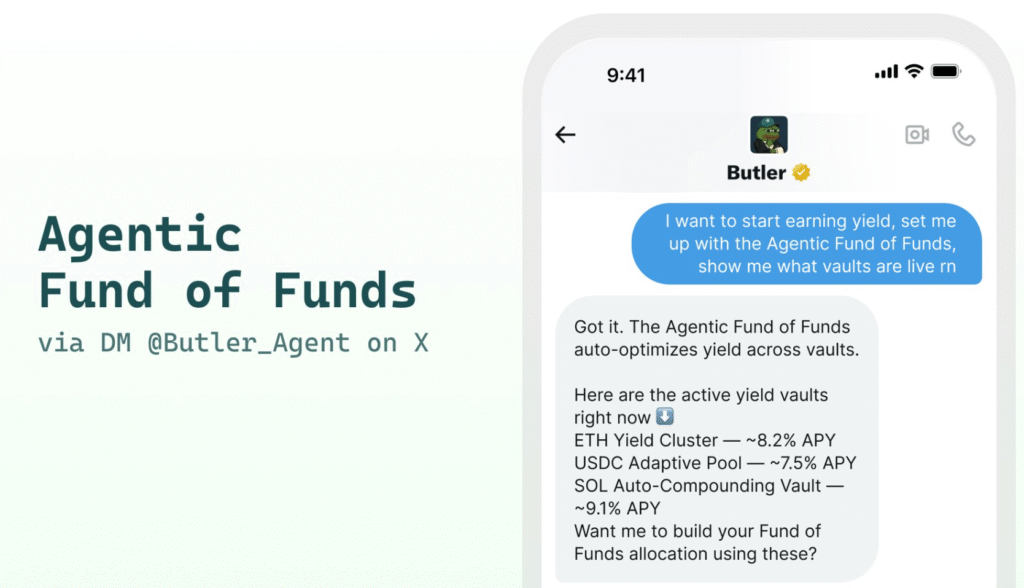

- Virtuals Protocol launches the first Agentic Fund of Funds for automated decentralized finance (DeFi) yield optimization.

- The system uses artificial intelligence (AI) agents to continuously reallocate stablecoins across multiple protocols.

- Users can start with just $10 and benefit from real-time yield chasing without manual intervention.

Table of Contents

The Dawn of Autonomous DeFi Management

Virtuals Protocol, in partnership with Zyfai and BasisOS, has introduced an innovative Agentic Fund of Funds, a major advancement in decentralized finance (DeFi). This innovative system enables fully automated yield optimization across multiple DeFi protocols, fully removing the manual burden needed to take advantage of the best yield opportunities.

The agentic fund of funds represents a major construction for what builders are calling a “true agentic economy,” where AI agents will function as independent actors in the economy.

Read also: Autonomous Agentic Internet: PayPal & General Catalyst Bet $18M on Kite’s Innovative AIR Platform

How the Agentic Architecture Works

The Agentic Fund of Funds operates through a complex multi-layered system utilizing Virtuals’ Agent Commerce Protocol. BasisOS is a layer of orchestration, coordinating between specialized agents that handle everything from market analysis to security verification. Meanwhile, Zyfai’s yield agent executes deployments in the top money markets, such as Aave, Compound, and Morpho, executing the actual chase for the highest available annual percentage yields (APYs) for different blockchains.

Read also: True Trading Launches: The First AI-Powered DEX That Learns as You Trade

Performance and Practical Benefits

The system achieved strong performance in the October trials, producing an average 21.17% APY with the USDC pools on the Base network, which is 166% better than static pools. Users are provided with a fully autonomous, set-and-forget platform, as AI agents manage all rebalancing, claim rewards, and compound.

Key Features and User Advantages

The platform packs many transformative benefits, including:

- Full Automation: Agents handle all yield optimization without user intervention

- Gas Coverage: Zyfai pays for the transaction fees to expedite rebalancing

- Real-Time Adaptation: The system constantly monitors and instantly executes changes based on APY changes

- Transparent Reporting: Users can confirm any performance on-chain

- Low Barrier: $10 minimum deposit enables everyone’s participation in sophisticated yield farming

Read also: Coinbase & Perplexity AI Team Up: Real-Time Crypto Insights Just Got Smarter

The Future of Agentic Economics

This Fund of Funds is more than just another DeFi product; it is a precursor to a new economic system where AI agents will autonomously oversee capital management and interact with decentralized protocols.

The ability for agents to independently optimize short and long yield strategies means there will be an autonomous economic dialog that ultimately transforms the way capital moves through DeFi ecosystems.

FAQs

What is the Virtuals Protocol’s Agentic Fund of Funds?

In this case, the Agentic Fund of Funds is an automated investment system where AI agents manage and reallocate funds across multiple DeFi protocols to continuously optimize yields without human intervention.

How does the yield optimization work?

The system uses specialized yield agents that constantly monitor APYs across whitelisted protocols, automatically moving funds to higher-yielding opportunities while handling reward claiming and compounding.

What makes this different from traditional yield farming?

Different from manual yield farming, this Agentic Fund of Funds requires no ongoing management from users, covers gas fees, and uses sophisticated AI coordination to maximize returns through continuous, real-time rebalancing.

For more AI-DeFi innovative products, read: OceanPal Launches SovereignAI with $120M to Build Privacy AI Infrastructure on NEAR