Key Takeaways

- The Gemini Solana Credit Card offers up to 4% rewards in SOL on categories like gas and dining.

- A new auto-staking feature compounds rewards, offering up to an additional 6.77% annual yield.

- The card has no annual fee and is available to U.S. customers, issued by WebBank.

Table of Contents

Spend and Earn in Solana

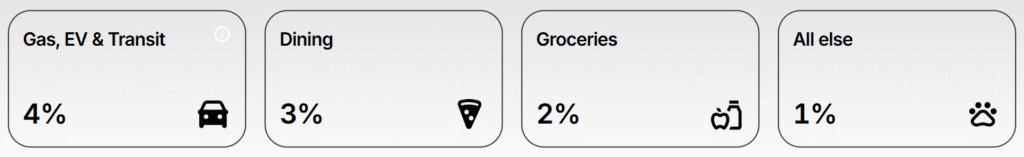

Gemini, the crypto exchange, has rolled out a specialized Gemini Solana Credit Card that provides rewards to users in SOL and includes staking as part of its rewards structure. In this version of the card, users can earn 4% back in Solana on qualifying purchases, such as gas and electric vehicle (EV) charging, 3% back on dining, and 2% back on groceries.

This plan is part of a strategy to engage with the very active Solana community, as well as using Solana’s very strong market performance, while offering users a meaningful way to engage with the Solana network through their everyday spending.

Read also: Gemini’s XRP Credit Card Launches: Earn 4% Crypto Back on Everyday Spending

Automated Staking for Passive Yield

To this point, the most innovative feature of the Gemini Solana Credit Card is its automatic staking capability, letting users to opt to have their earned SOL rewards staked automatically in the Gemini platform, yielding an estimated additional 6.77% per year. So far, this process transforms simple cashback rewards into an active participation mechanism in the Solana network, as the staked assets help secure the blockchain. Moreover, this dual-earning system, spending rewards plus staking yield, creates a powerful incentive for crypto-savvy consumers as well as incentivize adoption.

Read also: Gemini Expands Operations to Australia with Local Banking and New Leadership

A Mainstream Bridge for Crypto Utility

The debut of the Gemini Solana Credit Card represent an important development step in connecting traditional consumer finance with crypto-native concepts. This has been accomplished by carefully eliminating all the technical barriers like manual staking involved in normal processes and offering familiar credit card perks with no annual fee, Gemini is making decentralized finance (DeFi) mechanics accessible to a broader audience.

This card product strengthens Solana’s position within mainstream finance while signaling an important trend of exchanges creating deeper, utility-driven integrations with leading blockchain ecosystems.

FAQs

Is there a cost associated to the Gemini Solana Credit Card?

No, the Gemini Solana Credit Card has no annual fee, no fee on foreign transactions, and no fee to receive your crypto rewards. Teh card is issued by WebBank and is currently available to customers in the United States.

How does the Gemini Solana Credit Card auto-staking feature work?

When you opt in, the SOL rewards you earn from every purchase are automatically delegated to a validator on the Solana network through Gemini’s platform, immediately beginning to earn staking rewards without any action required from you.

What is the total potential yield of the Gemini Solana Credit Card?

Cardholders can effectively earn a combined yield: up to 4% back in SOL from spending, plus an additional 6.77% APR from staking those rewards, creating a total potential return exceeding 10% on their spending in the best-case scenario.

For more Gemini Solana Staking products, read: Gemini Opens Institutional Solana Staking with $5B Corporate Backing and a Juicy 6% APY