Key Takeaways

- Crypto whales go on a buying spree amid the market dip, adding millions of PEPE, HYPE, ETH, and more in recent hours.

- Despite the crash, Bitmine continues accumulating ETH, adding $14 million worth of coins.

- Tom Lee stated that today’s dip was a healthy shakeout, and the market is expected to rise within a week.

Crypto whales are diving back into the market as a major altcoin hits a massive discount following yesterday’s crash. According to CoinMarketCap data, the overall crypto market is down 8.43%, while top assets, including Bitcoin (BTC) and Ethereum (ETH), have dropped 6.5% and 9.25%, respectively, over the past 24 hours.

Where Are Crypto Whales Investing?

So, where are the crypto whales investing? Recently, crypto transaction tracker Lookonchain revealed that whales have shown strong interest in PEPE, Hyperliquid (HYPE), Ethereum (ETH), and Bitcoin (BTC).

Lookonchain reveals that:

- Whale wallet addresses 0x2bfb purchased 600.88 billion PEPE worth $4.97 million

- Whale named qianbaidu.eth purchased 657.8 billion PEPE worth $4.44 million and added 8.67 million USDC to Hyperliquid to buy HYPE; however, these purchases have not yet been confirmed.

- Whale wallet address 0x9b83 purchased 140,145 HYPE coins worth $5.5 million and also went long on BTC.

- An OTC whale purchased 14,165 ETH worth $55.5 million through FalconX, Coinbase, and Wintermute.

Not only have whales shown interest and taken advantage of the market dip, but institutions are following suit as well.

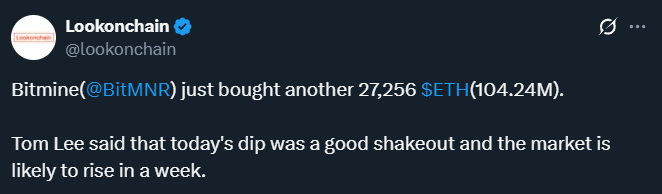

- Two wallets, likely belonging to Bitmine, added 33,323 ETH worth $126.4 million from FalconX and Kraken, while Bitmine itself purchased 27,256 ETH worth $104.24 million.

Looking at the current market sentiment, Tom Lee, a renowned investor and financial analyst, stated that today’s dip was a healthy shakeout and that the market is likely to rise within a week.

This now raises the question of whether this is an ideal time to buy or if the market could fall further.

Amid this accumulation, a crypto expert noted that whales seem to be rotating into meme coins like PEPE while hedging with BTC and high-beta assets such as HYPE.

When whales buy after a panic, they are not chasing hype but positioning for a liquidity return. Accumulating PEPE and HYPE while going long on BTC demonstrates confidence in a short-term sentiment recovery and the market’s underlying resilience.

Why are the Altcoins Down Today?

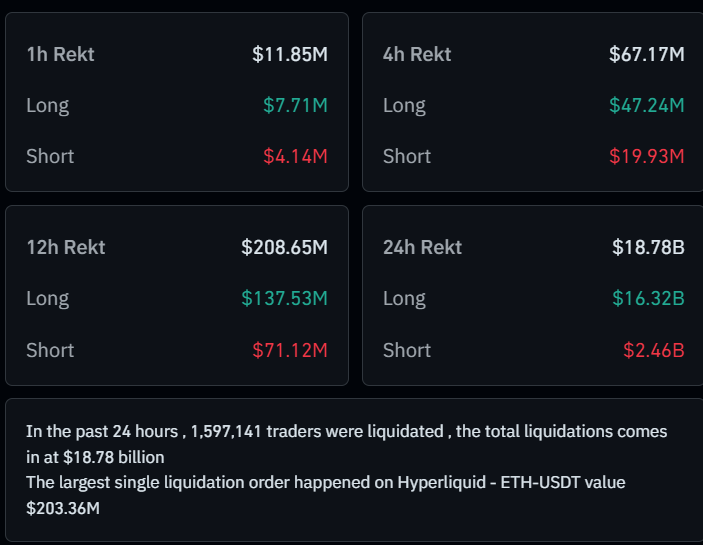

These accumulations, with altcoins at a discount, follow yesterday’s historic crypto crash. Over 1.59 million leveraged traders had $18.78 billion worth of positions liquidated, including both long and short positions, after US President Donald Trump announced a 100% tariff on China.

Data reveals that this crash was one of the biggest in crypto history, surpassing the Covid-19, Terra Luna, and FTX crashes reported in May and November 2022.

At press time, crypto market sentiment has shifted to fear, with the sentiment analysis value dropping to 27.