Key Takeaways

- Today, a newly created wallet transferred 5.01 million ASTER worth $7.65 million, hinting at potential accumulation and signaling that a major rally could be on the horizon.

- A crypto expert predicted that ASTER could cross $4 by November 2025.

- On-chain metrics show weakness, with TVL, DEX volume, and chain revenue all declining after the October 10 flash crash.

Aster (ASTER) appears to be on the whale radar, as a newly created wallet added 5.01 million tokens worth $7.65 million from Binance, despite the price continuing to decline. Today, the asset posted a 6.5% dip, but the whale’s recent accumulation suggests that ASTER could soon end its bearish streak and move toward a new high, as experts predicted on X.

Aster Current Price and Expert Prediction

As per the latest TradingView data, ASTER is currently trading near $1.39, posting a price dip of 6.47% today. Meanwhile, market participation remains lower compared to the previous day, with trading volume plummeting 47% to $975 million over the past 24 hours, as per CoinMarketCap data.

Looking at the current market sentiment and ASTER’s performance following the flash crash on October 10, a well-followed crypto expert praised the token for surviving the crash and holding above a key level.

The expert on X noted that ASTER is ready to soar and further predicted that by November 2025, ASTER could cross the $4 mark. In the post on X, the expert shared that a key catalyst driving ASTER’s upside rally is its strong fundamentals, which remain unchanged despite the price decline or shifts in market sentiment.

On-chain Metrics Show Weakness

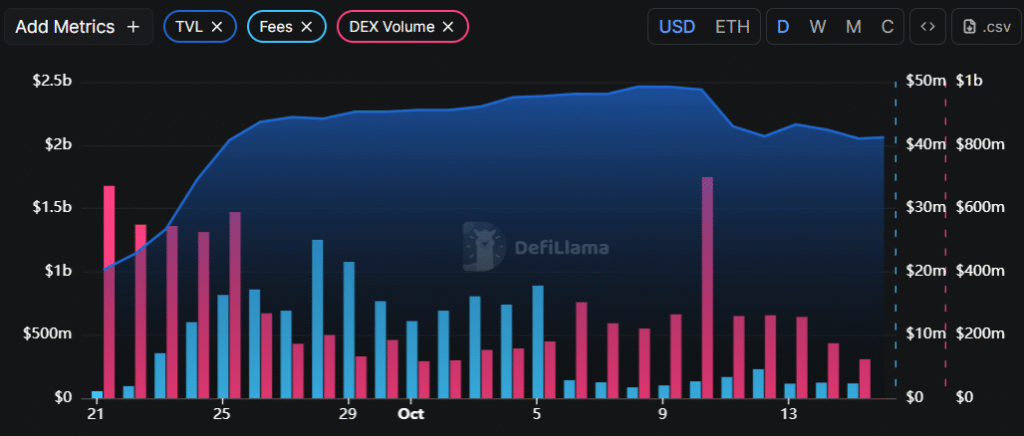

However, the DeFi aggregator DeFiLlama tells a different story. According to the latest data, since the historic crash, Aster’s Total Value Locked (TVL) on the protocol, DEX volume, and revenue have all taken a significant hit and may not rebound quickly due to the mass liquidation of overleveraged positions during the crash, which has sparked fear among market participants.

Data shows that ASTER’s TVL has fallen to $2.063 billion from $2.442 billion, recorded on October 10, 2025, the day of the crash. This drop in TVL indicates a significant outflow of funds from the ASTER ecosystem, reflecting reduced investor confidence and heightened selling pressure following the crash.

Meanwhile, Aster chain revenue also fell, albeit modestly, dropping to $2.35 million from $2.68 million, indicating a slowdown in platform activity and reduced fee generation. Amid this, DEX volume was the hardest-hit metric, falling to $123.1 million from $699.66 million, indicating a sharp decline in trading activity and waning user engagement on the platform.

Also Read: Aster vs. Hyperliquid: Whale Loads Up ASTER as HYPE Faces Sell-off

ASTER Price Action and Key Levels to watch

According to TimesCrypto’s technical analysis, ASTER is at a make-or-break point, as it approaches a key support level of $1.15.

Based on current price action, if the token holds this support, there is a strong possibility that ASTER could rebound significantly, potentially gaining 50% and reclaiming the $2.10 level. Otherwise, strong downside momentum could take hold.

At press time, the Supertrend indicator continues its red trend and hovers above the asset’s price, signaling that ASTER remains in a strong downtrend with sustained selling pressure.

Read More: Ethereum Price on the Edge: $41M ETH Whale Buy Sparks Potential Reversal