Key Takeaways:

- The Vietnam data breach was a significant hack against the National Credit Information Center (CIC), a major national financial institution of the State Bank of Vietnam.

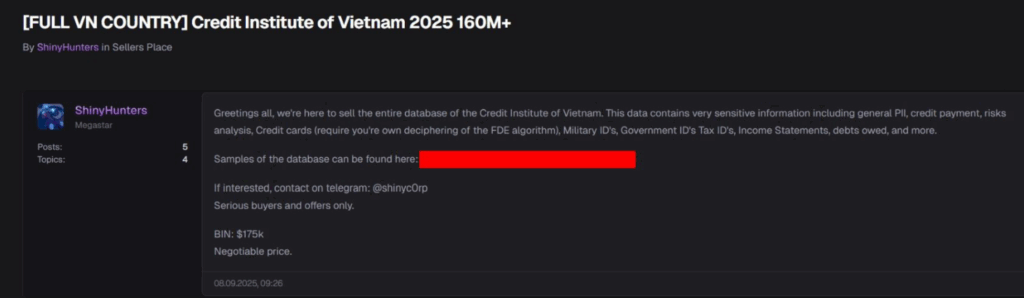

- The hacker group, Shiny Hunters, an international hacker group, obtained a large amount of sensitive data, including personal IDs, credit histories, and financial records.

- While authorities are urging citizens to protect themselves from possible phishing or financial fraud, they are also warning citizens to take immediate action to protect themselves.

Table of Contents

Vietnam Data Breach: A Nation’s Financial Core Compromised

The Vietnam data breach marks an unprecedented event of public trust violation, rupturing the country’s financial base and putting in extreme alert to the entire population. The Credit Information Center (CIC), which serves as the central data repository for the credit histories of millions of Vietnamese citizens and businesses, was the target of a sophisticated cyberattack.

While initial investigations are underway, it seems that the international hacking group known as Shiny Hunters is responsible for the attack. This group is known for high-profile attacks against large corporations around the world.

What Data Was Stolen?

The stolen data is a gold mine for cybercriminals, much worse than just login passwords. The compromised trove is reported to be:

- Deeply personal information: Government-issued IDs, military IDs, and tax identification numbers.

- Comprehensive financial profiles: Detailed credit payment histories, risk analyses, income statements, and records of debts owed.

- Encrypted credit card data, which, while protected, could be targeted for decryption efforts.

This provides criminals with all they need for mass identity theft, financial fraud, which, combined with other tools, can carry out sophisticated phishing campaigns.

Urgent Response and Public Advisory

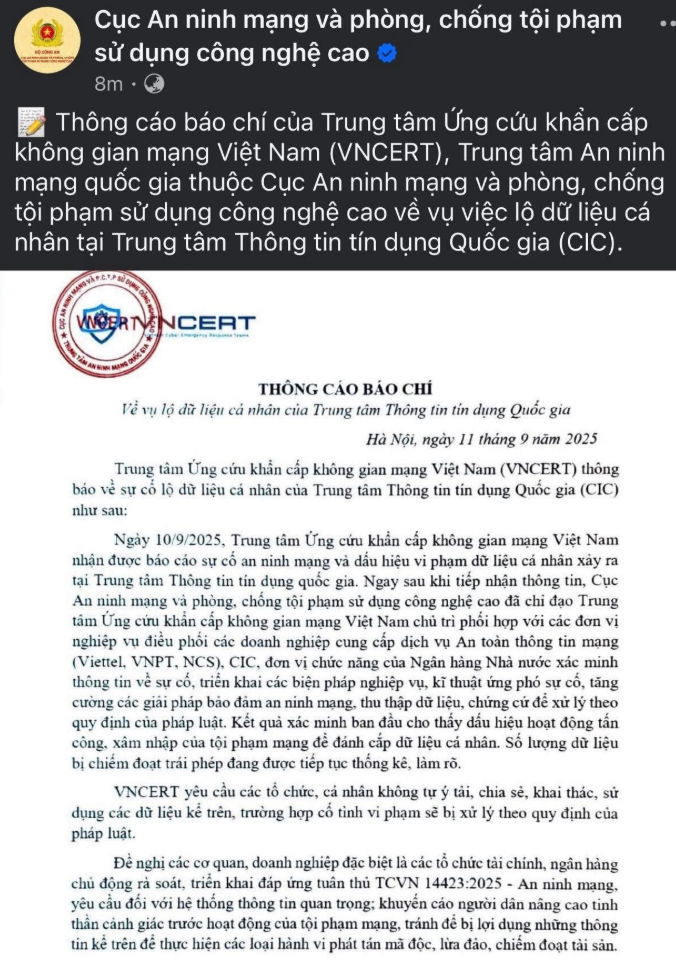

National cybersecurity agencies, led by the Vietnam Cyber Emergency Response Center (VNCERT), are coordinating an emergency response with major telecom and security firms. They have issued a stern public warning: do not download, share, or exploit any of the leaked data, as doing so violates Vietnamese law.

More critically, citizens are advised to immediately enable two-factor authentication on all financial accounts, monitor their bank statements for any unusual activity, and be extremely cautious of unsolicited communications claiming to be from banks, crypto exchanges, or government agencies.

Read also: Crypto-Stealing Malware Found in 18 Popular NPM Packages

A Wake-Up Call for Digital Security

The recent Vietnam data breach is more than a hack; it’s a wake-up call. It shows the weaknesses of centralized data stores as well as the catastrophic consequences it has when breached. For Vietnamese citizens, the immediate concern is that of financial fraud, but the downstream effects of both privacy and national security are of greater concern.

This breach demonstrates a need for secure and decentralized solutions, something that should be obvious to everyone we have observed in the Web3 space.

Final Thought: If a national credit bureau can be hacked, does this event make the case for a decentralized future for identity and credit verification?

FAQs

Who are the Shiny Hunters?

Shiny Hunters is a well-known global cybercriminal organization that specializes in stealing and selling large datasets from large companies and institutions on the dark web.

What is the CIC?

The Credit Information Center (CIC) is Vietnam’s national agency, managed by the State Bank of Vietnam, that collects and reports credit information for individuals and businesses across the country.

What should I do if I think I’m affected?

Immediately monitor your financial accounts for fraud, be wary of phishing attempts, change important passwords, and enable two-factor authentication everywhere it is offered.

For more cybercrime stories, read: Seoul Police Dismantle $30M Crypto Korean Hacking Organization with Chainalysis