Key Takeaways

- AUSTRAC ordered Binance Australia to hire external auditors after identifying concerns related to its anti-money laundering and counter-terrorism financing controls.

- Binance’s Australia unit has faced multiple hindrances with regulators in the region.

- Back in April 2023, ASIC revoked Binance’s Australian financial services license due to compliance concerns.

Binance Australia is back in the regulatory spotlight, facing fresh issues around auditing and compliance. The Australian Transaction Reports and Analysis Centre (AUSTRAC) orders the crypto exchange to hire external auditors after identifying concerns related to its anti-money laundering and counterterrorism financing controls.

AUSTRAC has pointed to the crypto exchange’s lack of local employees, inadequate senior management control, and the narrow scope of independent assessment as the reasons for the crackdown.

In under 28 days, Binance Australia must select independent auditors and send AUSTRAC their names for clearance. The auditors will extensively examine the exchange’s handling of checks for terrorism financing and money laundering. More stringent regulatory action may be taken against Binance if it misses the deadline.

AUSTRAC’s main worry stems from concerns that Binance is not doing enough to stop money laundering and terrorism financing. The regulator wants to make sure the globally renowned exchange has enough systems in place to track transactions and report suspicious activity. If these safeguards fall short, Binance could face serious consequences from regulators.

AUSTRAC CEO, Mr Brendan Thomas, said, “Big global operators may appear well resourced and positioned to meet complex regulatory requirements, but if they don’t understand local money laundering and terrorism financing risks, they are failing to meet their AML/CTF obligations in Australia.”

Binance Australia’s Tussle With AUSTRAC Continues: What Had Happened in The Past?

Binance’s Australia unit has faced multiple hindrances with regulators in the region. The exchange’s local derivatives section was sued by Australia’s corporate watchdog back in December for allegedly misclassifying retail clients as wholesale clients. The move would have allowed the platform to circumvent some investor protections.

Binance has later paid compensation of about A$13.1 million to the affected clients. Back in April 2023, ASIC revoked Binance’s Australian financial services license due to compliance concerns.

Further, the platform also lost access to the PayID system in May 2023, and the region’s banking giant, Westpac, banned its customers from transacting with the exchange.

AUSTRAC’s Heightened Security Comes Amid Rising Crypto Userbase in Australia

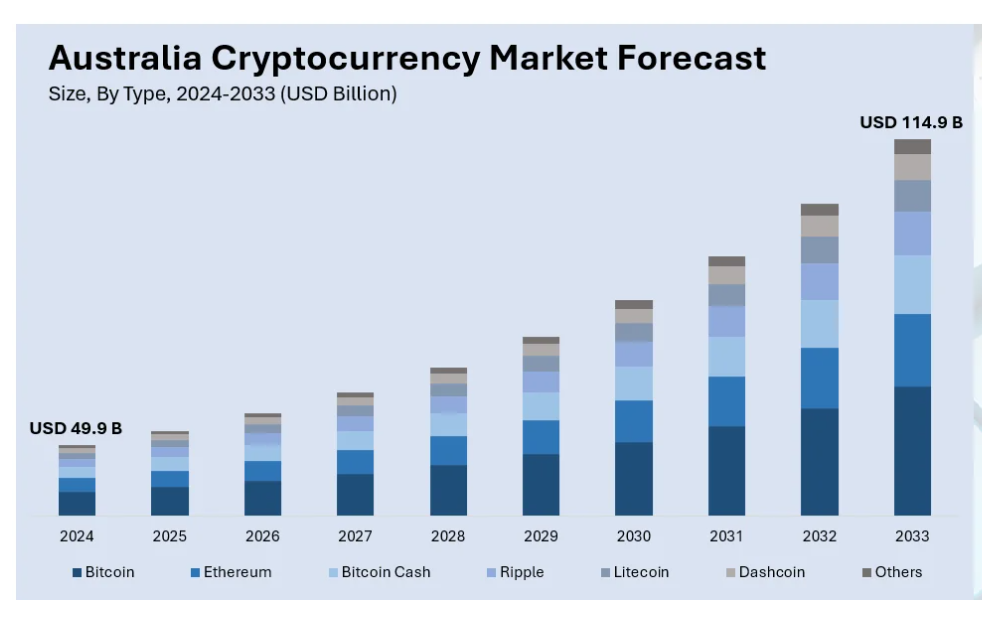

Australian authorities have often taken a tough approach to crypto, but that hasn’t slowed the sector’s growth. On the contrary, the Bitcoin market in Australia is flourishing. It was valued at $49.9 billion in 2024 and is expected to increase at an annual growth rate of 9.7%. With these projections, the Australian crypto market is expected to reach $114.9 billion by 2033.

The growth has been helped by clearer rules that reassure investors and increased institutional interest. Additionally, continuous advancements in blockchain technology have positioned Australia as an attractive crypto investment region.

As a result, the market is seeing an increase in the number of regular investors and the acceptance of digital assets as payment methods.

Global trends, economic situations, and government regulations all have a significant impact on how the market is shaped. All things considered, these elements are turning Australia into a significant centre for cryptocurrency activity in the Asia-Pacific region.

Due to the continuously rising user base, AUSTRAC has also increased its monitoring of the Australian cryptocurrency market. The government recently announced additional rules for Bitcoin ATM providers because of concerns that these devices could be used for fraud or other unlawful activities.

By taking these actions, AUSTRAC intends to guarantee that cryptocurrency platforms follow relevant anti-money laundering and counter-terrorism laws, protecting everyday users and keeping the quickly growing digital asset market safer and more dependable for everybody.