Key Takeaways

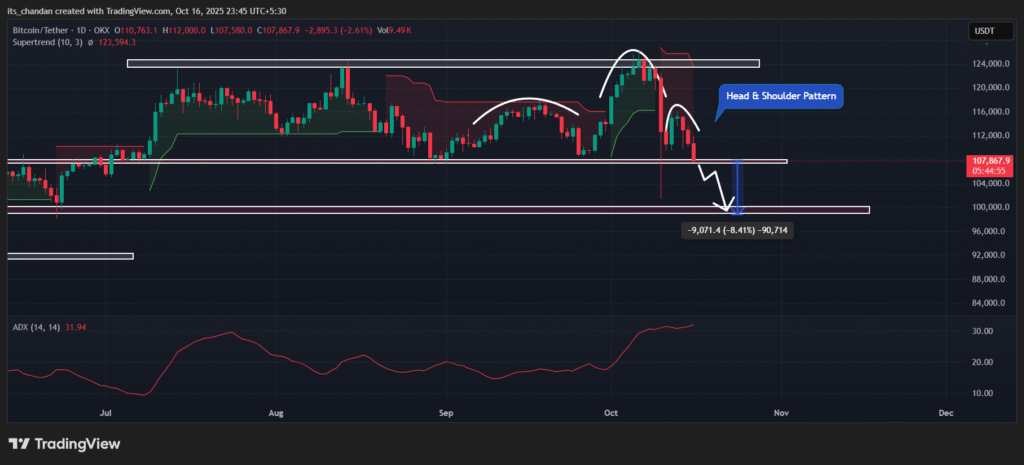

- With today’s price dip, Bitcoin (BTC) has reached the neckline of a bearish Head and Shoulders pattern and is on the verge of a breakdown.

- Price action suggests that if Bitcoin’s downward momentum continues and it falls below the $107,700 level, it could drop to the $100,000 mark in the coming days.

- The key catalysts driving Bitcoin’s price downward appear to be the ongoing trade war between China and the US, along with massive sell-offs by Binance and BlackRock.

The 2.30% price dip in Bitcoin has sparked fear among market participants, as it has completed a bearish Head and Shoulders pattern, hinting that the price may be on the verge of a massive fall. Moreover, the decline has pushed BTC close to the $107,800 neckline, with a strong red candle breaching four days of lows.

Bitcoin (BTC) Current Price Momentum

As per the latest TradingView data, Bitcoin is trading at the $108,250 level, posting a price decline of 2.30%. However, investors and traders have shown strong interest in the asset, which is reflected in the trading volume, as it jumped over 10% to $82.35 billion today, according to CoinMarketCap data.

Why is Bitcoin Price Falling?

The potential reason behind today’s dip and Bitcoin’s bearish outlook appears to be the ongoing trade war between the United States and China over rare earth metals, along with BTC sell-offs by whales and institutions like Binance and BlackRock.

Trade War Between the US and China

Today, a local news outlet reported that China’s Ministry of Commerce spokesperson, He Yongqian, accused the US of deliberately causing panic over rare earth metal controls, even though China remained open to trade talks with the US, during a press conference.

Additionally, US President Donald Trump has already threatened to impose 100% tariffs on China starting in November.

Whales and Institutions Activity

Adding to the bearish outlook, crypto experts with hundreds of thousands of crypto-based followers recently shared multiple posts noting that Binance and BlackRock are dumping Bitcoin and Ethereum.

In a post on X, one expert noted that today BlackRock sold 7,600 BTC worth $850 million, adding that this is classic market manipulation, similar to what was recorded on October 10, 2025.

Meanwhile, another expert noted that Binance is dumping millions in BTC and ETH to liquidate longs. However, the exact numbers remain undisclosed.

Another expert noted on X that a Barron Trump-linked wallet opened a 20x BTC short position worth $127 million.

These posts gained widespread attention from crypto enthusiasts while raising the question of whether there is any insider info that could tank BTC’s price or if it is merely following price action.

Bitcoin (BTC) Price Action and Technical Analysis

According to TimesCrypto technical analysis, Bitcoin has formed a bearish Head and Shoulders pattern on the daily chart and is currently approaching the $107,700 neckline.

Based on the current price action, if the downward momentum continues and the price fails to hold the $107,700 level, a massive 8.40% dip is possible, and the price could even fall to the $100,000 level.

However, this bearish thesis would only be valid if BTC falls and closes a daily candle below the $107,700 level; otherwise, it will be invalidated.

At press, BTC’s Average Directional Index (ADX) has reached 31.94, indicating strong directional momentum, which is currently bearish.

Also Read: Corporate Bitcoin Holdings Hit 1.02M BTC, What Does It Mean?