Key Takeaways

- The 3AC liquidation wallet dumped 2.25 million Worldcoin (WLD) tokens, worth $2.88 million.

- The WLD Long/Short ratio fell below 1, suggesting strong bearish sentiment among traders.

- Despite the sell-off, WLD price action indicates that the asset remains bullish, with room for a potential 30% price uptick.

The risk of a potential price decline for Worldcoin (WLD) is looming after it registered an 80% gain in the past 48 hours. The sell-off began when smart money and institutions started offloading WLD tokens following the notable rally.

3AC Dumps Millions of Worldcoin (WLD)

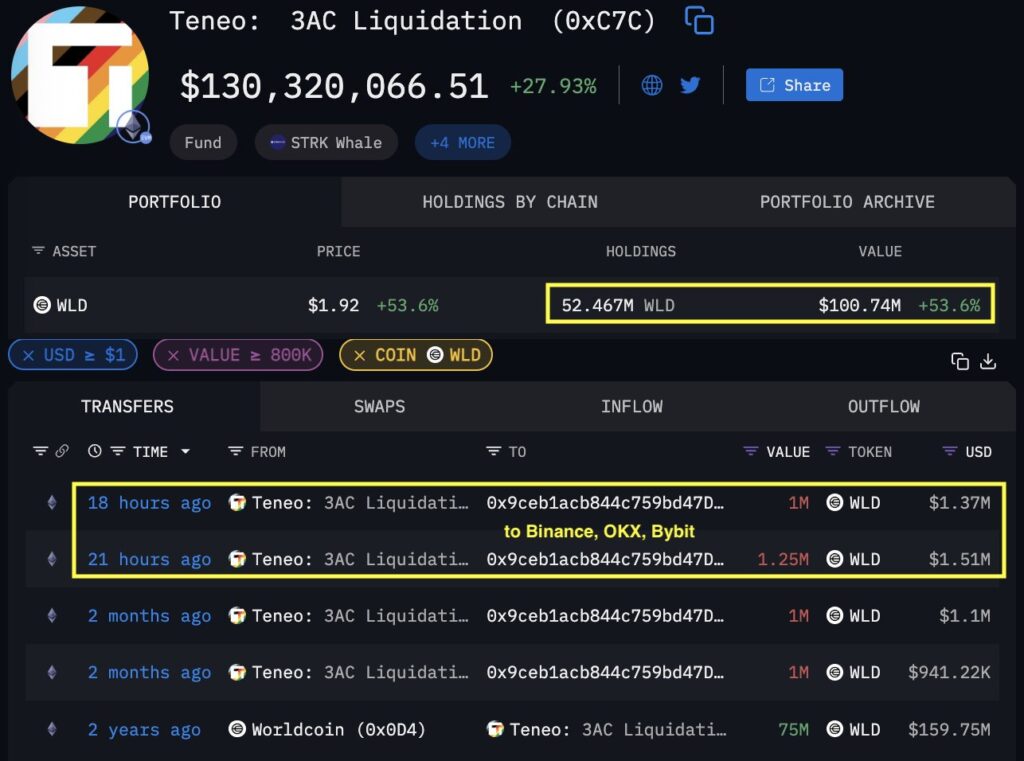

The transaction tracker Spotonchain reveals that the Teneo 3AC liquidation wallet has dumped 2.25 million WLD tokens worth $2.88 million. This notable sell-off was recorded on Binance, OKX, and Bybit.

Despite offloading millions of tokens, the on-chain tracker shows that the investment firm still holds 52.47 million WLD tokens valued at $101 million.

Data reveals that the 3AC liquidation wallet received 75 million WLD tokens two years ago and, as of July 2024, has offloaded 30% of them at the original amount.

WLD Holds Strong Amid Rising Volume

Despite a massive sell-off by the investment giant, WLD has managed to hold a 25% gain. However, in the past 24 hours, the asset reached an intraday high of $2.21 before falling 20%, and it is currently trading near the $1.80 level.

Meanwhile, participation from investors and traders continues to rise. Data from CoinMarketCap reveals that WLD’s 24-hour trading volume jumped 80% compared to the previous day.

This surge in the trading volume, along with the price, suggests the asset’s strong upside momentum and increasing interest from traders and investors.

On-Chain Data Shows Mixed Sentiment

At press, investors and traders show mixed sentiment, with some accumulating while others are betting on short positions. On-chain analytics tool Coinglass reveals that over $3.10 million worth of WLD tokens have moved out of exchanges in the past 24 hours, signaling accumulation.

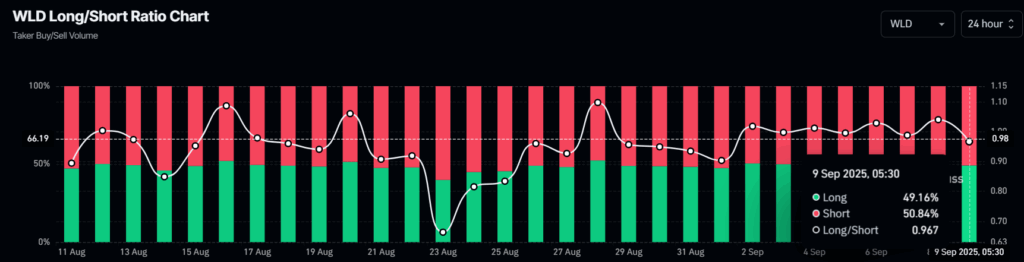

Meanwhile, some traders are strongly betting on short positions, hoping the price may fall in the coming days. Over the past 24 hours, the WLD Long/Short ratio fell below 1 and currently stands at 0.967, indicating strong bearish sentiment among traders.

However, at press, traders betting on long positions still outnumber those betting on short positions.

WLD Price Action Points to Next Key Level

Worldcoin (WLD) price action and technical analysis indicate that the asset is in an uptrend, following multiple bullish breakouts over the past 48 hours.

On the daily chart, WLD has successfully broken out of a descending trendline and the horizontal level at $1.50, which previously acted as a strong selling pressure.

Based on current price action, a short-term price correction is possible before the upside rally continues. WLD, however, has already opened room for a potential 30% gain, with the next resistance level at $2.46.