Key Takeaways

- CoinList crypto exchange transitions to fully non-custodial platform with on-chain operations.

- New wallet integration via Privy enables direct token distribution to user-controlled wallets.

- Platform focuses exclusively on token sales access while eliminating custodial trading.

Table of Contents

Significant Strategic Move Towards Real User Sovereignty

CoinList has revealed a substantial change, moving from a centralized exchange (CEX) to a fully non-custodial, on-chain model. This important move represents one of the largest steps toward real user sovereignty and “blockchain-native” platform moves by the major crypto platform.

The change reflects that the company’s most important users, projects, and investors want to act through on-chain and to have full control of their own assets rather than rely on centralized custody solutions.

Read also: DappRadar Shuts Down After 7-Year Run, Token Plummets 38%

Reacting to Evolving Market Demands

CoinList has decided to go fully non-custodial as they believe that deepening custodial functionality would move them away from their core purpose of providing access to quality token sales.

This approach is rooted in the feedback the platform’s leadership received from its customers, who reported back that they “are not interested in further centralized custody and trading” but instead want “access to great deals, tokens delivered on time, and 100% control over their wallet.”

This evolution reflects broader industry trends toward verifiable, on-chain finance where users retain control over their private keys.

New Platform Features and Benefits to Users

The transformed platform will offer several significant improvements:

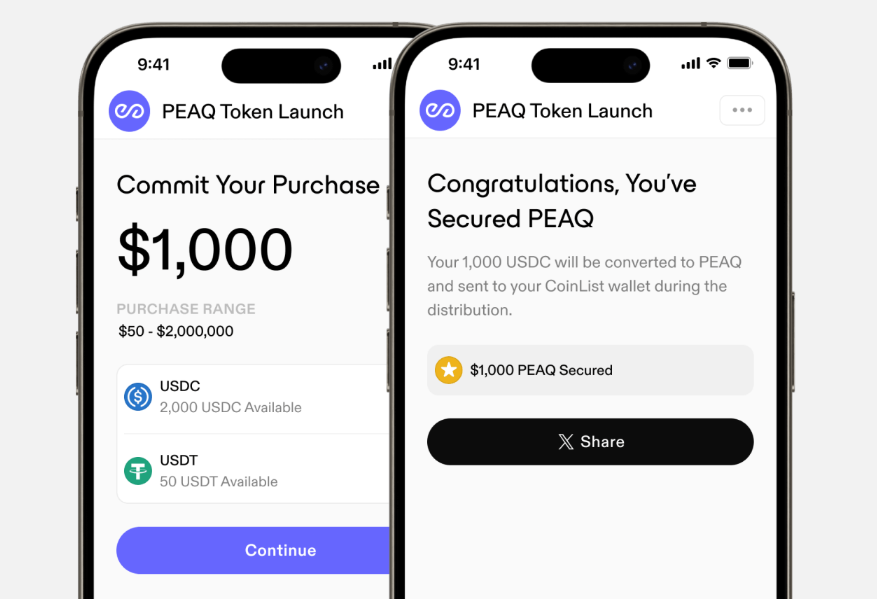

- Non-custodial wallet integration through partnership with Privy

- Direct token distribution to user-controlled wallets during sales

- Simplified migration process for existing custodial assets

- Full on-chain operations for Initial Coin Offerings (ICOs), trading, and asset tokenization

- Enhanced security through user-controlled key management

Read also: Binance’s CZ Advises “Will Function” for Asset Inheritance

A Crypto-Native Future

This transition positions CoinList as a “first mover” in adapting to the next phase of crypto adoption, where users will increasingly call for the sovereignty and transparency that only true non-custodial, on-chain systems can provide.

The crypto exchange focuses solely on pursuing its unique value proposition: providing access to promising projects, while embracing true decentralization. CoinList is demonstrating not only how an established platform can evolve without abandoning its core value proposition but also how platforms can adapt to changing market demand.

FAQs

What does CoinList’s move to non-custodial mean for users?

CoinList going non-custodial means users will maintain complete control over their assets through self-custodied wallets, eliminating reliance on the platform’s centralized custody while still accessing token sales.

How will the non-custodial transition work?

CoinList will integrate non-custodial wallets through Privy infrastructure, allowing users to receive token distributions directly to their controlled wallets and migrate existing custodial assets through a simplified process.

When will CoinList complete this transition?

The platform plans to introduce non-custodial wallets later this year, with full on-chain operations for ICOs, trading, and asset tokenization to follow as part of their comprehensive transformation.

For more DeFi-related stories, read: YZi Labs Builder Fund Deploys $1B to Supercharge BNB Ecosystem