Key Takeaways

- China alleges U.S. involvement in the LuBian mining pool hack that stole 127,000 BTC worth $13 billion.

- The theft occurred in 2020, with funds remaining dormant until 2024 transfers.

- U.S. authorities seized the Bitcoin in October 2025, claiming legitimate asset forfeiture.

Table of Contents

Geopolitical Showdown Over the Billion-Dollar Bitcoin Cache.

China’s National Computer Virus Emergency Response Center (CVERC) has accused the United States of carrying out the massive LuBian mining pool hack, which Beijing alleges was a “state-level” cyber operation.

According to the accusation, American authorities were behind the theft of 127,000 Bitcoin in 2020, only to later seize the funds as part of legitimate law enforcement processes nearly four years later.

This explosive accusation changes the LuBian mining pool hack from a criminal investigation to a flashpoint for diplomacy between the two largest economies in the world.

Read also: Shocking LuBian Bitcoin Hack: How $3.5B Vanished in Crypto’s Biggest Heist

Competing Narratives and Timeline of Events

The dispute relates to very different interpretations of the same timeline of events:

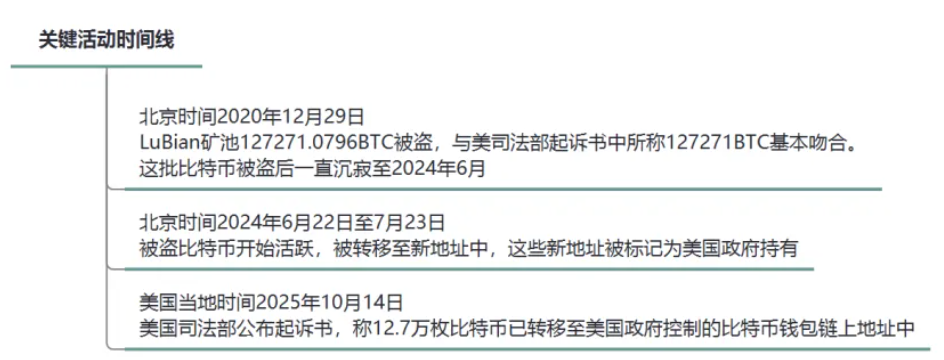

- December 2020: 127,000 BTC stolen from LuBian’s hot wallet

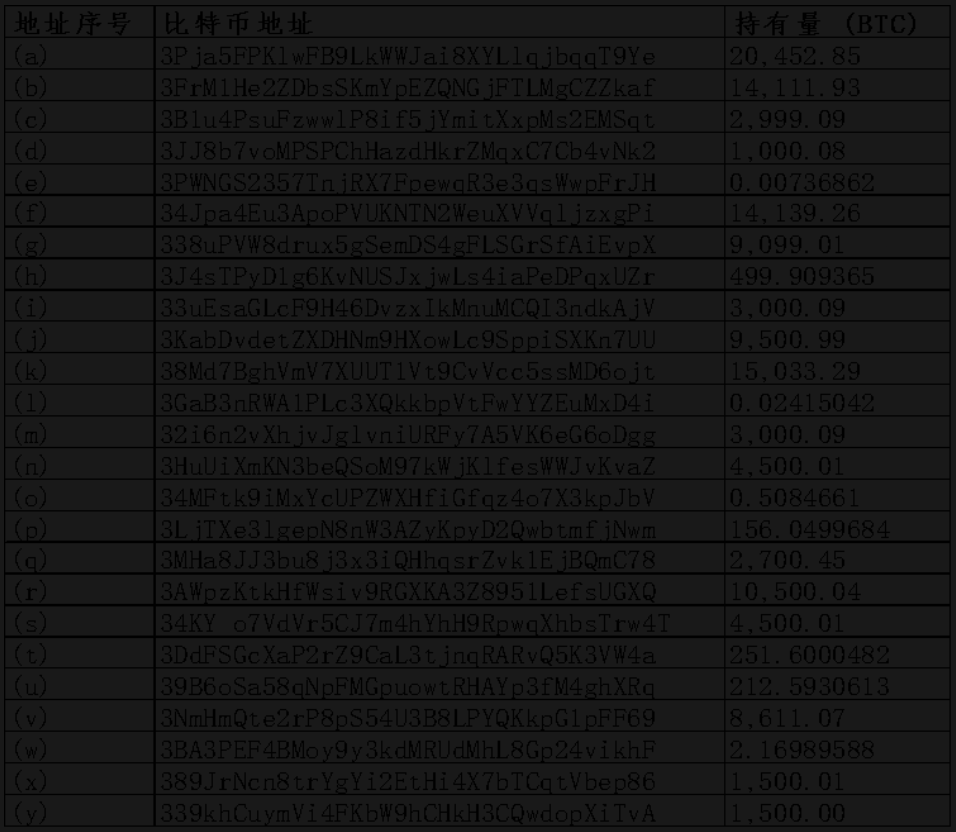

- 2020-2024: Stolen coins remain dormant across multiple addresses

- Mid-2024: Funds begin moving to new wallets

- October 2025: U.S. Department of Justice (DOJ) announces seizure, linking Bitcoin to Cambodian businessman Chen Zhi

- November 2025: China’s CVERC releases report alleging U.S. orchestrated original hack

Read also: U.S. Treasury Sanctions North Korean Bankers in Global Crypto Laundering Crackdown

Technical Analysis Fuels Diplomatic Conflict

China’s cybersecurity agency has reported that its analysis of “technical traceability” reveals some activity patterns that are not typical for criminal patterns of behavior. The analysis also claims that the slow, deliberate fund transfers indicate a level of government or state-sponsored action rather than opportunistic action for theft.

The investigation of the LuBian mining pool hack has become a proxy investigation for larger technological tension, as Beijing is pushing back on Washington’s claims that it was a standard seizure of alleged fraud proceeds as part of anti-money laundering enforcement.

Read also: UK Seizure of £5.5bn Bitcoin Reveals Biggest Crypto Fraud In History

Bitcoin Becomes a Diplomatic Tool in Tech Cold War

The allegations surrounding the LuBian mining pool hack are an unprecedented moment for crypto to become a focus of international diplomacy. The volume of 127,000 BTC, which is approximately 0.65% of the circulating supply, extends beyond bilateral relations to potential impacts on global crypto markets.

With neither side showing signs of backing down, this dispute demonstrates how more and more digital assets are becoming entangled in geopolitical disputes between superpowers.

As neither side shows signs of backing down, the incident demonstrates how digital assets are increasingly entangled in geopolitical power struggles.

FAQs

What is the LuBian mining pool hack?

The LuBian mining pool hack refers to the December 2020 theft of 127,000 Bitcoin from the Chinese mining pool’s hot wallet, now valued at approximately $13 billion.

Why does China accuse the U.S. of involvement?

China’s cybersecurity agency claims technical analysis shows patterns consistent with state-level operations and that U.S. authorities seized the funds under false pretenses after orchestrating the original LuBian mining pool hack.

How has the U.S. government responded?

The U.S. Department of Justice (DoJ) maintains the Bitcoin seizure was legitimate asset forfeiture connected to anti-money laundering investigations against Cambodian businessman Chen Zhi, denying involvement in the original LuBian mining pool hack.

For more crypto crime stories, read: The TimesCrypto Crime Report: Unmasking the New Wave of Sophisticated Crypto Scams