Key Takeaways

- U.S. Fed announces 25 basis points rate cut as economic activity takes a hit.

- Bitcoin remains largely unchanged at $115K ; DXY hits 43-month low.

- Attention in crypto shifts to identifying the next trigger for a potential rally as the market stands at the threshold of a structural capital shift.

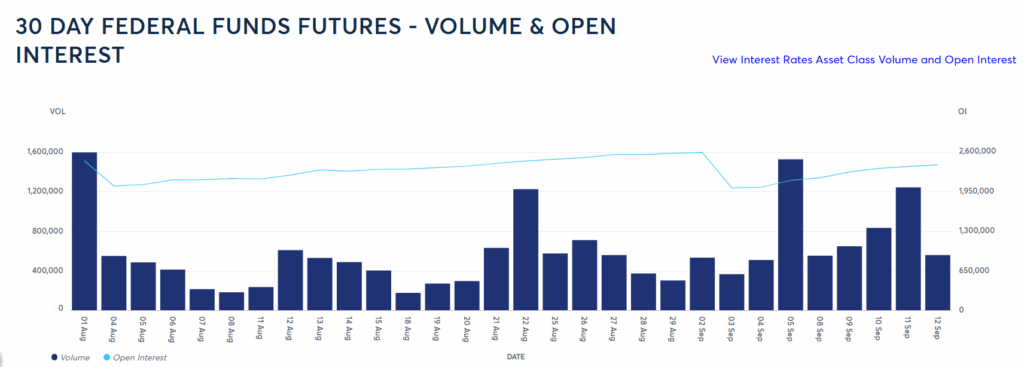

The U.S. Fed cuts interest rates by a 25 basis points, bringing them down to 4.00-4.25%, citing moderation in economic growth. The move came largely in tandem with market expectations, which had priced in a 94% chance of 25 basis points reduction, according to CME Fed watch tool.

However, the policymaker has still reiterated that uncertainty about the economic outlook remains elevated. The Fed’s first-rate cut in nine months has now fuelled speculations over how aggressively policymakers may ease rates through year-end.

Bitcoin price slipped over 1% to hit $115,475.73 in an initial market reaction. On the other hand, the Dollar Index hit a 43-month low, falling into the 96.30 zone for the first time since February of 2022.

Other altcoins like Ethereum and XRP also remained largely unchanged, with $ETH sliding to $4,467.38 and $XRP hitting $3.02.

The U.S. Fed’s decision to cut interest rates comes amid persistent pressure from the U.S. President, Donald Trump. The Fed’s view of keeping interest rates higher until economic signals improve has made Chair Jerome Powell face growing political scrutiny, despite inflation remaining a top concern.

U.S. Fed’s Inflation Dilemma Keeps Bitcoin Investors On Edge

In the past months, the U.S. Fed has faced a dilemma as data points have failed to align with its expectations. On the one hand, prices aren’t falling as much as the Fed would like since inflation is still too high, hovering about 3.10%. However, it is evident that the job market is deteriorating.

According to recent data points, hiring is slowing, unemployment is slightly rising, and the United States actually added 911,000 less jobs than previously believed. This puts the Fed in a difficult position because maintaining high interest rates in an effort to combat inflation may worsen the state of the labour market. However, prices may begin to rise once again if rates are lowered to support jobs.

In this circumstance, Bitcoin frequently suffers , especially if markets become erratic. Bitcoin prices are usually affected by macro-economic factors whether due to interest rate changes, concerns about inflation, or international conflicts.

While riskier investments see a decline in value with some investors pulling out due to dampened sentiments, other people rush in because they view Bitcoin as a safe haven and a form of “digital gold”.

Dean Chen from crypto exchange Bitunix told TimesCrypto, “For crypto assets, a prolonged low-interest-rate environment will reduce funding costs, potentially reviving investors’ risk appetite and attracting capital back into risk assets.”

He adds, “Should markets start to anticipate further rate cuts, leveraged funds and institutional capital may accelerate their positioning, laying the foundation for a medium- to long-term bull market.”

What Are Crypto Markets Looking Forward to?

With the current interest rate decision appeasing the markets, crypto investors are now gauging for bullish cues for the future. It is likely that participants will feel more comfortable investing in risky assets like Bitcoin and Ethereum if the central bank keeps lowering interest rates even in the future, causing a favourable prices rise.

However, if the dollar appreciates and investors become more cautious, demand for cryptocurrencies may decline in the near-term. To put it simply, a more accommodative Fed in future will provide more impetus for a cryptocurrency advance, whilst a more aggressive approach may cause things to slow down.

But, the U.S. Fed’s latest dot plot could mean a big shift in how it approaches the economy. With jobs weakening and inflation not spiralling, the Fed might start focusing more on protecting the labour market than fighting prices. This opens the door for interest rate cuts sooner than markets expected, a shift that could ripple across stocks, bonds, and even crypto.

Dean Chen further added that the future of crypto market currently resides on three situations. If liquidity returns to easing, it can provide a fuel for a bull market. However, incase market conditions turn adverse, it can result in a higher volatility for crypto, driven by news and leverage.

Finally, a declining weight of U.S. dollar assets can make crypto poised to benefit as a key destination for capital reallocation. Overall, the crypto market is standing at the threshold of a structural capital shift.

In a case where Bitcoin prices, see a downwards trend, altcoins might face the brunt as well. Shawn Young, Chief Analyst of MEXC Research says, “altcoins are especially vulnerable (in this scenario), as capital tends to consolidate back into Bitcoin as a macro hedge, while stablecoins and ETFs absorb defensive flows. Ethereum’s ETF activity will be closely watched, while higher-beta assets like Solana, XRP, and Dogecoin could see outsized moves of up to 8–10%.”

Additionally, the Fed will probably continue to consider important data points and inflation prints as important considerations for future monetary decisions, even as the political context of tariffs and Trump’s remarks affect public mood. Future inflation figures and labour indicators will be crucial considerations for crypto investors, as the current data continues to worry regulators. Notably, Trump’s generally positive views on digital assets could have an impact on the regulatory environment more broadly, but they are unlikely to supersede the Fed’s institutional structure.