Key Takeaways

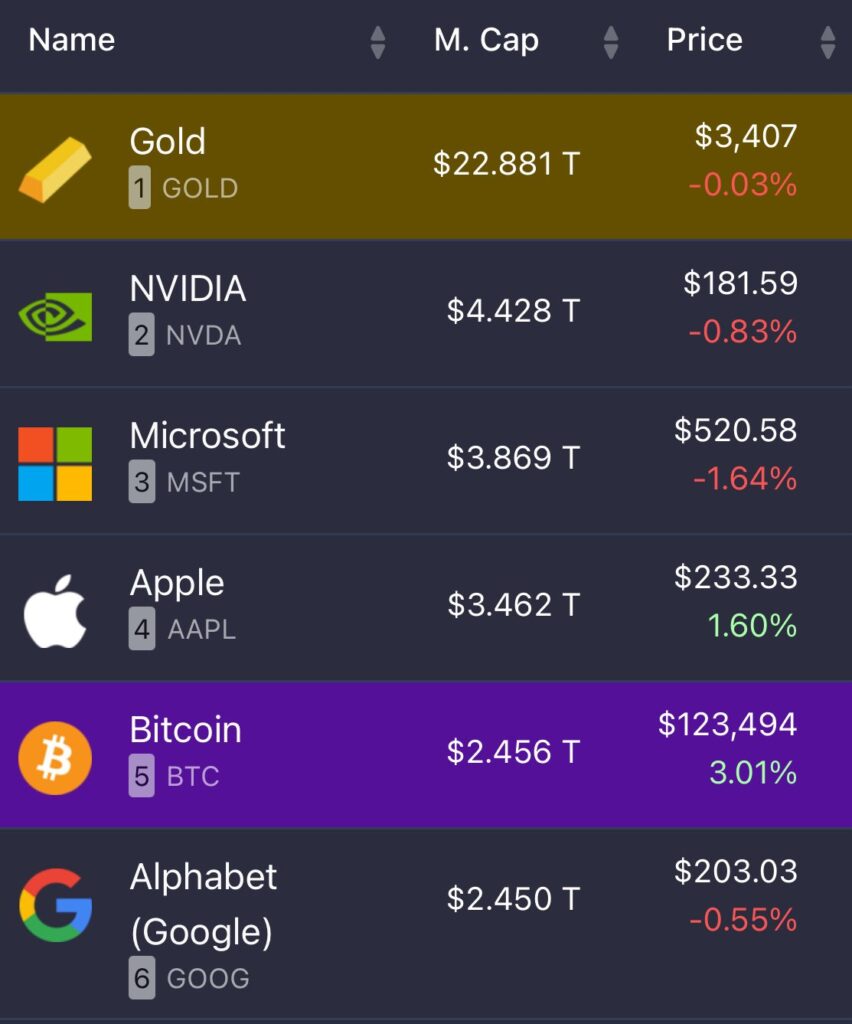

- Bitcoin became the fifth-largest asset by market capitalization, overtaking Google’s $2.4 trillion market cap.

- Bitcoin’s optimistic trading was in tandem with the U.S. equities that rose on the back of investors pilling riskier assets.

- Trump’s GENIUS Act and the surprising crypto 401(k) plan have kept investor sentiments boosted, giving BTC a higher edge.

Bitcoin (BTC) overtakes Google’s parent company, Alphabet, in market capitalization of $2.4 trillion. The pioneer cryptocurrency achieved a new milestone, reaching an all-time high of $124K on Thursday.

Bitcoin momentarily became the fifth-largest asset by market capitalization, overtaking Google’s $2.4 trillion market cap. The rise coincided with the S&P 500 recording its second straight record finish, indicating that Bitcoin mimicked a stock gain as both markets benefited from the same optimistic macro environment.

However, the later trading hours saw investors indulge in slight profit-taking, making BTC inch back to $121,890.38 at the press time. The current market capitalisation also stands at $2.42 trillion. Bitcoin’s optimistic trading was in tandem with U.S. equities that rose on the back of investors piling riskier assets.

Bitcoin Surpassing Google Cements Digital Asset Dominance

Bitcoin’s domination and rise to prominence alongside tech behemoths like Apple, Microsoft, and Amazon highlight how cryptocurrencies are becoming more widely accepted in the financial industry. Even while critics like Peter Schiff have called Bitcoin’s rise nothing more than hype, the cryptocurrency’s steady trading momentum shows that it is establishing a respectable place in international finance.

Digital assets are becoming more widely accepted as genuine reservoirs of value and hedge against inflation in the current context. After previously being viewed as specialised or speculative, crypto is no longer a niche asset.

This milestone is indicative of a larger change in perception: cryptocurrencies are now seen as global competitors, vying with some of the most well-known businesses in the world. Bitcoin’s position indicates that the financial industry is treating digital assets seriously as their acceptance and recognition increase.

Bitcoin Price Rise Helped by Institutional Inflows: But There is A Catch

While most market participants are attributing clearer regulatory guidelines and heightened institutional interest for Bitcoin’s current surge, there is something the larger market is missing.

Regulations, across the U.S. and other major markets, are also becoming more transparent, which gives investors greater assurance that Bitcoin is a real financial asset and not just a speculative one.

Trump’s GENIUS Act and the surprising crypto 401(k) plan have kept investor sentiments boosted, giving BTC a higher edge.

Additionally, as Timescrypto reported earlier, Bitcoin’s addition into portfolios, hedge funds, businesses, and exchange-traded funds (ETFs) is enhancing the market’s legitimacy and stability.

Momentum has also been generated by noteworthy alliances and declarations from significant financial organisations, attracting both individual and institutional investors.

If Bitcoin maintains its $120,000 support, technical charts suggest that $130 and $136,000 would be the next stops. More upbeat fundamental analysts, such as Standard Chartered, are projecting $200K assuming ETF inflows continue by year’s end.

Bitcoin Price Rise Casts Ripple Effect in Market

Bitcoin being the biggest crypto by market cap usually drives sentiments in the crypto market. The recent surge has pushed the whole cryptocurrency market up as well. Per CoinMarketCap data, the total market capitalisation of the digital asset market currently is at $4.13 trillion, up 1.17% in the last 24-hours. Alongside Bitcoin, Ethereum and other significant altcoins have increased in value.

While some coins have independently reached ATH milestones due to ecosystem specific developments, the psychology for the overall virtual asset market revolves around Bitcoin’s charts and technical indicators.