Key Takeaways

- Crypto firm Circle reports Q2 Net loss of $482 million.

- Firm’s USDC in circulation grew 90% year-over-year to $61.3 billion at quarter end.

- In the upcoming year, Circle anticipates significant expansion.

Crypto firm Circle announced its Q2 2025 results on Tuesday, its first as a public company. The company reported a net loss of $482 million in the period. Despite the loss, total revenue and reserve income grew 53% year-over-year to $658 million. However, the stock fell more than 5% as the company announced late Tuesday an offering of up to 10 million shares in a public offering, according to a filing with the Securities and Exchange Commission.

In the earnings reports, a significant portion of the $591 million loss reported by the corporation was not a loss in cash. Out of the mentioned, $424 million, comes from stock awards granted to staff members for IPO-related requirements. A further $167 million is the result of accounting adjustments as a result of the company’s convertible debt being more valuable due to an increase in share price. Therefore, even though it appears to be a significant loss on paper, it primarily represents accounting regulations and stock-related expenses rather than actual money leaving the business.

Jeremy Allaire, Co-Founder, Chief Executive Officer, and Chairman at Circle, said, “I’m proud of Circle’s performance in the second quarter, our first as a public company, where we demonstrated sustained growth and adoption of our platform across a multitude of use cases and with a diverse set of industry-defining partners.”

Crypto Firm Circle Sees Rise in Stock Price Despite Loss

Despite the $482 million loss, Circle’s stock price saw a rise of between 1% and 3% during the trading day. Investor confidence in the firm’s earnings was likely boosted by the fact that the firm’s USDC in circulation grew 90% year-over-year to $61.3 billion at quarter’s end, and has grown an additional 6.4% to $65.2 billion as of August 10, 2025.

Additionally, the company’s losses come as a one-time impairment due to the public listing. Market participants are likely expecting the firm to swing to profitability in the coming quarters, being bullish in tandem with other crypto peers like Coinbase and Strategy.

Additionally, the firm’s revenue was $658 million, higher than the Zacks Consensus Estimate of $645.35 million. The Company’s Earnings Per Share (EPS) reported at $1.02, compared to $0 in the year-ago quarter.

Circle’s Future Guidance: What to Expect?

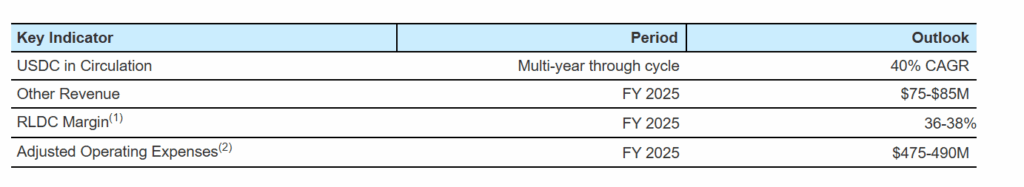

In the upcoming year, Circle anticipates significant expansion. Given the robust adoption of its stablecoin, the USDC in circulation is expected to grow at an annual pace of 40%. The business expects $75–85M in other revenue in FY 2025, while maintaining a high RLDC margin of 36–38%. With cautious expenditure to sustain growth, adjusted operating expenses are anticipated to be between $475 and $490 million. All things considered, Circle is setting itself up for consistent revenue growth, effective business practices, and wider use of its ecosystem of digital currencies.

Why Were Circle’s Earnings Important?

Circle’s earnings boosted the confidence of crypto market participants.

The growth and underlying economics point to a strong long-term strategy despite a reported net loss.

Additionally, Circle made it clear that it wanted to establish itself not just as a coin issuer but as a core infrastructure platform.

If the firm manages to turn its balance sheet around towards profitable earnings, it will likely send a bullish message across the entire crypto market. Circle’s Stablecoin bets are also likely to cement the rise in the stablecoin market.