Key Takeaways

- 9,000 BTC moved across three whale wallets that had zero balance remaining, which may indicate redistribution.

- Bitcoin touches $112.0 mark following the transfer period, indicating the funds likely shifted to a private wallet instead of exchanges.

- These whales may not be interested in an accumulation, as no major inflows were tracked on these whale wallets.

Three dormant wallets collectively transferred 9,000 BTC on 9 July 2025 (valued at ~$967 million), leaving their wallets at a zero balance.

Address 1: 1HJDQbLauXEkzsTujzw5PaAqbcDCBeLiq1

Address 2: 1MPsPzkBK3w8J6CJyAFUkoiSaxTqWRabsk

Address 3: 1DwajJWEtWg3KHBepyUFMB4WjudYcoe542

Wallet Activity Overview

Address 1: 1HJDQbLauXEkzsTujzw5PaAqbcDCBeLiq1

Key Transactions:

- Jul 9, 2025: The user transferred 4,000.00039888 BTC (~$429.9M) with the fee rate of 7.93 satoshi per byte.

- Jul 25, 2019: Transferred 3,999.974 BTC (~$38.7M), which is now valued at 430,537,201.49 USD.

- Some of the maintenance transfers or microtransactions are from 2020 to 2024.

Moves in the year 2019 and 2025 show some redistribution or selling activity from the wallet holder. The address now holds zero balance. No incoming transactions may reflect that they are no longer buying. The smaller amount of frequent transfers (e.g., 0.00000547 BTC) likely are wallet maintenance.

Address 2: 1MPsPzkBK3w8J6CJyAFUkoiSaxTqWRabsk

Key Transactions:

- Jul 9, 2025: The holder moved 4,000.00042497 BTC, which are currently valued at ~430.54 million USD.

- Jul 25, 2019: Moved 3,999.988 BTC (~$38.7M) and paid transaction fees of 23.58 USD.

Address 3: 1DwajJWEtWg3KHBepyUFMB4WjudYcoe542

Key Transactions:

- Jul 9, 2025: The wallet has performed the transfer of 1,000.00015544 BTC, which are currently valued at ~$107.5 million USD.

- Mar 12, 2021: Transferred 999.99832318 BTC (~$57.2M). The fee paid was 335.69 USD with the fee rate of 89.47 satoshi per byte.

Trend Analysis

The three whale Bitcoin wallets transferred a total of 9,000 BTC (worth $967.28M at the time at $107,475/BTC) on July 9,2025. The transfer carried out in one large synchronized transaction: Address 1 (4,000 BTC), Address 2 (4,000 BTC), and Address 3 (1,000 BTC).

The BTC movement from the three whale addresses in the time period of 2019 to 2025 shows the redistribution trend. The bar chart represents the quantity of BTC that is moved at key periods (July 2019, December 2019, August 2020–June 2021, December 2024, and July 2025).

In the past, most BTC tracked moved from these three addresses in large outbound amounts in 2019 and 2021, with little other underlying maintenance since. There is no recent incoming BTC flow and zero price drop involved. It could be possible that these transfers are redistribution transactions and not sales transactions.

Large Transfers

The below table shows the major BTC transfers executed by these addresses, aligned with the value involved.

| Address | Date | BTC Transferred | Value at Time | Value at ~$108,759/BTC |

| 1HJDQbLauXEkzsTujzw5PaAqbcDCBeLiq1 | Jul 25, 2019 | 3,999.97 | $38.73M | ~$435.03M |

| 1HJDQbLauXEkzsTujzw5PaAqbcDCBeLiq1 | Jul 9, 2025 | 4,000.00 | $429.9M | ~$435.03M |

| 1MPsPzkBK3w8J6CJyAFUkoiSaxTqWRabsk | Jul 25, 2019 | 3,999.99 | $38.73M | ~$435.03M |

| 1MPsPzkBK3w8J6CJyAFUkoiSaxTqWRabsk | Jul 9, 2025 | 4,000.00 | $429.9M | ~$435.03M |

| 1DwajJWEtWg3KHBepyUFMB4WjudYcoe542 | Mar 12, 2021 | 999.9983232 | $57.28M | ~$108.76M |

| 1DwajJWEtWg3KHBepyUFMB4WjudYcoe542 | Jul 9, 2025 | 1,000.00 | $107.5M | ~$108.76M |

Bitcoin Price Analysis

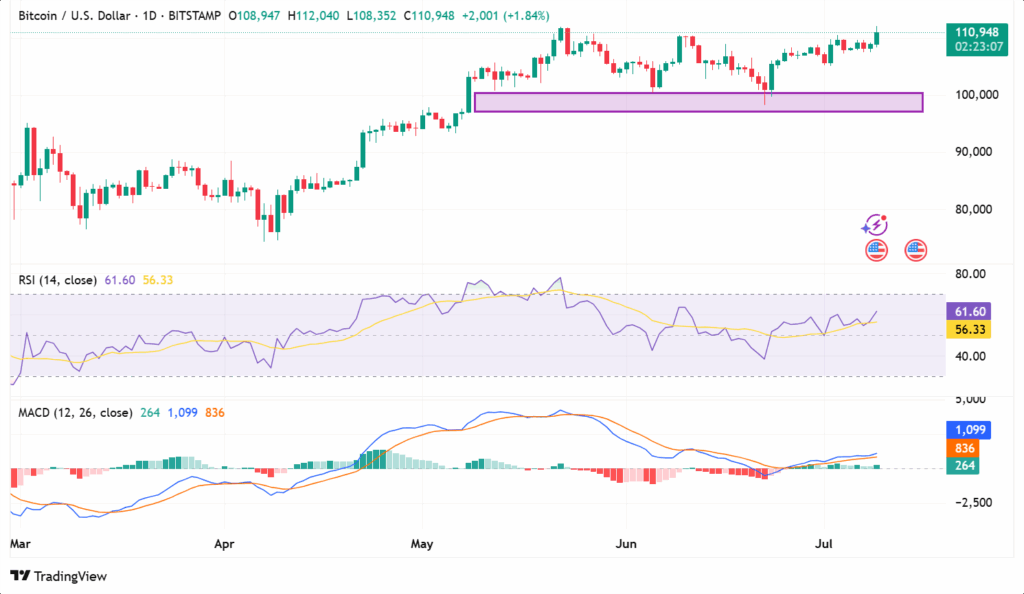

On the daily chart, the Bitcoin (BTC) price touches an all-time-high (ATH) above $112.0K mark. The largest cryptocurrency by the market cap breaks the short-term price range of $106K and $109K. After touching the low of $98,240 on June 22, 2025, the price gained 14% marking the high of $112.04K.

BTC bulls should give a daily close above the mentioned level to continue the upside momentum.

Both the momentum oscillators, the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicates the underlying bullish sentiment.

On the flip side, if there is any shift in the bullish sentiment, it could trigger a sell-off in the price. Moving lower, an immediate support is lying around the $108K mark followed by the low of July 1 at $105,280 level.