Key Takeaways

- WLFI neutralized a wave of wallet breach attempts linked to compromised private keys before its token launch, blacklisting affected addresses to protect locked funds.

- The project plans to burn 47 million tokens, worth over $10 million, from its treasury as part of a deflationary strategy aimed at supporting long-term holders.

- WLFI’s token saw over $1 billion in first-hour trading, briefly touching $0.40 before stabilizing near $0.22 amid speculation and short-term price swings.

- With only a few days of trading history, technical indicators show fading momentum, while the token’s future performance is expected to hinge on governance developments and liquidity dynamics.

World Liberty Financial (WLFI), the Trump-affiliated decentralized finance (DeFi) project, said it prevented attempted wallet breaches stemming from individual user compromises during the token’s launch week.

In a statement on social media platform, X, WLFI said a designated wallet executed a mass blacklisting of addresses identified as compromised through private key loss. The measure, taken before the token’s public debut, reportedly prevented unauthorized withdrawals from the project’s Lockbox, with the team now assisting affected users in regaining access.

WLFI Responds to Early Price Swings with Supply Reduction Plan

The WLFI token began trading on September 1 and saw over $1 billion in volume within the first hour. It surged toward $0.40 before retreating to the $0.20–$0.25 range, where it has since stabilized. Analysts now point to concentrated liquidity between $0.29 and $0.32, resistance near $0.36 to $0.40, and support around $0.22 to $0.24, with a firmer base closer to $0.20.

In response to the rapid price swings and short-term expectations, WLFI proposed a governance-led measure to allocate all protocol-owned liquidity (POL) fees toward open-market buybacks and permanent token burns.

These fees are collected through decentralized trading pools operated by WLFI on Ethereum, Binance Smart Chain, and Solana, with all proceeds from transaction fees to be used to repurchase WLFI tokens, which are then sent to a burn address, removing them permanently from circulation.

The team said the strategy is designed to reduce supply, increase the relative ownership of long-term participants, align token deflation with trading activity, and provide on-chain transparency.

To support the shift, WLFI announced the immediate burn of 47 million tokens, valued at more than $10 million, sourced from its unlocked treasury, describing it as a structural commitment to long-term governance alignment.

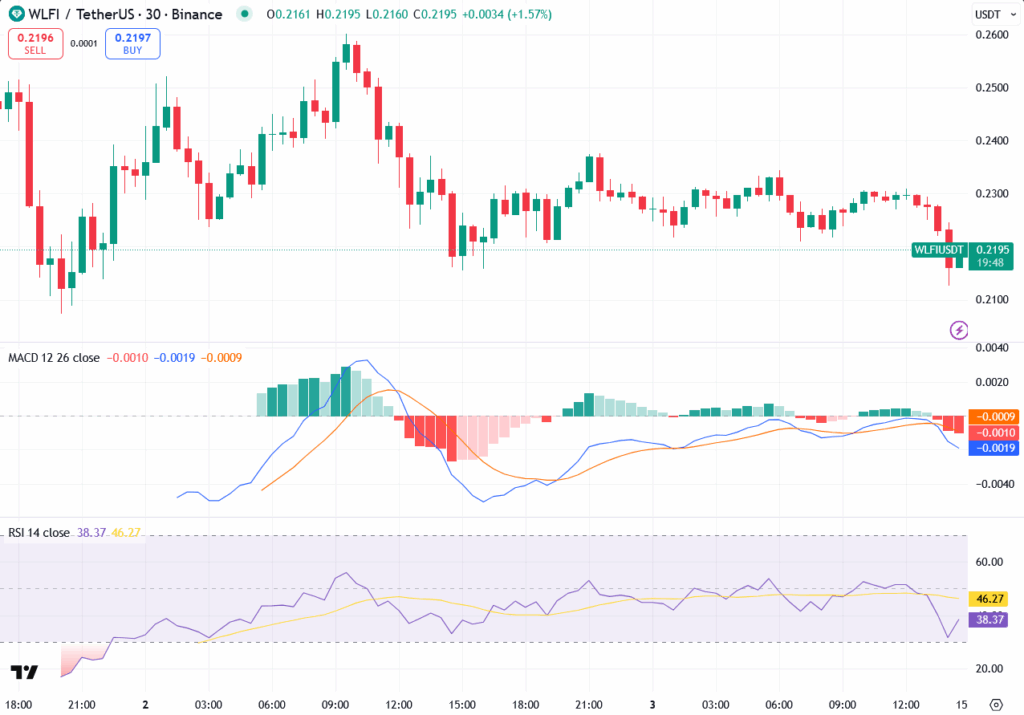

A Quick Technical Look at the WLFI Chart

WLFI launched just three days ago, offering little long-term chart history. As a result, short time frames, liquidity zones, and news-driven movements are currently the only viable tools for analysis.

On the 30-min chart, WLFI/USDT shows clear signs of early price turbulence. After an initial push toward $0.25, the token retraced and has hovered in a tight consolidation range.

Technical Indicators:

- MACD (12,26): The histogram recently turned red again, with the signal line and MACD line crossing downward. This suggests fading bullish momentum and the potential for further short-term pressure unless supported by buying volume.

- RSI (14): The Relative Strength Index is trending near the midline after recovering from oversold territory. While not signaling extreme conditions, the RSI reflects a neutral to slightly bearish sentiment in the short term.

The token’s performance is expected to be influenced by short-term developments, market liquidity, and protocol updates, including the recently announced $10 million treasury burn and governance proposals under review.

Read More: Kraken and Backed Launch Tokenized Stocks on Ethereum, Expanding xStocks to DeFi’s Largest Network