Key Takeaways

- Robinhood lists BNB for its 27 million funded accounts, expanding access to the world’s fourth-largest crypto asset.

- Coinbase has confirmed it will be offering BNB-USD trading pairs, marking a coordinated shift in U.S. exchange policy.

- The listings come as BNB’s market cap approaches $150 billion following a massive 2025 rally.

Table of Contents

An Important Policy Change for Access to the Binance Ecosystem

In a surprising policy reversal and win-win situation, Robinhood lists BNB on its platform, providing mainstream U.S. investors with direct access to Binance’s native token for the first time.

The move, confirmed on October 22, marks a significant shift in the traditional American exchange approach post-Binance 2023 regulatory settlements. On the heels of Robinhood listing BNB, Coinbase has revealed that it will soon add a BNB-USD trading pair, which will provide a one-two punch that officially legitimizes this asset for the retail market in the U.S.

Read also: GalaxyOne Retail Trading App Launches with 8% Yield to Challenge Robinhood

Strategic Expansion Amid Regulatory Thaw

The move for Robinhood to list BNB fits the description of the CEO, Vlad Tenev, of tokenization as “an unstoppable freight train.” The platform processed $8.6 billion in crypto volume this past August alone and continues to grow its digital assets past the 40 tokens available on its site.

This strategic growth is happening in a much more favorable U.S. regulatory environment and shows the exchanges need to address rising customer demand for major altcoins, even those previously considered controversial due to their association with legally-challenged entities.

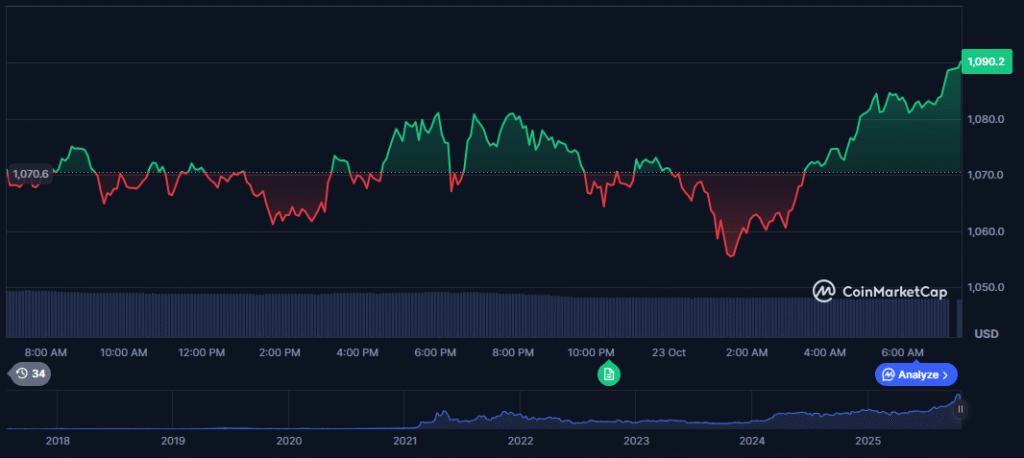

BNB price reacted with a surge of around 2%, despite the actual market conditions. Trading at $1,090 at the time of writing.

Read also: Telegram Wallet Listing Tokenized U.S. Stocks Starting this October

Validating BNB’s Market Dominance

The move to have Robinhood lists BNB provides institutional validation for the token’s remarkable 2025 performance, which saw its price surge from $500 in February to over $1,350 in October. Moreover, with its market cap nearing $151 billion at the time of writing, BNB has firmly established itself as the fourth-largest crypto behind only Bitcoin, Ethereum, and Tether.

So far, this listing not only grants Robinhood’s massive user base exposure to one of crypto’s strongest performers ever, but also signals that major U.S. platforms, mostly traditional ones, can no longer ignore the trading volume and ecosystem utility of Binance-connected assets.

FAQs

Why is ‘Robinhood lists BNB’ a significant announcement?

This marks a major policy shift for U.S. exchanges, which had largely avoided Binance-connected assets following the company’s 2023 regulatory issues. Providing 27 million funded accounts access to the world’s fourth-largest crypto represents a normalization of BNB in mainstream American finance.

What drove BNB’s price surge before the listing?

BNB’s rally to all-time highs was fueled by massive growth in its ecosystem, including record activity on PancakeSwap, booming memecoin trading on BNB Chain, and the token’s expanding utility across decentralized finance (DeFi) applications, creating what traders called “BNB SZN.”

Will other U.S. exchanges follow Robinhood and Coinbase?

Analysts expect other platforms to reconsider listings of major exchange tokens like OKB and CRO if regulatory conditions remain stable, especially given BNB’s massive liquidity and market demand that U.S. exchanges can no longer afford to ignore.

For more BNB ecosystem stories, read: YZi Labs Builder Fund Deploys $1B to Supercharge BNB Ecosystem