Key Takeaways

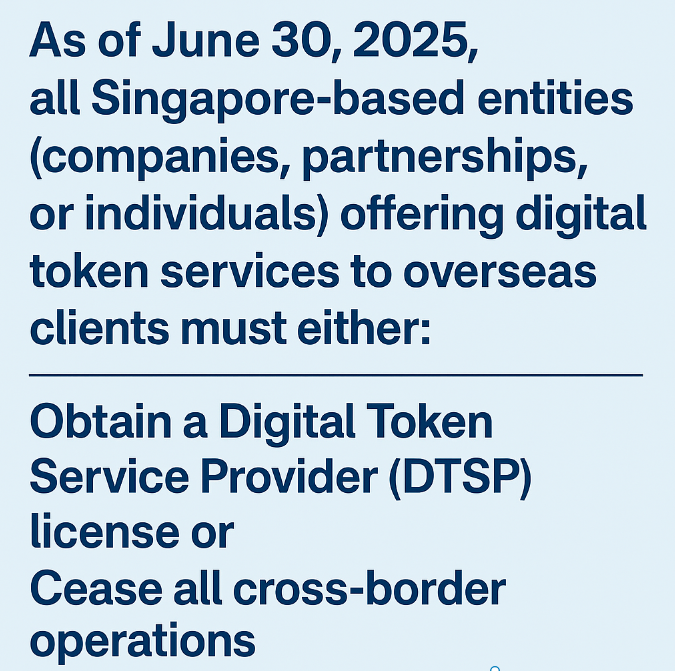

- Mandatory Licensing by June 30, 2025: All Singapore-based crypto firms serving overseas clients must obtain a Digital Token Service Provider (DTSP) license or cease international operations entirely. No grace periods or transition allowances will be provided.

- Obtaining the Licensing is Tough: The Monetary Authority of Singapore (MAS) has made clear that it will “generally not issue” new DTSP licenses due to anti-money laundering (AML) and terrorism financing risks, effectively creating a de facto ban on new approvals.

- Very Broad Scope, Encompassing Many: The DTSP definition applies to a wide range of entities, from exchanges and wallet providers to marketing firms, regardless of size.

- Severe Penalties for Non-Compliance: Firms that fail to comply by the deadline face criminal penalties, including fines up to SGD 250,000 (~USD 185,000) and up to three years in prison.

- Companies Relocate as a Reaction: The strict rules have prompted a “crypto exodus” from Singapore, with companies like WazirX, Bybit, and Bitget moving to jurisdictions such as Panama, Dubai, and Hong Kong.

Singapore Mandates License For All Overseas Digital Token Services

The Monetary Authority of Singapore (MAS) delivered a decisive blow to crypto firms operating from the city, requiring immediate compliance with the new Digital Token Service Provider (DTSP) licensing rules. Companies serving overseas clients must secure licenses under the Financial Services and Markets Act 2022.

Industry players pleaded against the abrupt timeline, less than a month in many cases. They said that it gave insufficient time to restructure or unwind services.

However, MAS has explicitly rejected industry requests for grace periods or transitional arrangements, creating what industry experts describe as a “compliance cliff.”

Non-compliant firms will face criminal penalties, regardless of the business size or violation scope, elevating licensing from a regulatory issue to a legal survival matter. The penalties include:

- SGD 250,000 fine (~USD 200,000)

- Up to 3 years in prison

Broad Definition Captures Wide Range of Crypto Businesses

The regulatory authority has adopted an intentionally broad approach to defining DTSPs, covering everything from centralized crypto exchanges and DeFi platforms to wallet providers and token issuers. The scope extends beyond pure crypto companies to include any Singapore-based firm offering token-related services to clients abroad.

This means that even indirect crypto activities — such as a local startup marketing an international crypto project — could trigger DTSP classification, irrespective of any direct involvement with user funds.

Crucially, the regulations apply regardless of business scale. Companies serving overseas clients as a minor revenue stream face the same requirements as major international operators. This implies that a Singapore-based startup running a marketing campaign for a foreign crypto project may still be considered a DTSP, even if they don’t touch user funds directly.

Furthermore, the regulatory lens focuses on the place of incorporation, not where servers are located or where the end-user resides.

Seems Like a De Facto Ban

Earlier this month, MAS announced that cryptocurrency licenses will only be issued in extremely limited circumstances due to unresolved AML and combating the financing of terrorism (CFT) concerns. MAS has deliberately set an exceptionally high bar for licensing, and media reports state that they will generally not issue licenses.

This is largely due to the inherent difficulties in regulating offshore token services and crypto-related legal risks, MAS claims. The policy effectively creates a de facto licensing ban for most cryptocurrency companies in Singapore. Only firms with elite compliance infrastructure and strong operational justification are likely to receive regulatory approval, making Singapore’s crypto licensing requirements among the world’s most stringent.

Reeling Under The Pressure, Firms Relocate

The regulatory crackdown has triggered significant industry movement. High-profile exchange WazirX relocated operations to Panama after Singapore courts blocked its restructuring efforts. Major platforms, including Bybit and Bitget, have begun withdrawing teams from Singapore, citing licensing uncertainty and compliance obstacles.

Industry leaders view the exodus toward jurisdictions like Panama, Hong Kong, and Dubai as a response to Singapore’s increasingly restrictive approach. Thailand and the Philippines have emerged as alternative hubs, offering more accessible crypto policies while maintaining regulatory oversight.

Singapore Aims to Preserve Financial Hub Status

MAS designed these regulations to combat regulatory arbitrage, where crypto companies gained legitimacy from Singapore registration while serving overseas clients under minimal oversight. The authority seeks to protect Singapore’s reputation as a trusted financial center by ensuring comprehensive compliance requirements apply regardless of where users, servers, or funds are located.

Despite tightening retail crypto access, Singapore continues exploring institutional adoption through initiatives like Project Orchid for digital Singapore dollar development and Project Guardian for blockchain-based trading networks.