Key Takeaways

- A Chainalysis seizable crypto report estimates $75 billion of crypto associated with illicit activity could be recoverable.

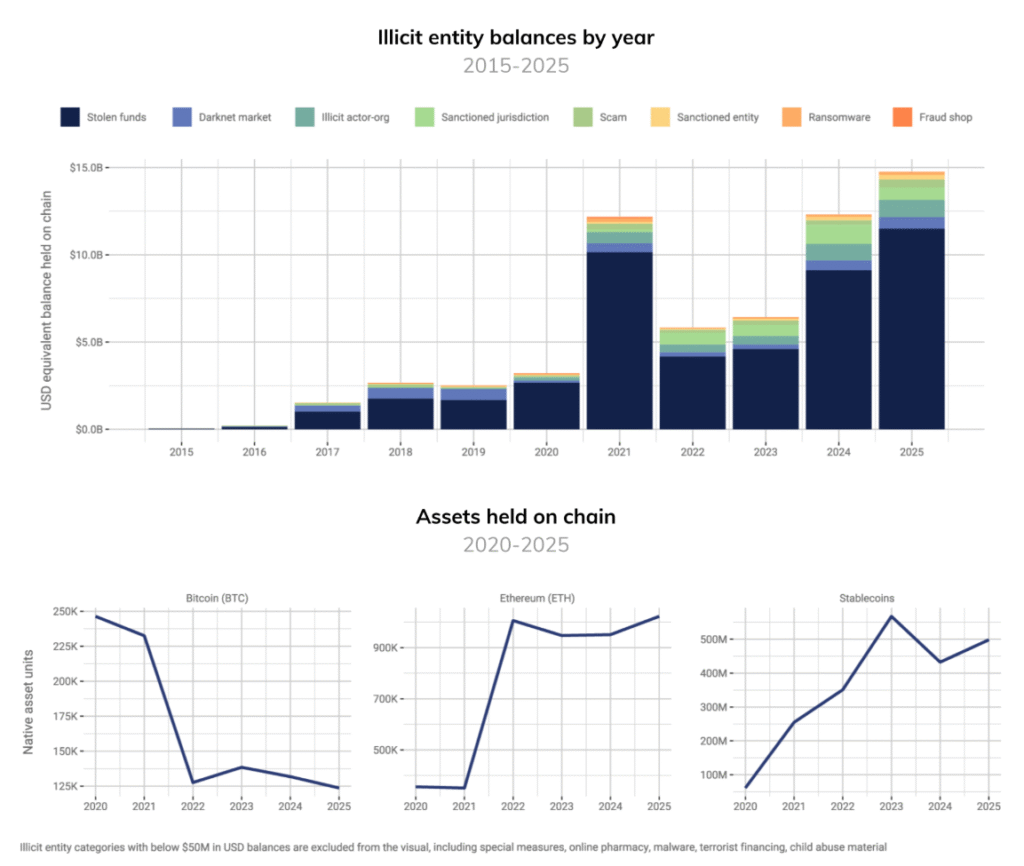

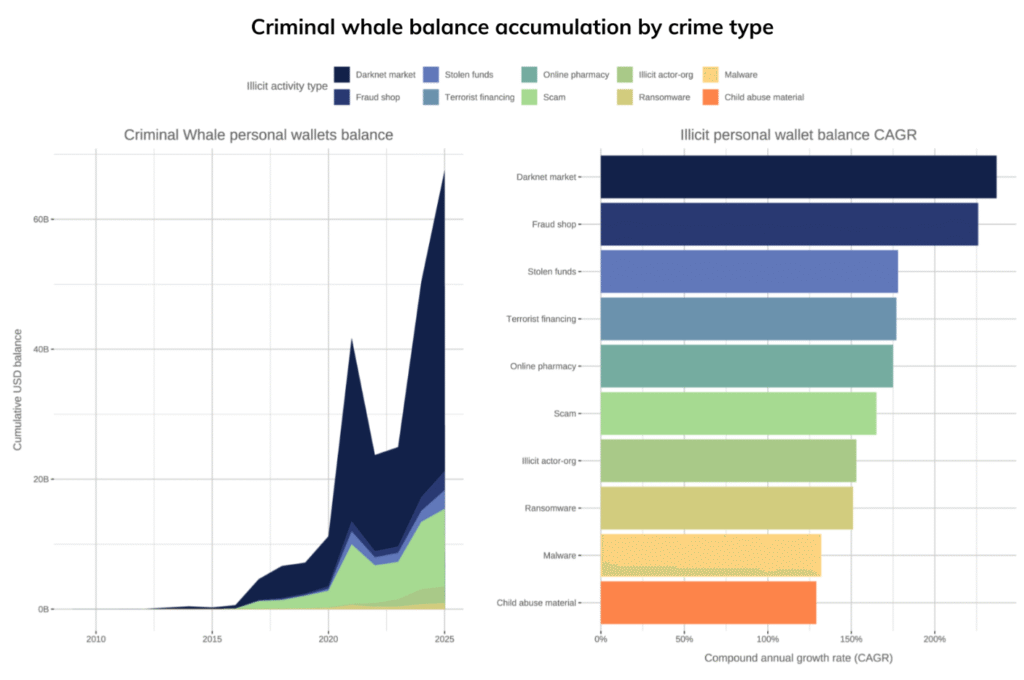

- Direct illicit entities hold nearly $15 billion, while downstream wallets linked to criminal activity control over $60 billion.

- Darknet marketplace administrators and vendors account for more than $40 billion in on-chain assets.

Table of Contents

Chainalysis Disclosed a Massive Crypto Recovery Opportunity

The very well-known blockchain analytics firm has released its Chainalysis seizable crypto report, revealing that criminals and their networks control over $75 billion in potentially recoverable crypto assets. For better understanding, the detailed analysis discriminates between nearly $15 billion controlled directly by illicit actors and more than $60 billion held in downstream wallets that have received large inflows from criminal sources.

This Chainalysis seizable crypto report comes at a time when governments around the world are looking to create national crypto reserves, with the United States already establishing both a Strategic Bitcoin Reserve and Digital Asset Stockpile.

Read also: Seoul Police Dismantle $30M Crypto Korean Hacking Organization with Chainalysis

Bitcoin Dominates Criminal Portfolios

The Chainalysis seizable crypto report reveals that Bitcoin still ranks as the leading asset in criminal portfolios so far, representing 75% of total illicit entity balances, largely reflecting its price appreciation over time. Nevertheless, stablecoins and Ethereum grew significantly in criminal activities compared to previous years. Moreover, darknet markets have surged as the largest single category, with admins and vendors controlling over $40 billion in on-chain value.

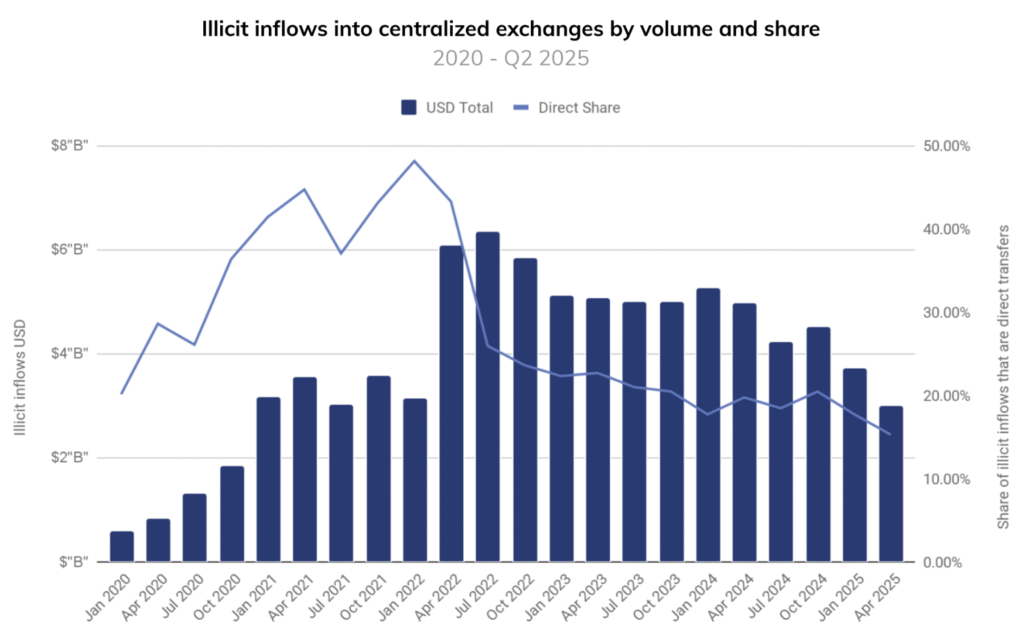

The analysis also reveals that criminal cash-out patterns have evolved considerably throughout the years, with direct transfers to exchanges collapsing from 40% in 2021-2022 to just 15% in Q2 2025 as criminals are implementing more sophisticated layering techniques.

Read also: INTERPOL’s Global Financial Crime Operation Recovers $439M, Freezes 400 Crypto Wallets

Key Findings from the Analysis

- Stolen funds represent the largest category of illicit entity balances, often held while criminals determine laundering strategies

- Criminal balances are heavily concentrated, with over 50% of assets typically held in just three wallets per illicit category

- Stablecoins have less concentration than BTC or ETH, showcasing a criminal’s hedging against freezing capabilities

- There has been a sharp drop in deposit address reuse, showing criminals are quickly evolving and changing their ways of avoiding detection.

Read also: UK Seizure of £5.5bn Bitcoin Reveals Biggest Crypto Fraud In History

Transforming Enforcement Capabilities

This remarkable Chainalysis seizable crypto report illustrates how blockchain transparency offers unprecedented opportunities for asset recovery in ways that simply do not exist in traditional finance. So far, the firm has already helped law enforcement agencies worldwide seize more than $12.6 billion in illicit funds through its data and services.

As criminal methodologies continue to evolve, the Chainalysis report provides an important source of intelligence for prioritizing enforcement actions and developing comprehensive strategies that combine expedited seizure powers across jurisdictions, coordination among law enforcement agencies internationally, and technical capabilities to convert identifiable criminal-related assets.

FAQs

What constitutes “seizable” for the Chainalysis seizable crypto report?

These are cryptocurrency holdings sitting in wallets associated with illicit activity that law enforcement could potentially recover through coordinated action and proper legal authority.

How have criminal cash-out patterns changed?

Criminals are using more deposit addresses, and for shorter amounts of time, with direct transfers to exchanges for cash outs dropping from around 40% to 15% while adding layering steps.

What makes Bitcoin dominant in criminal portfolios?

Despite decreasing amounts held since 2020, Bitcoin’s massive price appreciation means it still represents 75% of the total value in illicit entity wallets.

For more crypto seizure innovation tools, read: Beacon Network: TRM Labs to Combat Crypto Theft by Freezing Stolen Funds Instantly