Key Takeaways

- Trials of the HSBC Quantum algorithmic trading system with IBM showed a 34% improvement in predicting bond trade success.

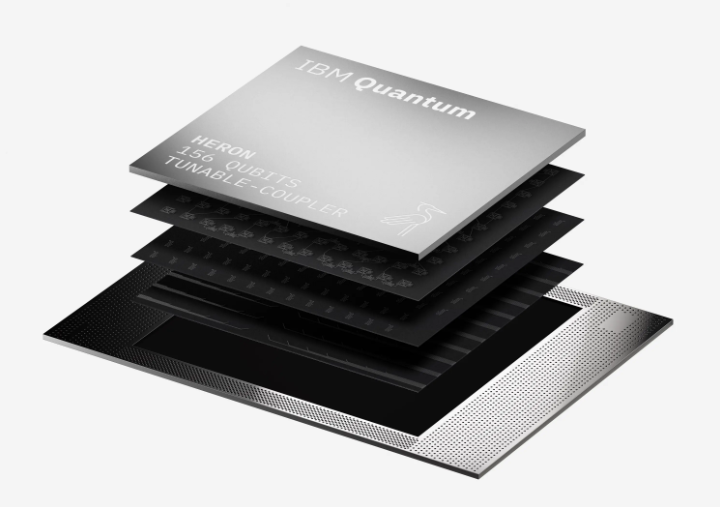

- The test used IBM’s Heron quantum processors to analyze real European corporate bond market data.

- The success signals quantum computing’s move from theory to practical, near-term financial application.

Table of Contents

HSBC Quantum Algorithmic Trading: A Tangible Leap for Quantum Finance

This trial represents a turning point in providing the first known empirical evidence of quantum computing’s value in the real world of finance. The HSBC Quantum algorithmic trading trials were focused on the “request for quote” process in the over-the-counter European corporate bond market. By integrating International Business Machines (NYSE: IBM)’s quantum processors into their classical computing workflows allowed HSBC to more accurately predict the probability of a trade being filled at a quoted price, a critical factor for profitability and reducing slippage.

How Quantum Provided the Edge

Quantum computers utilize qubits that can explore a much larger computational space than classical bits. Here, IBM’s Heron processor enabled the extraction of complex, hidden patterns from noisy market data that standard algorithms struggle to find. This hybrid approach uses the ability to exploit both classical and quantum computing styles, allowing a superior analysis of real-time market conditions and risk factors, leading to a substantial 34% performance gain.

Read also: NVIDIA’s Robotics Developments: Omniverse & Cosmos AI Redefine Machine Intelligence

Implications Beyond Trading

While the immediate focus is on bond trading, the implications are much larger:

- First, it is now established that quantum hardware from the current generation can solve real-world, complex business problems, meaning the quantum adoption timeline in finance, as with industry as a whole, has drastically improved.

- Second, and perhaps of equal significance to the fast changing crypto world, it also underscores the urgency of developing quantum-resistant cryptography, as the same technology that optimizes trading could one day threaten the cryptographic security of blockchains.

Read also: True Trading Launches: The First AI-Powered DEX That Learns as You Trade

The Quantum Age is Closer Than You Think

The announcement of the HSBC quantum algorithmic trading breakthrough suggests that quantum advantage in the industry and the society itself is no longer a distant sci-fi concept but an emerging reality. That being said, financial institutions that ignore this technological innovation risk being left behind, while the entire digital asset ecosystem must now seriously prepare for a post-quantum cryptographic future.

Final Thought: If quantum computers can already optimize bond trading, how soon will they redefine the entire landscape of financial markets and digital security?

FAQs

What is algorithmic trading?

Algorithmic trading uses computer applications to execute trades based on pre-defined instructions, such as price and timing, much faster than a human could.

What is a quantum computer?

A quantum computer uses quantum bits (qubits) that can exist in multiple states at once, allowing it to process complex calculations exponentially faster than classical computers for specific problems.

Does this mean Bitcoin is at risk?

Not immediately. The encryption securing Bitcoin is still far too complex for today’s quantum computers to break; on the other hand, the resources that may be needed to put in place for breaking Bitcoin’s encryption are not worth it right now, but this trial highlights the need to develop quantum-resistant algorithms for the future.

For more tech breakthroughs, read: Chinese Researchers Unveil World’s First Universal 6G Chip