- Hong Kong tests Chainlink CCIP – The HKMA is testing Chainlink’s interoperability protocol to enable seamless cross-chain transactions.

- Bridging private and public blockchains – Visa, ANZ, and Fidelity are integrating ANZ’s private DASchain with Ethereum to explore secure, compliant financial interactions.

- Simulating cross-border tokenized payments – The pilot focuses on PvP and DvP settlement using tokenized fund units, e-HKD, and deposits.

- Hong Kong’s ongoing blockchain push – Since 2017, the city has advanced various blockchain projects, including mBridge, eTradeConnect, and the new 2025 DLT Supervisory Incubator.

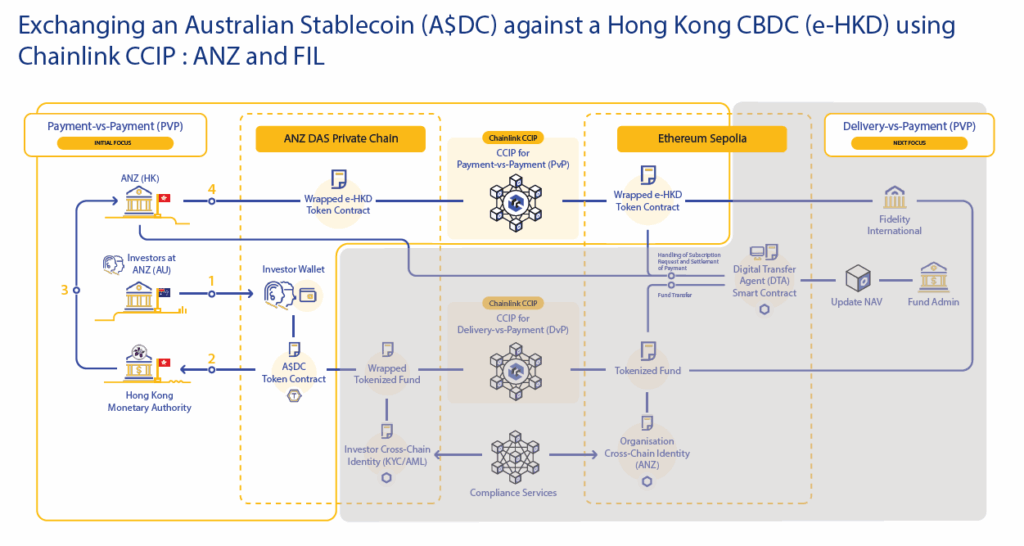

The Hong Kong Monetary Authority (HKMA) has announced that Phase 2 of its e-HKD Pilot Programme will incorporate Chainlink’s Cross-Chain Interoperability Protocol (CCIP) as part of a broader effort to enable seamless transactions across blockchain networks.

According to a report published by Visa, New Zealand Banking Group (ANZ), Fidelity International (FIL), and ChinaAMC Hong Kong, along with Visa, are among the 11 consortia taking part in the pilot.

Their primary focus will be on programmability and the settlement of tokenized assets, while also leading the integration of Chainlink’s CCIP to bridge ANZ’s private DASchain with the public Ethereum network.

The testing phase will involve Payment-vs-Payment (PvP) and Delivery-vs-Payment (DvP) flows that will simulate cross-border transactions using tokenized fund units and digital money forms, such as the e-HKD and tokenized deposits.

Chainlink’s infrastructure is expected to serve as the cross-chain bridge, enabling atomic settlement and mitigating counterparty risk.

Additional Objectives and Pilot Components

- Smart Contract-Driven Automation: Visa’s Tokenized Asset Platform (VTAP) will facilitate smart contract operations, including minting, transfer, and identity management across wallets and networks.

- Regulatory Token Standards: The programme will be testing both ERC-20 and ERC-3643 token standards to assess compliance, scalability, and security in regulated financial environments.

- 24/7 Settlement Infrastructure: While not directly tested, the pilot supports future design considerations for continuous, real-time settlement systems that operate beyond traditional market hours.

- On-Chain KYC Mechanism: Chainlink’s Compliance Services module will be used to port verified identity data onto the blockchain, supporting secure wallet onboarding and cross-chain identity (CCID) features.

Hong Kong’s Push for a Smarter, Tokenized Future

Long before the e-HKD pilot, Hong Kong’s central bank began its blockchain exploration in 2017 with Project LionRock, a wholesale CBDC proof-of-concept conducted with the note-issuing banks and the Hong Kong Interbank Clearing Limited, to study Delivery vs. Payment and large-value payments on a DLT backbone.

Additionally, in October 2018, the HKMA partnered with a group of twelve banks to launch eTradeConnect, the city’s first large-scale blockchain trade-finance platform. Originally launched as a proof-of-concept in 2017, the platform transitioned to live operations, focusing on digitizing trade documents, automating financing, and mitigating counterparty risk.

Furthermore, in an attempt to expand its CBDC program, Hong Kong joined the mBridge initiative in 2021 – a project led by the BIS, connecting Thailand, UAE, and China’s central bank. The initiative tested real-world transactions, showcasing how a shared DLT ledger can make cross-border payments more efficient.

Most recently, in January 2025, the HKMA launched its Supervisory Incubator for Distributed Ledger Technology to help banks safely integrate DLT into their operations, further lowering barriers to blockchain adoption across the financial sector.

Read more: Market Digest: Bitcoin Surges to $110K as Gold Retreats amid Trade Talk Optimism