Key Takeaways

- Crypto Bank AMINA receives Securities and Futures Commission (SFC) Type 1 license uplift for institutional crypto services.

- Platform offers 24/7 trading and regulated custody for 13 major cryptocurrencies.

- Expansion addresses critical gap in Hong Kong’s institutional digital asset market.

Table of Contents

Regulatory Milestone for Institutional Crypto Access

Crypto Bank AMINA has achieved a key regulatory accomplishment in Hong Kong, receiving a Securities and Futures Commission (SFC) Type 1 license uplift that permits complete crypto spot trading and asset custody services for sophisticated investors.

The Swiss-regulated banking group is the first non-local institution to provide these services in Hong Kong. It addresses a significant gap in the market for institutional adoption for the growing number of institutional and private investors in the territory.

This expansion for crypto bank AMINA, as a significant custodian participant in institutional-grade services, addresses a previous market limitation for professional investors and family offices, who, before the license uplift, may not have had access or presence in locally onboarding institutional crypto services.

Read also: CoinRoutes Forges Premier Institutional Crypto Trading Platform in QIS Risk $5M Acquisition

Comprehensive Service Offering for Professional Investors

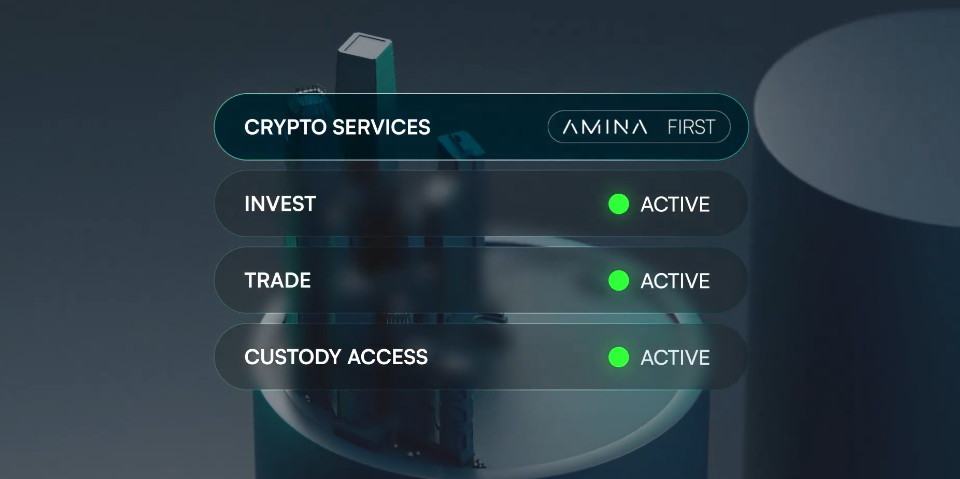

The licensed Crypto bank AMINA Hong Kong subsidiary is now offering sophisticated investors a broad array of key services, which include:

- 24/7 professional trading across major digital asset pairs, including Bitcoin (BTC) and Ethereum (ETH)

- Regulated custody access meeting Securities and Futures Commission (SFC) compliance standards with multi-layered security

- Support for crypto deposits and withdrawals to whitelisted external wallets

- Multi-channel access via mobile applications, web portals, and personalized management

- Initial offering of 13 vetted cryptocurrencies, including stablecoins and decentralized finance (DeFi) tokens

Read also: IBM Digital Asset Haven Launches to Bridge Traditional Finance & Crypto

Bridging Swiss Banking Rigor with Asian Market Expertise

The careful expansion of Crypto bank AMINA into Hong Kong is a merging of Swiss banking standards and experience in the Asian digital asset markets.

According to Michael Benz, Head of AMINA Hong Kong and Asia-Pacific region (APAC), the license allows the bank to extend its crypto product shelf to include private fund management, structured products, derivatives, and tokenized real-world assets, all delivered within the regulatory framework required by institutional investors.

AMINA’s offering showcases how traditional financial institutions are renewing their bridges to both conventional and digital finance worlds in relevant markets globally.

FAQs

What services does Crypto Bank AMINA now offer in Hong Kong?

Crypto bank AMINA provides 24/7 crypto spot trading, institutional-grade custody, and asset safeguarding services to professional investors through its SFC-licensed Hong Kong subsidiary.

Why is AMINA’s Hong Kong crypto bank license significant?

Crypto bank AMINA becomes the first international banking group to offer comprehensive crypto trading with custody access in Hong Kong, addressing a critical gap in institutional-grade digital asset services for professional investors.

Which cryptocurrencies does crypto bank AMINA support in Hong Kong?

Crypto bank AMINA initially offers 13 vetted cryptocurrencies, including Bitcoin, Ethereum, major stablecoins like USDC and USDT, and leading DeFi tokens through its newly licensed Hong Kong platform.

For more institutional crypto stories, read: Rootstock Institutional BTCFi Aims to Unlock $260B in Idle Bitcoin