Key Takeaways

- A crypto whale withdrew 25,097 AAVE tokens worth $7.9 million.

- With a 4.75% uptick, AAVE has paved the way for a potential 22% further gain.

- AAVE’s major liquidation levels stand at $310.2 on the lower side and $329.4 on the upper side.

Today, September 3, 2025, AAVE has finally ended its prolonged consolidation with an impressive performance. This comes after a shift in market sentiment, bullish price action, and massive whale accumulation.

Crypto Whale Accumulates $8 Million Worth of AAVE

The blockchain-based transaction tracker Lookonchain revealed that whale wallet address 0xF436 withdrew 25,097 AAVE tokens worth $7.9 million from exchanges a few hours ago.

This notable accumulation occurred ahead of the breakout, which now appears to be the main catalyst behind AAVE’s consolidation breakout.

The post on X further noted that this whale has been aggressively accumulating AAVE tokens over the past week. According to the data, the whale has withdrawn a total of 167,451 AAVE tokens worth $53.65 million.

AAVE’s Price Analysis

This notable accumulation, combined with the market shift, had a strong impact on the asset’s price. According to CoinMarketCap data, AAVE has climbed over 4.75% in the past 24 hours and is currently trading at $326.5.

However, trader and investor participation declined during the same period, pushing the trading volume down by 7% compared to the previous day.

Despite lower participation, this impressive price uptick could attract more traders and investors as it has triggered a bullish breakout.

AAVE Technical Analysis and Upcoming Levels

According to the TradingView daily chart, AAVE appears to be in an uptrend and is now poised to continue this upside momentum.

Since August 2025, the asset has been moving within an ascending channel pattern between its upper and lower boundaries.

To date, AAVE has tested the lower boundary twice, and each time it recorded a price uptick of over 20%. This time, AAVE seems to be repeating its past performance as it formed a bullish candlestick at the lower boundary and bounced off the 50-day EMA, signaling a possible repeat of past 20% upticks.

Not only that, but AAVE also ended a week-long consolidation that had formed between the $303 and $325 levels.

However, the recent rally has already cleared the $325 level and opened the path for the next leg up. Based on recent price action, if AAVE’s momentum continues and the price holds above $325, there is a strong possibility that the asset could soar by 22% and may reach the $400 mark.

At press, the Supertrend technical indicator has turned green and is hovering below the asset price, suggesting strong buying pressure.

Traders Strong Bullish Outlook

Given the current market sentiment, it appears that traders have started following the trend, strongly betting on long positions.

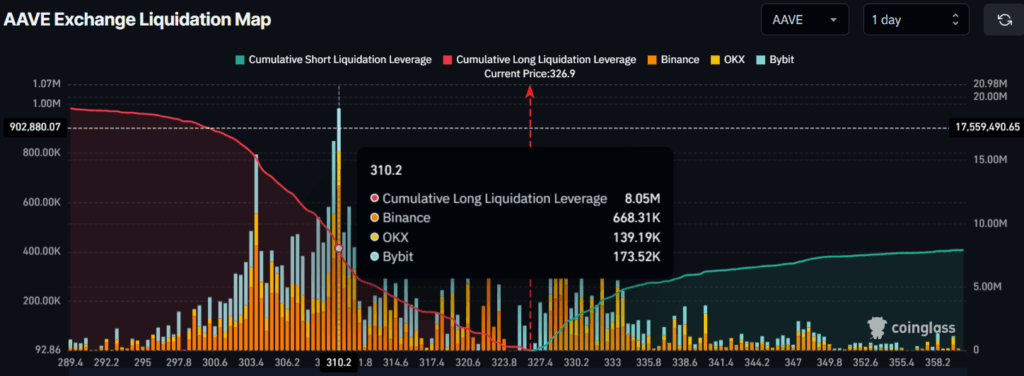

Coinglass’s Exchange Liquidation Map shows that AAVE’s key levels are $310.2 on the lower side and $329.4 on the upper side.

At these levels, traders are over-leveraged, with $8.05 million in long positions and $2.23 million in short positions. This indicates that bulls are dominating the asset, with the only significant hurdle now at the $329.4 level.