Key Takeaways

- Propanc Biopharma Digital Asset Acquisition strategy secured up to $100 million from Hexstone Capital.

- Initial $1 million received, with remaining $99 million available through warrant exercises.

- Funds will support both crypto treasury building and cancer treatment development.

Table of Contents

Biotech Firm Embraces Dual-Track Investment Strategy

Tech and crypto keep showing us groundbreaking moves by bridging biotechnology and digital assets. Propanc Biopharma Digital Asset Acquisition plans have received important backing through a $100 million private placement agreement.

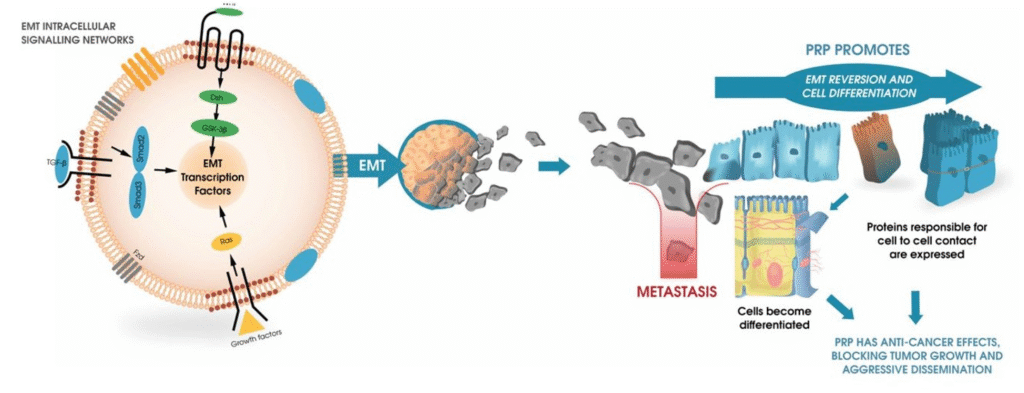

The Nasdaq-listed company (ticker: PPCB) announced it will use capital from family office Hexstone Capital to simultaneously build a diversified crypto treasury while accelerating development of its lead cancer treatment, Platelet-rich plasma (PRP), which targets recurrent and metastatic cancers by activating proenzyme.

Read also: Shineco Launches Blockchain-Biotech Network: Stem Cells Tokenization on Ethereum – Stock Surge 50%

Collaborative Alliance with a Crypto-Experienced Investor

The Propanc Biopharma Digital Asset Acquisition program becomes more credible through an arrangement with Hexstone Capital, which has extensive experience investing in digital asset treasury companies, leading cryptocurrencies, including Bitcoin, Ethereum, Solana, and Injective.

Under the structured agreement, the Propanc firm receives an immediate infusion of $1 million in cash and an additional $99 million available through warrants, exercisable over the next 12 months, providing an optional and flexible way to fund both digital asset accumulation and biomedical research projects.

Read also: Vietnam Debuts NDAChain: A National Blockchain for 100M Citizens

Balancing Innovation with Financial Strategy

CEO James Nathanielsz calls the Propanc Biopharma Digital Asset Acquisition “transformative” for fortifying the company’s balance sheet as it moves forward with developing its cancer treatment pipeline and, hopefully, obtaining first-in-human trial approvals starting in late 2026.

The strategy aims to identify undervalued digital asset treasury companies trading below their net asset value, creating potential shareholder value through strategic diversification beyond traditional biotech funding models.

Propanc’s investors reacted poorly to the move, as evidenced by a 12.4% drop in PPCB shares on the Nasdaq on Monday, though the company still believes, as many others do now, that crypto should be included on any firm’s balance sheet going forward.

Read also: Jiuzi Holdings $1B Crypto Treasury Strategy Approved

A New Way to Fund Biotech

The Propanc Biopharma Digital Asset Acquisition program is a unique combination of Biomedical research development and crypto investing that may establish a new model for how small biotechnology companies can leverage various digital assets to fund a lengthy drug development process while establishing long-term treasury value.

FAQs

What is the Propanc Biopharma Digital Asset Acquisition strategy?

The Propanc Biopharma Digital Asset Acquisition strategy is to create a diversified cryptocurrency treasury while funding cancer treatment research, in collaboration with crypto-focused investor Hexstone Capital, to purchase digital assets funded up to $100 million.

How will the funding be used?

The Propanc Biopharma Digital Asset Acquisition funding will support digital asset purchases and advance the company’s PRP cancer treatment toward human clinical trials, likely in the second half of 2026.

What makes this different from other corporate crypto strategies?

The Propanc Biopharma Digital Asset Acquisition approach uniquely combines capital to fund biomedical research with investments in the digital asset space, targeting undervalued crypto treasury companies, all while developing actual cancer treatments rather than purely financial speculation.

For more crypto treasury stories, read: French Chipmaker Sequans Plans $200M Raise to Boost Bitcoin Treasury Strategy