Key Takeaways

- IBM Digital Asset Haven offers an all-in-one platform for managing institutional digital assets across 40+ blockchains.

- The solution integrates IBM’s security infrastructure with Dfns’ custody technology.

- The platform will be available in Q4 2025 as a Service as a Software (SaaS) offering, with on-premises deployment planned for 2026.

Table of Contents

Crypto Infrastructure for Enterprises

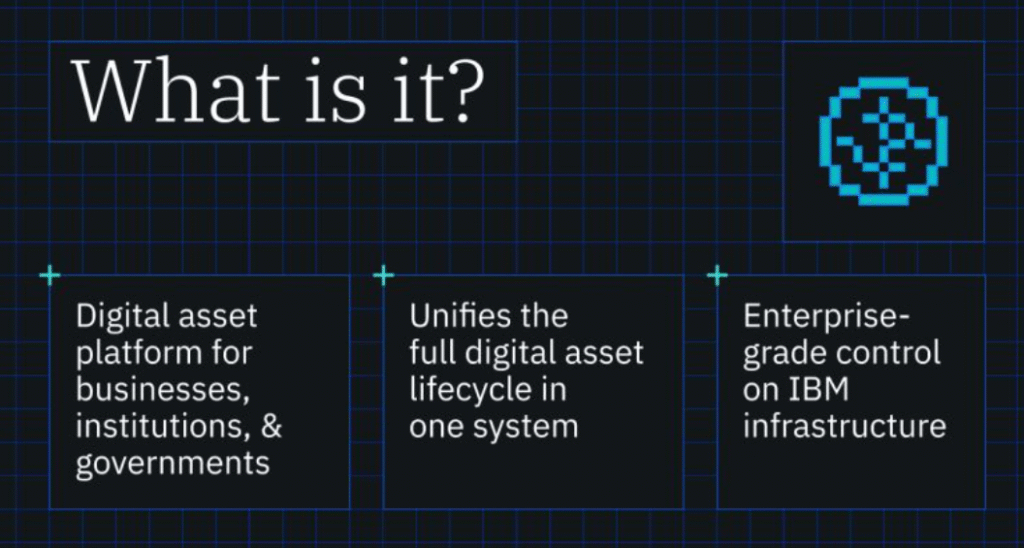

IBM, the technology company, has introduced the IBM Digital Asset Haven, an all-in-one platform for financial institutions, governments, and corporations looking to formally enter the digital asset ecosystem safely. The solution was developed in partnership with Dfns (a custody infrastructure provider). The platform offers a full-stack solution for managing digital assets from custody to settlement while maintaining strict compliance with regulatory requirements.

IBM Digital Asset Haven is one of the largest enterprise moves into crypto infrastructure to date, bridging the gap between traditional finance (TradFi) and blockchain technology.

Read also: HSBC Quantum Algorithmic Trading Trials with IBM Quantum Processors Show a 34% Boost

Security and Compliance at Scale

The IBM Digital Asset Haven platform combines IBM’s strong security architecture, inclusive of Hardware Security Modules and quantum-safe cryptography, with Dfns’ custody technology for digital assets that already supports 15 million wallets across 250 clients. Nevertheless, the solution also features a multi-party computation to enable distributed signing, policy-driven governance frameworks, and support for both hot and cold wallet operations. Moreover, this security-first approach ultimately addresses the primary concerns that have prevented many regulated institutions from fully engaging with digital assets until now.

Read also: Chinese Researchers Unveil World’s First Universal 6G Chip

Accelerating Institutional Adoption

By providing pre-integrated services for Know Your Customer (KYC), Anti-Money Laundering (AML), and yield generation alongside developer-friendly Application Programming Interfaces (APIs), IBM Digital Asset Haven aims to significantly reduce the technical barriers for traditional financial institutions entering the crypto space.

So far, the platform has built transaction lifecycle management on over 40 public and private blockchains, giving institutions the flexibility to operate across various networks, consistently establishing a secure and compliant standard.

This move by IBM is evidence that an increasing number of digital assets projects are moving from experimentation to production-ready financial infrastructure.

FAQs

What types of organizations is IBM Digital Asset Haven designed for?

The platform specifically targets regulated enterprises, including banks, financial institutions, governments, and corporations that require enterprise-grade security, compliance features, and integration capabilities with existing financial systems.

How does the platform handle security?

IBM Digital Asset Haven employs multiple security mechanisms, including Multi-Party Computation (MPC) technology, Hardware Security Modules, and cold storage options via IBM’s Offline Signing Orchestrator, all supported by guidance provided for quantum-safe cryptography.

When will the platform be available?

SaaS and Hybrid SaaS instances will be ready in Q4 2025, with on-prem solutions available for those organizations wanting full control of the infrastructure in Q2 2026.

For more tech innovation stories, read: NVIDIA’s Robotics Developments: Omniverse & Cosmos AI Redefine Machine Intelligence