Key takeaways:

- Ethereum ETF inflows surge in June and July 2025, which indicates rising institutional interest in the network.

- BlackRock, Robinhood, and Deutsche Bank are all getting onto Ethereum. Institutions may realize Ethereum’s critical importance to modern finance.

- Ethereum holds above its daily support at $2,440 and could break upside if on-chain aligns.

Institutional investors might gradually shift their allocations from Bitcoin (BTC) to Ethereum (ETH) due to broader use cases and yield generation. The transition might change the landscape of crypto investments. Institutions seem to consider Ethereum to be a more prominent piece of financial infrastructure rather than just a technical platform.

Top Ethereum ETFs

As of July 8, 2025, the iShares Ethereum ETF by BlackRock is the largest, with $4.6 billion AUM, and Grayscale’s Ethereum Trust secures second at $2.9 billion.

Additionally, Fidelity and Grayscale each manage $1.3 billion, and Volatility Shares manages $286.3 million in ETH’s futures ETF. Other funds remained actively trading but simply had small daily losses.

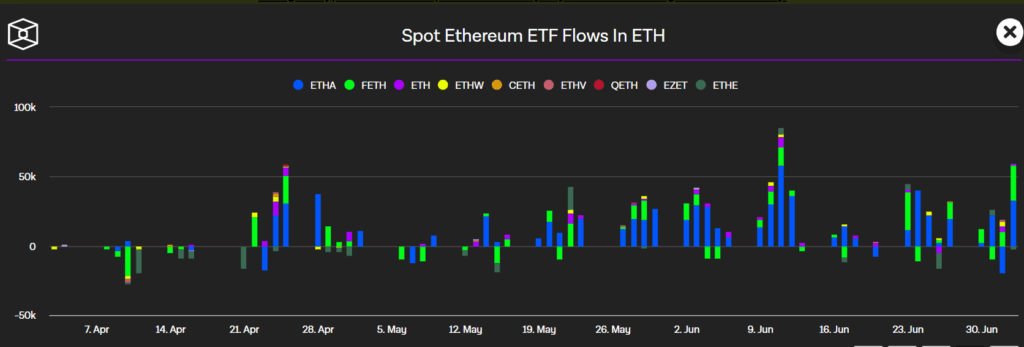

Ethereum ETF’s Flow

As of July 8, 2025, ETF inflows since April 2025 stayed over 50,000 ETH, with multiple days showing the consistent inflows over that level. The trend reflects the growth of institutional interest and confidence in Ethereum-based investment products. On 11 June 2025, these inflows peak at around 85,500 ETH.

Ethereum is the infrastructure for decentralized finance (DeFi), tokenization, and smart contracts, and institutions appear to be utilizing this increased functionality. Large inflows into Ethereum have dramatically increased in recent months as investors have shifted large sums into ETH primarily due to both the approval and positive initial performance of U.S. spot Ethereum ETFs.

Following the recent Ethereum Community Conference (EthCC) in Cannes, it’s apparent that Ethereum is rapidly attracting institutional support. BlackRock, Deutsche Bank, Coinbase, and Robinhood are among several prominent financial institutions building products on the Ethereum-based network, which indicates it is gaining momentum in terms of institutional trust.

Robinhood most recently released tokenized stocks based off of Ethereum’s Arbitrum network, which is pushing Ethereum’s real-world use further. Ether’s price responded and rose nearly 6% in relation to those announcements.

Technical Landscape For Ethereum

The Ethereum price is currently trading at $2,575 while holding its daily support. The price deviated below the daily support level on 22, June 2025 and reclaimed the zone in the next week.

Additionally, the price is now holding strong above the support at $2,440. For the bullish outlook, ETH bulls need to flip the price level of $2,590, which will become a crucial zone on the daily time frame.

The daily RSI is currently at 55.3, suggesting neutral sentiment for the asset. Trading above the mentioned zones could push Ethereum’s price to $3,000 and above.

Conclusion

Institutional adoption of Ethereum (ETH) continues to rise, as investors see Ethereum’s utility, staking rewards, and network reliability as a better choice than Bitcoin’s store of value function. Institutions consider Ethereum as a business infrastructure rather than just a store of value, unlike Bitcoin.