Key Takeaways

- The GalaxyOne retail trading app offers commission-free trading for both crypto and US equities with automated reinvestment features.

- Accredited investors can access an 8% Premium Yield product, while all users receive 4% APY on Federal Deposit Insurance Corporation (FDIC)-insured cash accounts.

- Led by former BlockFi CEO Zac Prince, the platform represents Galaxy Digital’s strategic expansion from institutional to retail services.

Table of Contents

Institutional Influence and Retail Access

Galaxy Digital has officially launched the GalaxyOne retail trading app, marking the institutional giant’s notorious entry into the consumer finance market. The platform, spearheaded by ex-BlockFi CEO Zac Prince, mixes commission-free stock and crypto trading with high-yield cash accounts in a single interface. This strategic move takes advantage of Galaxy’s institutional infrastructure, including its $1.1 billion lending desk, to provide retail investors with products previously available only to high-net-worth clients and institutions.

Read also: Walmart’s OnePay to Add Crypto Trading and Custody in Mainstream Push

Competitive Yields and Integrated Trading

The GalaxyOne retail trading app stands out, offering aggressive yields that directly compete with established institutions. One of the most important benefits is that all users receive a 4% Annual Percentage Yield (APY) on cash deposited with the Federal Deposit Insurance Corporation (FDIC) through Cross River Bank, while accredited investors will earn 8% Premium Yield product, with a minimum deposit of $25,000, supported by Galaxy’s balance sheet.

In addition to major crypto assets such as Bitcoin (BTC), Ethereum (ETH, and Solana (SOL), users can trade thousands of U.S. stocks, including exchange-traded funds (ETFs), with auto-reinvest features that compound earnings.

Read also: eToro Enters Crypto: 100 U.S. Stocks to Be Tokenized on Ethereum

A New Contender in the Retail Arena

By launching its GalaxyOne retail trading app, Galaxy Digital is establishing itself as a serious competitor to Robinhood, Coinbase, or even eToro, especially among investors looking for yield.

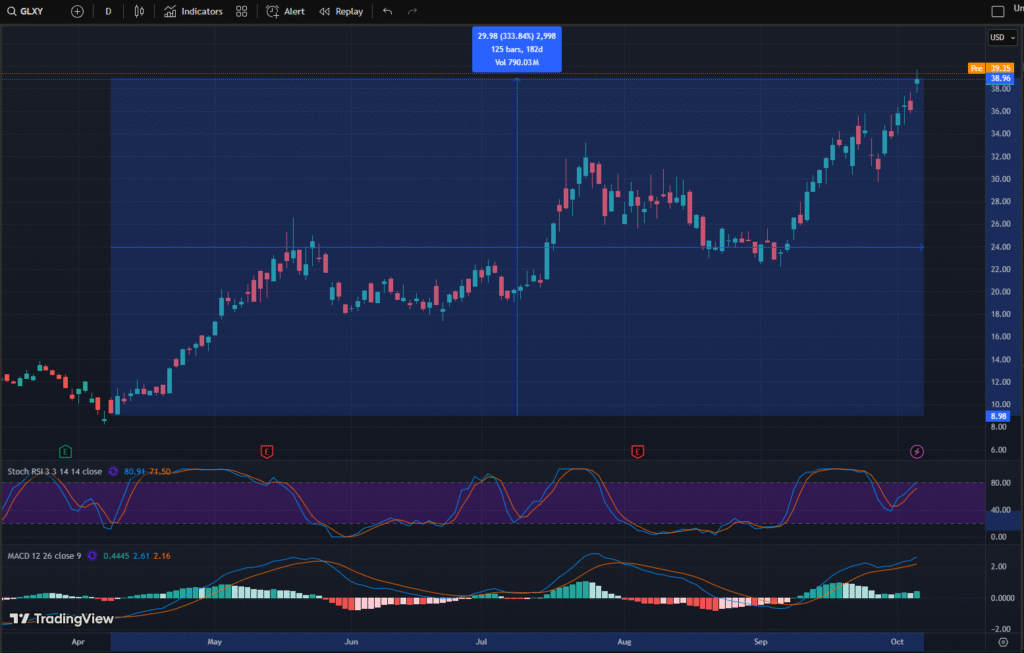

Galaxy stock (Nasdaq: GLXY) surged 1.5% after the announcement, showing investors believe the new app is a way for Galaxy to expand its business beyond its institutional roots. Furthermore, the stock saw an incredible increase of over 300% in its price since last April.

With Prince applying lessons learned from BlockFi’s collapse, such as proper risk control and regulatory practices, the platform now aims to redefine retail investing by merging traditional finance (TradFi) with digital assets under one umbrella.

FAQs

What yields does the GalaxyOne retail trading app offer?

The app provides 4% APY on FDIC-insured cash accounts for all users and 8% APY for accredited investors with minimum $25,000 deposits.

Who is leading this initiative?

Former BlockFi CEO Zac Prince is managing the platform, bringing his experience from building one of crypto’s most popular retail lending products.

How does it differentiate from Robinhood?

GalaxyOne is focused on higher yields, institutional-grade infrastructure with crypto-traditional finance features that go beyond simple commission-free trading.

For more crypto app services, read: MoonPay Enters Crypto Yield Game With 8.49% Solana Staking