Key Takeaways

- XRP whale dumps 30 million tokens worth $68.35 million amid market uncertainty.

- Price action hints XRP could see a further dip if it fails to reclaim the $2.33 level.

- Ripple’s $2 billion plan for an XRP buyback could propel the asset’s price.

Amid market uncertainty, a crypto whale dumped 30 million XRP tokens, valued at $68.35 million, on the BitGet exchange. The wallet address remains unknown, but the transaction was recorded when XRP broke the key support level of $0.325, while the overall crypto market was bleeding.

Trump Signals Possible Changes to China’s 100% Tariff Deadline

However, market sentiment appears to be improving once again following U.S. President Donald Trump’s recent remark that he could move up China’s 100% tariff deadline from November 1st if he wishes. In the press conference, Trump stated, “China wants to talk, and we like talking to China.”

Impact on XRP Price

This announcement by the U.S. President has had a significant impact on XRP, along with other cryptocurrencies. Earlier today, before the announcement, XRP was trading near $2.199, but later improved significantly.

According to the latest data, XRP is currently trading near $2.30, though it is still down 2% for the day. This impressive price recovery has attracted mass participation, reflected in a 45% jump in trading volume to $8.95 billion.

Now, it will be interesting to watch whether the XRP price will soar or if the downward momentum will continue in the coming days.

Also Read: Time to Buy XRP? 18.73 Million Tokens Exit Exchanges

XRP Price Action and Technical Analysis

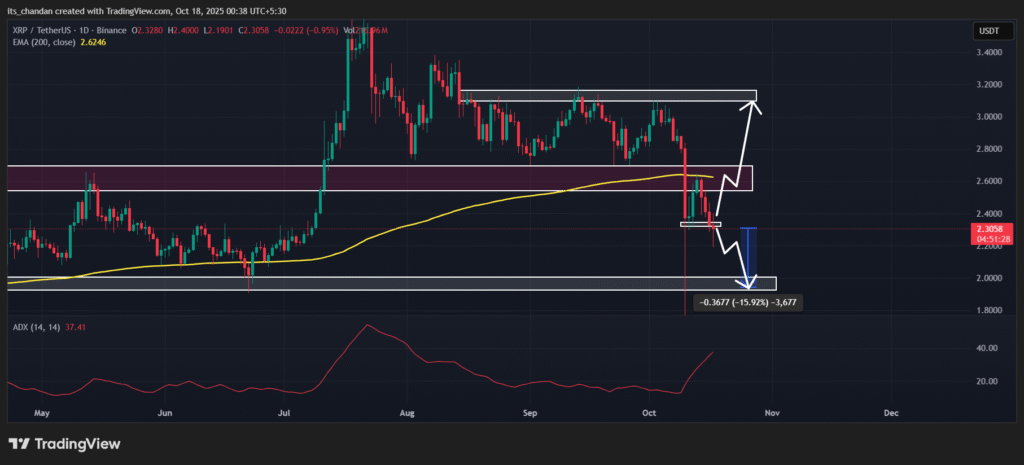

According to TimesCrypto’s technical analysis, XRP is in a downtrend, as it has been trading below the key support level of $2.60 and the 200 EMA, which it had held since June 2025.

On the daily chart, following Trump’s recent development regarding trade talks and the 100% tariff, XRP appears to be rebounding.

Based on the current price action, there are two scenarios XRP could face in the coming days.

If the downward momentum continues and XRP fails to reclaim the $2.33 level, it could see a decline of over 16% and may reach the $1.95 level.

On the other hand, if XRP manages to reclaim the $2.33 level, a reversal could be possible; however, a major rally would only occur if XRP breaks above the $2.65 level.

However, there is a strong possibility that XRP could soon see a price recovery. Recently, Ripple confirmed plans to raise at least $1 billion USD to buy back XRP, which could boost the asset’s price and potentially bring back the bull run.

At press time, the technical indicator Average Directional Index (ADX) has reached 37.41, above the key threshold of 25, indicating strong directional momentum; however, the current momentum is bearish.

XRP Traders Depict Bearish Outlook

Despite the improving market, trader sentiment remains bearish, as bets on short positions are still higher than long positions.

Derivative tool Coinglass reveals that XRP’s major liquidation levels stand at $2.254 on the lower side and $2.332 on the upper side. At these levels, traders are over-leveraged, with $18.99 million worth of long positions and $23.99 million worth of short positions.

These bets indicate that bears are still dominating XRP, while bulls remain hesitant despite major developments regarding China’s 100% tariff update.