Key Takeaways

- Aster (ASTER) price hits a new all-time high of $2.1353, marking a 52% price jump.

- The key catalysts behind the rally appear to be rising TVL, increasing revenue, whale accumulation, and more.

- Price action suggests that $1.93 acts as a make-or-break level for ASTER, if it holds, the asset could reach a new high, but if it fails, a tumble is possible.

Aster (ASTER) has been making waves in the cryptocurrency space with its impressive price surge. On September 23, 2025, while most assets, including Bitcoin (BTC) are struggling to gain momentum, ASTER has recorded a remarkable 52% price increase.

Aster (ASTER) Current Price and Rising Trading Volume

At press time, ASTER is trading near $2.02, marking a 52% price increase over the past 24 hours. During this period, the asset recorded an intraday low of $1.3106 and a high of $2.1353. Meanwhile, investors and traders have shown strong participation, driving a 25% surge in trading volume compared to the previous day.

Amid such gains during market uncertainty, questions arise: Why is the ASTER price rising? Will the rally continue, or is there a chance of a downside correction?

Why is the ASTER Price Rising?

Over the past 24 hours, several bullish catalysts have been recorded, triggering this rally. From fundamentals to price action, everything seems to be pushing the ASTER price toward a new high.

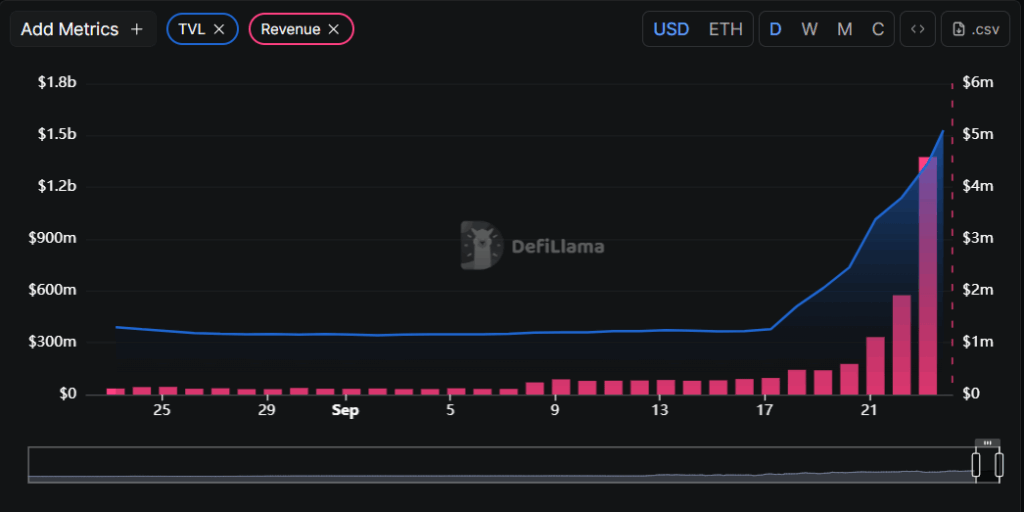

Data from DeFiLlama reveals that Aster’s Total Value Locked (TVL) has reached a peak of $1.53 billion. Not only that, but its revenue continues to soar exponentially each day. On September 17, Aster generated a revenue of $320,030, and by September 23, this figure had not only crossed $1 million but surged to $4.29 million in a single day.

These strong fundamentals might be the prime catalyst for whales’ interest in the asset. Crypto transaction tracker Lookonchain shared multiple tweets recording that whales have purchased $3.88 million worth of ASTER over the past 24 hours.

Additionally, Lookonchain also revealed that Aster’s 24-hour perpetual trading volume has exceeded $11.8 billion, surpassing Hyperliquid.

Looking at whales’ interest and rising price, an expert noted that CZ won’t stop pushing, and ASTER is already outperforming the market even as most assets are in the red.

This claim comes after several appreciation posts published by CZ over the past 24 hours. In a recent post, CZ stated, “Aster cracks me up… leveraged me fully… Well played.” This tweet was made when the asset was hovering near the $1.31 level, and since then, the price has continued to rise.

ASTER Technical Outlook: Key Levels to Watch

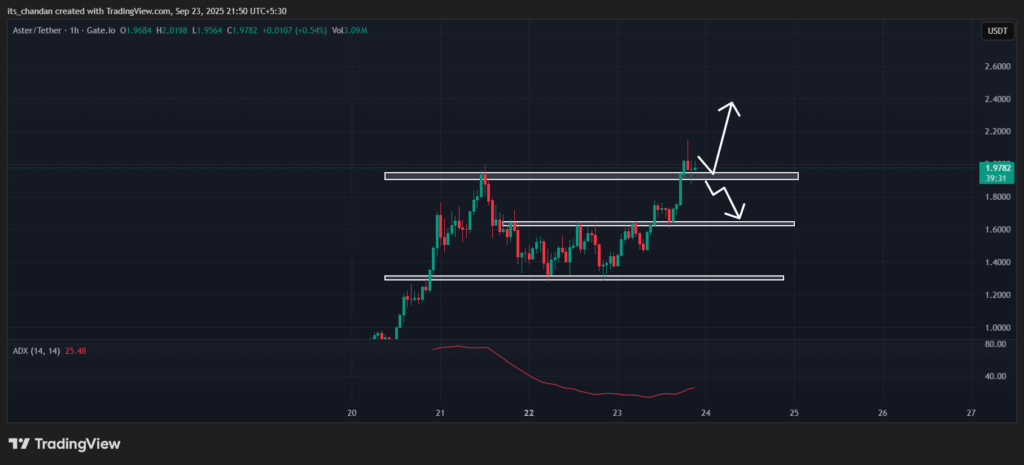

According to TimesCrypto’s technical analysis, ASTER is in an uptrend and is currently retesting the breakout level of $1.93. On the hourly chart, this level appears to be a make-or-break point for the asset.

Based on the current price action, if ASTER successfully holds this breakout level, the market could see another new high. On the other hand, if it fails and the price falls below this level, there is a strong possibility that ASTER could tumble.

Currently, the Average Directional Index (ADX) has reached 25.48, indicating a strong upside trend for ASTER and suggesting that it could continue this momentum in the coming hours.