Key Takeaways

- VyFinance launches cstAPEX as a staked version of the APEX token with up to 10% annual yield.

- The token is designed for cross-chain capabilities, all backed by the Apex Fusion interoperability framework.

- This is an important move to connect Cardano’s unique Unspent Transaction Output (UTxO) architecture with the wider EVM ecosystem.

Table of Contents

A Strategic Bridge Between Ecosystems

In a noteworthy step toward development for blockchain interoperability, VyFinance launches cstAPEX, a yield-generating token designed to connect Cardano’s decentralized finance (DeFi) ecosystem with Ethereum Virtual Machine (EVM) networks.

The staked APEX derivative will offer holders up to 10% Annual Percentage Yield (APY) while retaining the liquidity and composability required to facilitate cross-chain functionality. With this strategic release, Cardano is clearly pushing a multi-chain approach versus working in isolation, and solves arguably the network’s largest challenges, gaining access to greater liquidity across DeFi.

Read also: New mXRP Liquid Staking Token Launches, Offering XRP Holders Up to 8% Yield

Technical Architecture and Yield Mechanics

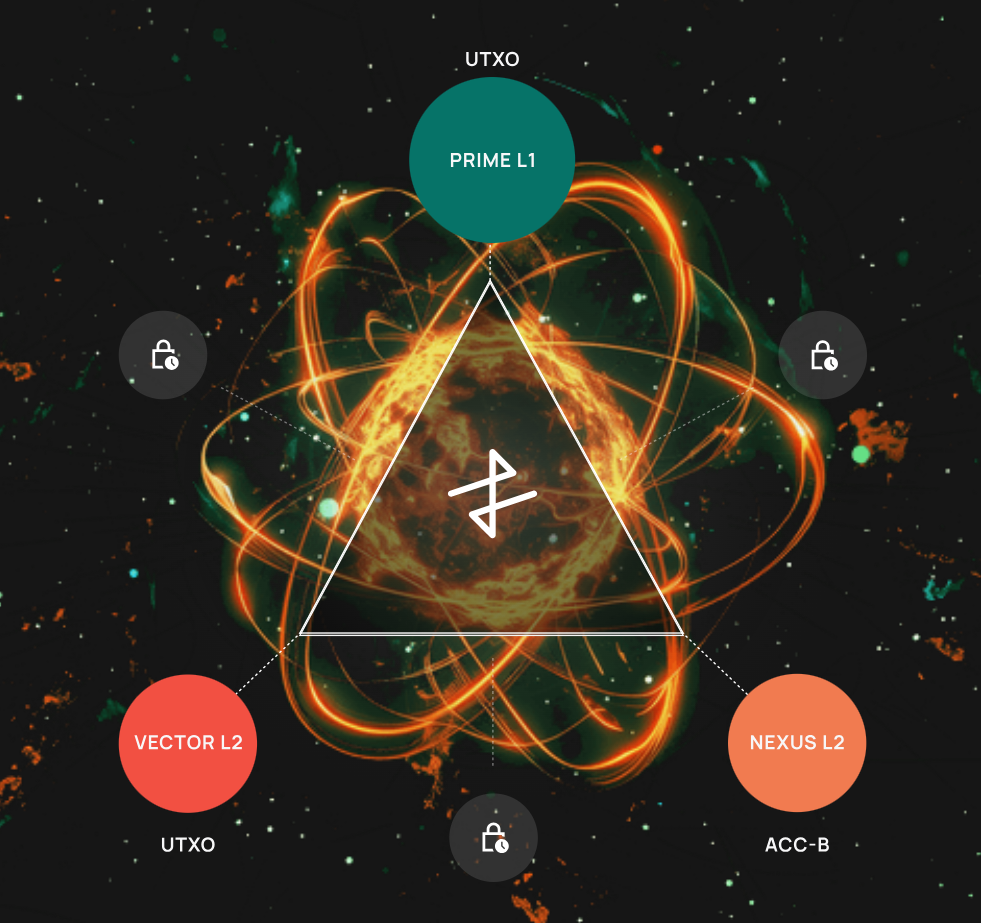

The decision by VyFinance launches cstAPEX, leveraging the Apex Fusion tri-chain architecture, which combines:

- PRIME for decentralized settlement

- VECTOR for high-speed Cardano execution

- NEXUS for EVM compatibility

Built entirely on Cardano initially, the staking rewards from cstAPEX will be similar to staking APEX directly on Prime Network, thus creating a yield-generating tool that can eventually move across chains.

The Cardano-native APEX token has a significant base on VyFinance, having already accumulated close to $1 million in liquidity, deployed in pools yielding around 35% annual percentage rate (APR), providing a great base for this expanded functionality.

Read also: Rootstock Institutional BTCFi Aims to Unlock $260B in Idle Bitcoin

Redefining Cardano’s DeFi Future

The decision to have VyFinance launch cstAPEX represents a paradigm shift for Cardano’s DeFi ecosystem, effectively transforming yield generation into a bridge between technological architectures. As VyFinance CEO Steven noted, this development “turbocharges Cardano’s DeFi” by preparing it for global, multi-chain participation while preserving the network’s signature security and stability.

For regular users, this means accessing Cardano-native yields within Ethereum-based applications, and effectively breaking down the barriers that have traditionally separated UTxO and EVM-based ecosystems in the DeFi space.

FAQs

What is the main purpose of VyFinance launches cstAPEX?

VyFinance launches cstAPEX with dual purposes: to provide Cardano users with up to 10% APY via staking rewards and to serve functioning as an interoperability bridge which will ultimately allow Cardano-native yield to be utilized within EVM-compatible DeFi applications.

How does cstAPEX achieve cross-chain functionality?

The token operates through Apex Fusion’s interoperability framework, which uses a tri-layer architecture (PRIME, VECTOR, NEXUS) and partners like LayerZero to connect Cardano’s UTxO model with Ethereum Virtual Machine networks.

Can cstAPEX be used on Ethereum-based platforms immediately?

Currently, cstAPEX exists natively on Cardano, but the architecture is designed for future expansion to EVM chains. The yield-bearing characteristics will remain consistent when the token becomes available on compatible networks.

For more DeFi-related stories, read: Botanix Launches First Decentralized Bitcoin L2: 5-Second Blocks, EVM Compatibility