Key Takeaways

- The new Balancer v3 Proposal aims to disable all v2 pool factories across networks.

- Existing v2 liquidity remains operational but users are encouraged to migrate to v3.

- The move follows recent security incidents and leverages v3’s enhanced architecture.

Table of Contents

Security-Driven Protocol Upgrade Initiative

A major Balancer v3 Proposal has been introduced to permanently disable all v2 pool factories. This represents a definitive step forward into the upgraded protocol’s architecture. This change was introduced as a precautionary security measure following recent exploits, and will mean that no new pools can be created outside Balancer v3’s more secure architecture.

The Balancer v3 Proposal marks an important stage in the evolution of the decentralized finance (DeFi) protocol by prioritizing opportunities to protect users, all while providing continuity for key systems like veBAL and integration partners.

Read also: Balancer Exploit Drains $120M in Major DeFi Security Breach

Discontinuing Legacy Infrastructure

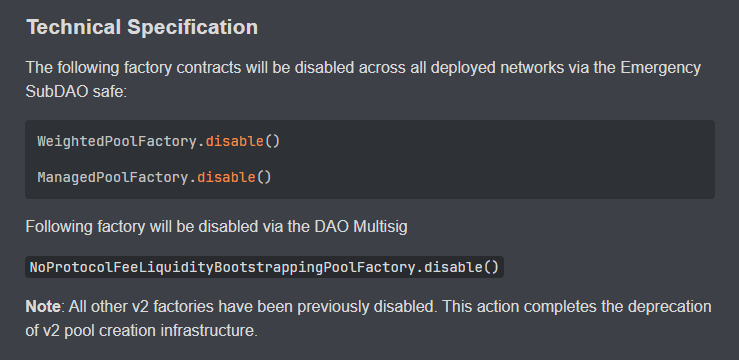

The Balancer v3 Proposal explicitly aims to disable all remaining active v2 factories (WeightedPoolFactory, ManagedPoolFactory, and NoProtocolFeeLiquidityBootstrappingPoolFactory) on all deployed networks.

Although v2 liquidity pools will continue to operate, new v2 pools cannot be deployed once the proposal has passed. This strategic deprecation allows Balancer to invest development and security resources into v3’s superior platform, evaluated on stronger security properties and operational stability versus its predecessor.

Read also: New SUI Consensus Engine Mysticeti v2 Launches With Major Speed Boost

A Thoughtful Path Forward

The Balancer v3 Proposal reflects a commitment by Balancer Labs to be proactively secure instead of incrementally patching outdated infrastructure. From providing migration paths for partners with meaningful v2 liquidity positions, hoping to enhance efficiencies for partners, while also protecting users from system vulnerabilities inadvertently introduced through legacy infrastructure.

The coordinated transition shows mature protocol governance in action and an equilibrium between innovation and responsible risk management.

FAQs

What does the Balancer v3 Proposal entail for current users?

The Balancer v3 Proposal incentivizes liquidity providers to transition liquidity from v2 to v3 pools. Existing liquidity will still be operable in v2 pools; only new pools cannot be set up in v2.

Why is Balancer disabling the v2 factories?

The Balancer v3 Proposal is an initiative to enhance security by migrating all new activity to v3’s more secure architecture, especially in light of recent events that make it clear that proactive measures are vital, and there is no reason to wait.

When will this transition happen?

The Balancer v3 Proposal will need to go through community governance voting before implementation, and the factory will then be disabled across all networks via Emergency SubDAO and DAO Multisig actions.

For more DeFi-related stories, read: Stream Finance Freezes Withdrawals After $93M Loss Sends Stablecoin Spiraling