Key Takeaways:

- Ethereum’s $1TS initiative targets trillion-dollar contracts and mass user trust.

- Security audits span UX, wallets, smart contracts, and infrastructure.

- Advisors include SEAL’s Samczsun and Sigma Prime’s Mehdi Zerouali.

- Community input will shape priority fixes and long-term upgrades.

Ethereum’s Bid to Become the “Digital Fort Knox”

The Ethereum Foundation has announced its largest security overhaul to date: the Trillion Dollar Security (1TS) initiative that is designed “to future-proof Ethereum for institutional capital and global scale by making Ethereum a multi-trillion dollar security layer that can be used to secure trillions of dollars of assets (and it being currency itself as well) against legacy systems.“

1TS Implications: From Crypto to Civilization-Scale

While Ethereum already has the crypto industry’s most reliable network, processing more than $4 trillion worth of transactions a year, the 1TS initiative is focused on fixing weaknesses that could obstruct its next upgrade. Which is the goal? Entering an era when governments and companies can trust Ethereum to transact amounts similar to the GDP of a small nation.

Security isn’t just about code; it’s about aligning incentives across every layer, from wallet firmware to cloud dependencies.

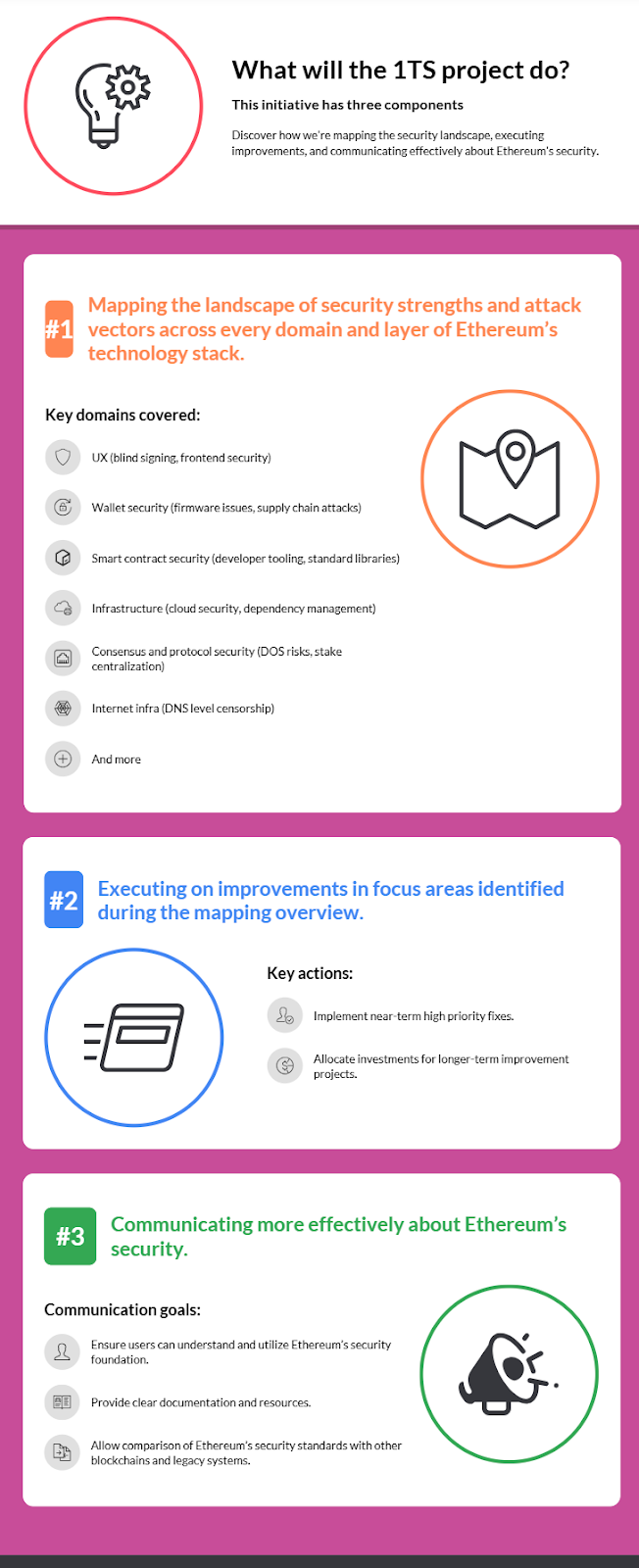

The Three-Pronged Strategy

- Security Mapping: A comprehensive audit across 12 domains, including frontend vulnerabilities, wallet firmware risks, and stake centralization in Ethereum’s consensus layer. Think of it as a blockchain-wide stress test.

- Targeted Upgrades: Immediate fixes for high-risk areas (e.g., blind signing exploits) paired with long-term investments in ZK-proof integration and quantum resistance.

- Transparency Campaign: Simplifying security metrics for non-technical users, allowing direct comparisons with legacy systems like SWIFT or Fedwire.

The Guardians of 1TS

Cybersecurity heavyweights spearhead the initiative:

- Samczsun (SEAL founder), known for exposing critical flaws in protocols like Rarible and Compound.

- Mehdi Zerouali (Sigma Prime), whose team audited Ethereum’s Merge.

- Zach Obront (Etherealize), architect of OP Succinct’s ZK-rollup security.

This is not just for preventing hacks but for building a safety net so robust that even skeptics can’t ignore it.

Community at the Core

Unlike traditional tech upgrades, 1TS relies on crowdsourced insights. Through an open submission portal, developers and users can flag vulnerabilities or propose solutions, a nod to Ethereum’s decentralized spirit.

What to Expect

If successful, 1TS could position Ethereum as the default settlement layer for central bank digital currencies (CBDCs) and institutional DeFi. But the clock is ticking: Rivals like Solana and Cosmos are ramping up their own security overhauls.

Will Ethereum’s trillion-dollar gambit redefine trust in finance, or will the weight of its ambitions fracture its decentralized roots? As the first audit reports loom, the stakes – and potential rewards – have never been higher.

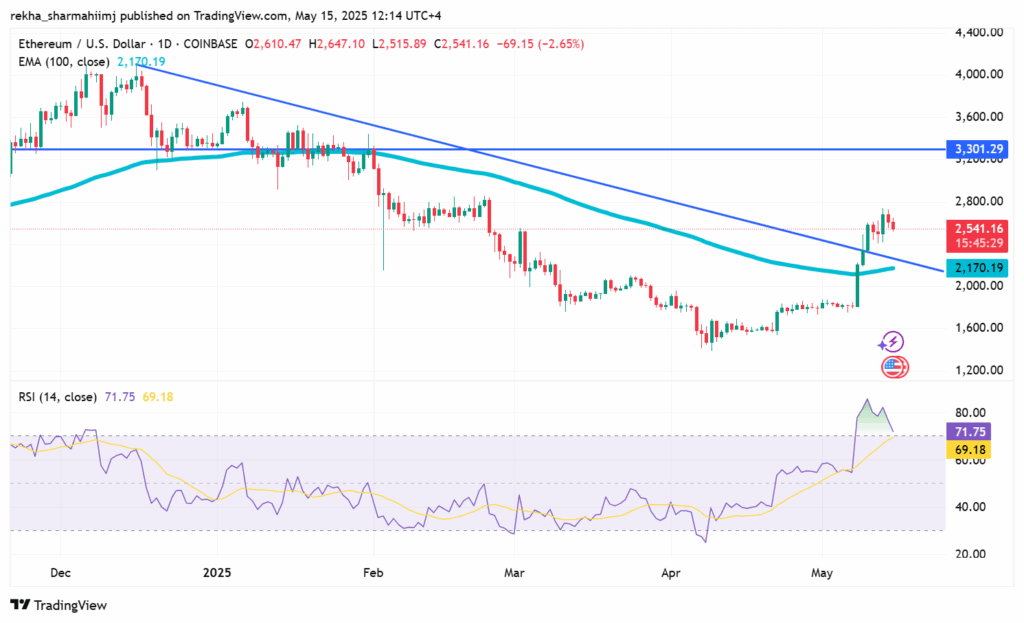

Ethereum Price Forecast: ETH buyers eye $3000 in the short term

Ethereum (ETH) price shows signs of exhaustion after rallying nearly 80% from the low of $1,383.26 made on April 9. The ETH/USD pair tested the high of $2,739.05 on Tuesday, followed by sustained buying pressure since May 8. However, for the past two sessions, the buyers ran out of steam near the short-term support-turned-resistance level around $2,550 on the daily chart.

In addition, the bearish trend line that extends from the high of $4,019 made on December 17, 2024, acts as a bullish barrier for the ETH price. Bulls attempted to breach the resistance zone on May 10 and continued to rise thereafter to hit the high of $2,739.5.

The buyers should be able to sustain the low of the bullish candle made on May 13 at $2,415.65. In that case, the next upside target would be the psychological $2,800 mark, followed by the $3,330 mark in the short term.

On the other hand, if a break below the above-mentioned level occurs, the ETH sellers are expected to dominate the price action. Moving forward, the first downside target is located at the low, made on May 10 at the $2,317.23 level.

There is a probability of touching the mark of $1,770 once the 100-day SMA is taken out by the sellers amid the sustained selling pressure.

The Relative Strength Index (RSI) trades in the oversold zone at 72, signalling a challenge for the ETH bulls to ride higher.

Buyers are advised to wait for confirmation before betting on any directional bias.