Key Takeaways

- Hong Kong authorities have charged 16 individuals in the $205 million JPEX Crypto Fraud case.

- Prominent influencer Joseph Lam and YouTube personalities are among those accused of promoting the unlicensed platform.

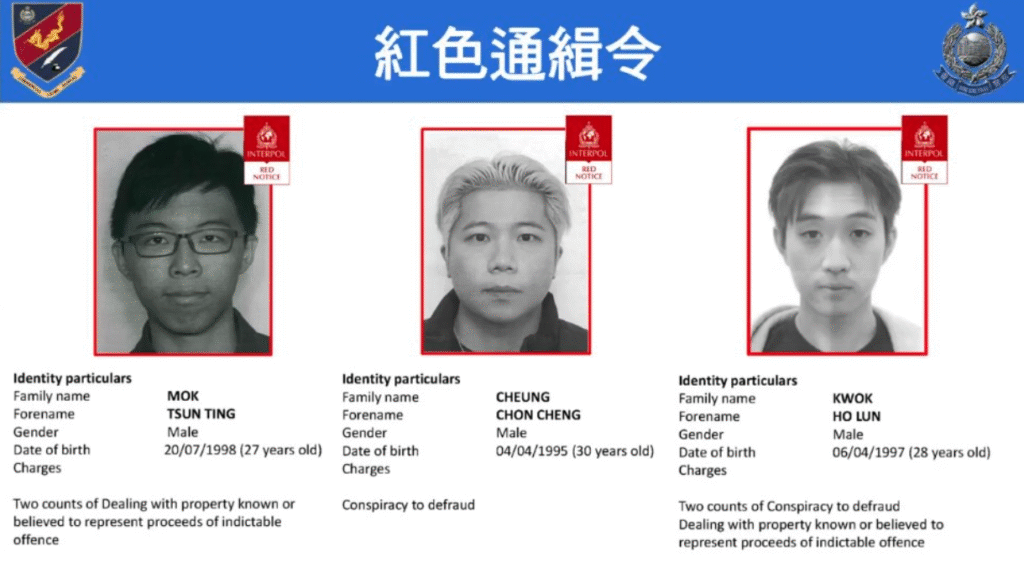

- Interpol has issued Red Notices for three key suspects who have fled Hong Kong.

Table of Contents

Major Breakthrough in JPEX Crypto Fraud Investigation

Police in Hong Kong have officially brought charges against 16 individuals in relation to the major JPEX Crypto Fraud, which represents a landmark in a two-year investigation into a $205 million scam scandal. The accused include core platform members, over-the-counter (OTC) exchange operators, and social media influencers who are also accused of deceiving more than 2,700 investors.

To this point, this is the largest financial fraud case in Hong Kong’s history and signals a major crackdown on unlicensed crypto operations.

Read also: U.S. Treasury Sanctions North Korean Bankers in Global Crypto Laundering Crackdown

Elaborate Scheme and International Manhunt

The JPEX Crypto Fraud ran as an expansive scheme through an elaborate system that used ubiquitous advertisements and influencer marketing campaigns to portray JPEX as a legitimate, low-risk exchange with high returns.

According to authorities, the suspects limited withdrawals and raised fees, effectively trapping users’ funds while laundering money through multiple crypto wallets.

Additionally, Interpol has issued Red Notices for three primary suspects: Mok Tsun-ting, Cheung Chon-cheng, and Kwok Ho-lun, who have since left the city and are now subject to an international manhunt.

Read also: Vietnam Shark Tank Investor Arrested in $34M Crypto Fraud Scandal

Regulatory Reckoning for Crypto Influencers

The charges marked the first application of Hong Kong’s updated Anti-Money Laundering (AML) and Counter-Terrorist Financing Ordinance to a crypto case.

Influencers such as former lawyer Joseph Lam, for instance, will face significant repercussions for promoting the unlicensed platform after receiving notices from the Securities and Futures Commission (SFC), explaining the illegality of the platform.

Authorities seized around $28 million in cash, luxury cars, and other assets from suspects due to their lavish lifestyles didn’t match their declared incomes.

Read also: UK Seizure of £5.5bn Bitcoin Reveals Biggest Crypto Fraud In History

A Watershed Moment for Crypto Regulation

The JPEX Crypto Fraud saga sends a clear warning to the influencers and unregulated platforms operating, particularly in the Hong Kong digital space. While the city aims to become a regulated crypto jurisdiction, its prosecution sends a clear message to this industry that regulators are serious about enforcement, providing investor protection, and having a zero-tolerance level for compliance.

To this point, with 64 individuals still under investigation, this case likely represents just the beginning of Hong Kong’s crackdown on crypto misconduct.

FAQs

What was the JPEX Crypto Fraud scheme?

Basically, the JPEX Crypto Fraud involved an unlicensed exchange that used influencers and aggressive marketing to attract investors, then restricted withdrawals while laundering customer funds through multiple crypto wallets.

Who are the key figures charged in the JPEX case?

Those charged include core JPEX members, over-the-counter (OTC) exchange operators, and social media influencers like Joseph Lam and YouTuber Chan Wing-yee, all accused of conspiracy to defraud and money laundering.

What does this mean for crypto regulation in Hong Kong?

The JPEX Crypto Fraud case highlights Hong Kong’s strengthened commitment to enforcing its licensing regime and holding both platforms and promoters accountable for unlicensed crypto activities.

For more crypto fraud stories, read: The TimesCrypto Crime Report: Unmasking the New Wave of Sophisticated Crypto Scams