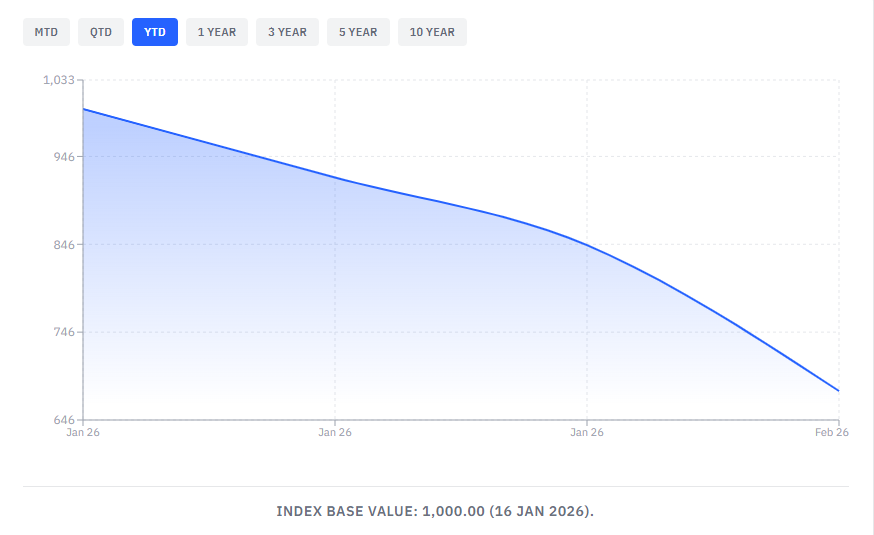

The DEFI Technologies’ launch of DEFT Valour Investment Opportunity (DVIO) Index is a new benchmark, which analyzes the movement of institutional capital into distributed ledger technologies (DLT) by decoding investment flows across Valour’s regulated exchange-traded products (ETPs).

Why the DVIO Index Changes the Game

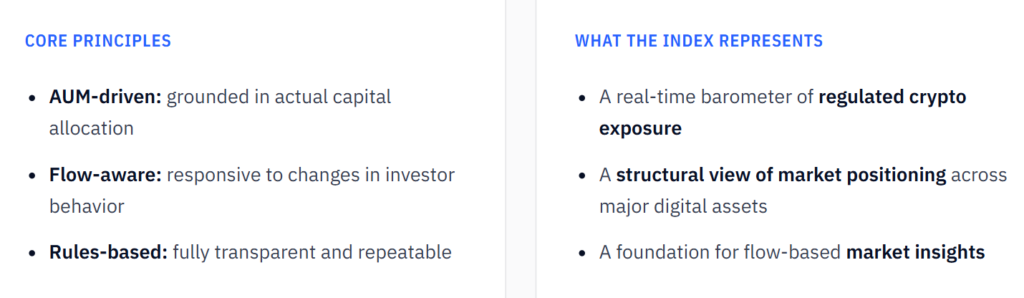

The DVIO Index is transformative because it presents a clear picture of investment trends in the current real-time environment, rather than using inaccurate price charts or historical on-chain data; in effect, it provides distinct exposure to institutional capital’s potential in DLT by identifying the movement of the smart money. The DVIO Index tracks the top 50 digital assets by assets under management (AUM) and weekly inflows or outflows across more than 100 regulated ETPs.

The DVIO Index does not represent speculative retail trading activity; rather, it is a descriptive account of where institutional capital is positioning itself in crypto through uniform regulated vehicles. As such, the weekly rebalancing of the index will allow for a pulse check regarding any change of conviction towards major, Layer 1s (L1s), or decentralized finance (DeFi) tokens before they become obvious in broader market prices.

From Benchmark to Business Intelligence

The initial launch is more than just a new metric; it’s the core of a commercial insights platform. DeFi Technologies will develop institutional-grade reports, sentiment barometers, and watchlists from the DVIO’s flow data. In the future, the firm will look to license the DVIO index for third-party financial products and to create a sophisticated analytics terminal.

In essence, Valour’s unique ability to see real capital on the move, through a structured framework, provides the basis for a scalable business that enhances its ETP ecosystem.