Key Takeaways

- XRP’s Binance reserves fell by 18.73 million tokens, signaling potential accumulation.

- Price action reveals that a major rally for XRP is possible only if the asset clears the $2.60 level.

- XRP’s major liquidation levels stand at $2.469 on the lower side and $2.544 on the upper side.

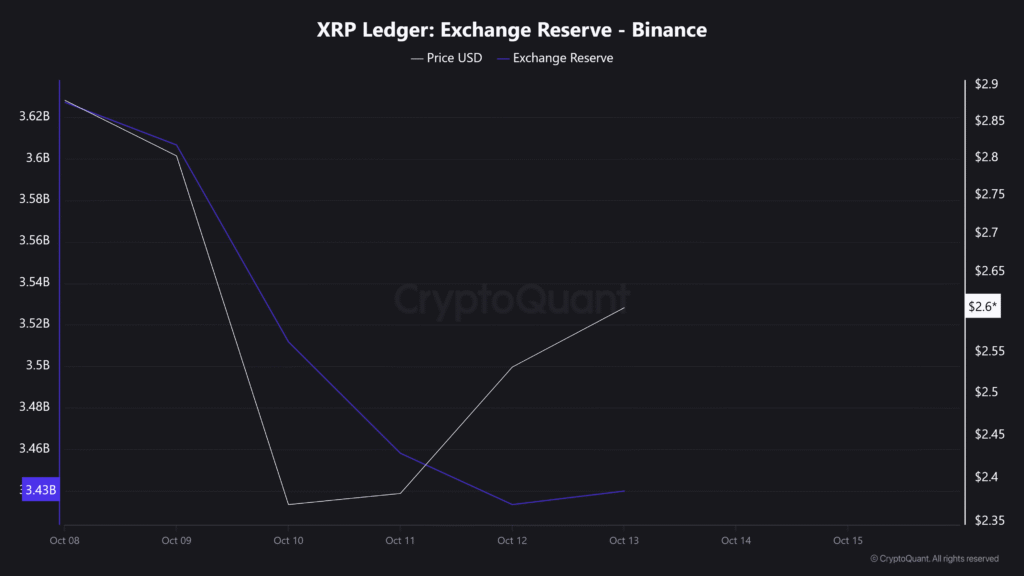

Amid the market downturn, XRP, Ripple’s native token, witnessed 18.73 million tokens exiting Binance’s reserves. On-chain data from CryptoQuant shows that Binance’s XRP holdings dropped from $3.627 billion to $3.439 billion, signaling significant accumulation and hinting at an ideal buying opportunity.

XRP Binance Reserves See Major Decline

According to the on-chain platform, if XRP’s exchange reserves continue to decline, it indicates increasing buying pressure. The metrics further suggest that falling exchange reserves could either drive the asset’s price higher or reduce selling pressure during a downtrend.

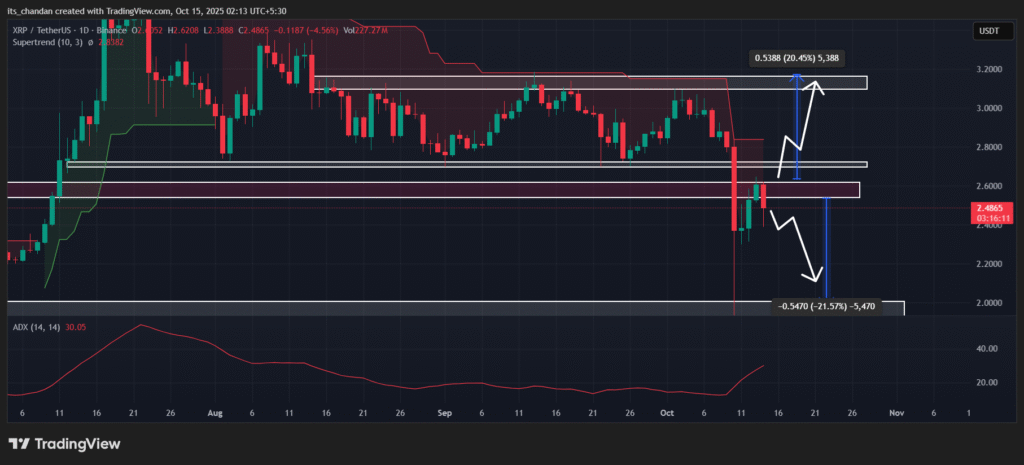

According to TradingView data, XRP’s price has once again started to climb; however, due to the market downturn, it failed to sustain the momentum. The latest data shows that the asset is currently trading at $2.47, down by 4.80% today.

XRP Technical Outlook: Key Levels to Watch

However, the current level still appears to be a cautious zone for XRP holders. As per the daily chart, $2.60 previously served as a key support level for the asset but has now turned into resistance. Moreover, XRP recently closed a daily candle below this level, suggesting that bearish momentum could intensify if it fails to reclaim the $2.60 level.

TimeCrypto’s technical analysis on the daily chart reveals that XRP is approaching its key support level. If a rebound occurs, there is a strong possibility that the asset could experience a 20% price uptick and reach the $3.17 level. On the other hand, if XRP fails to hold this support, the asset could see a 20% downside move and may drop to the $1.988 level.

As of now, the Supertrend indicator continues to display a red trend and hovers above the asset’s price, indicating that XRP is in a downtrend. Meanwhile, its Average Directional Index (ADX) value has reached 30, signaling strong directional momentum.

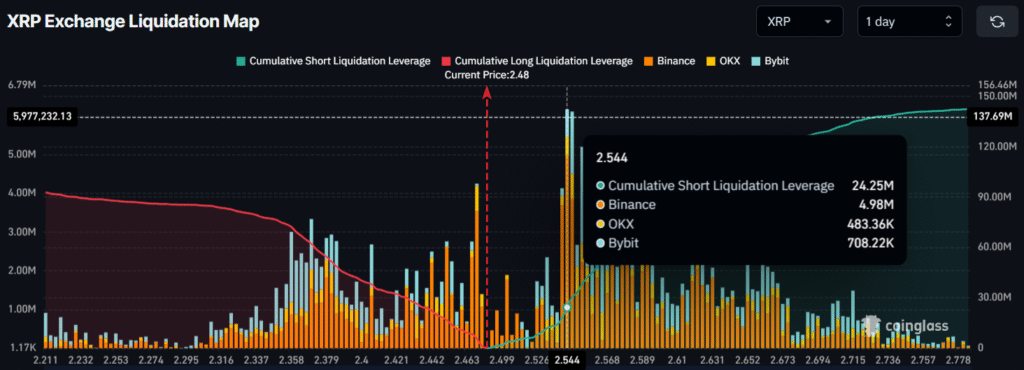

XRP’s Major Liquidation Levels

Looking at the current market sentiment, it appears that sellers are still dominating. Derivatives data from Coinglass reveals that nearly $5.65 million worth of short positions are at risk of liquidation. According to the Coinglass liquidation heatmap, XRP’s major liquidation levels stand at $2.469 on the lower side and $2.544 on the upper side.

At these levels, traders have built $5.65 million worth of long positions and $24.25 million worth of short positions. This data further suggests that traders strongly believe XRP’s price will not cross the $2.544 level. If it does, the market could experience sharp upward momentum, and the $24.25 million in short positions could also be liquidated.

When combining XRP’s on-chain metrics, price action, and derivatives data, it appears that XRP has a positive long-term sentiment. However, for upward momentum to sustain, the asset not only needs to clear the $2.60 resistance level but also surpass the major short liquidation level of $2.544.

Also Read: Ripple Price News: XRP fell 5.0% Near $2.40; Are You Holding?