Key Takeaways

- Global exchange Crypto.com secures CFTC approval for the U.S.

- The new licence will allow the platform to enter the cleared margined derivatives market for cryptocurrency and other asset classes.

- Traders can now access leveraged products while maintaining the security and openness of a regulated clearinghouse.

Crypto.com receives approval from the U.S. Commodity Futures Trading Commission (CFTC) to offer margined derivatives in the United States. The approval comes via the firm’s unit Crypto.com | Derivatives North America (CDNA) and marks a major regulatory milestone for the global crypto platform.

CDNA, an exchange and clearinghouse already registered with the CFTC, has been granted an upgraded Derivatives Clearing Organisation (DCO) license, which allows it to provide more sophisticated products.

The new licence will allow CDNA to enter the cleared margined derivatives market for cryptocurrency and other asset classes. As a result, traders can now access leveraged products while maintaining the security and openness of a regulated clearinghouse.

It’s a significant step for CDNA, enabling it to expand beyond its previous products and become a more flexible player in the traditional derivatives market as well as the cryptocurrency industry. It also gives traders more faith in the platform by reaffirming the company’s dedication to operating in accordance with US regulatory norms.

“The full stack of CFTC-approved derivatives licenses allows Crypto.com to seamlessly provide clients with the most comprehensive and integrated derivatives experience, alongside Crypto.com’s additional product offerings including spot markets, prediction markets, stocks, qualified custody, credit and debit cards, and more,” said Kris Marszalek, Co-Founder and CEO of Crypto.com.

They add, “We sincerely appreciate the partnership with Acting Chairman Pham and the CFTC, who are working hard to carry out the crypto agenda of President Trump. We will soon bring regulated, leveraged derivatives to retail customers in the U.S. through one interface.”

Crypto.com Secures Additional FCM Licence

Crypto.com, through its arm Foris DAX FCM LLC (operating as Crypto.com | FCM), has also received approval as a Futures Commission Merchant (FCM) from the National Futures Association (NFA). This means the platform can now officially act as a middleman for derivatives trading in the U.S., connecting both retail and institutional clients to the market.

With this status, Crypto.com can offer futures and other derivative products in a regulated and secure environment, ensuring client funds are protected and trading practices meet strict compliance standards.

The approval is a major milestone for Crypto.com in the U.S., allowing it to expand its derivatives offerings and provide a safer, more reliable platform for investors looking to trade crypto and other asset classes.

Crypto.com Secures CFTC Approval: Why is It Important?

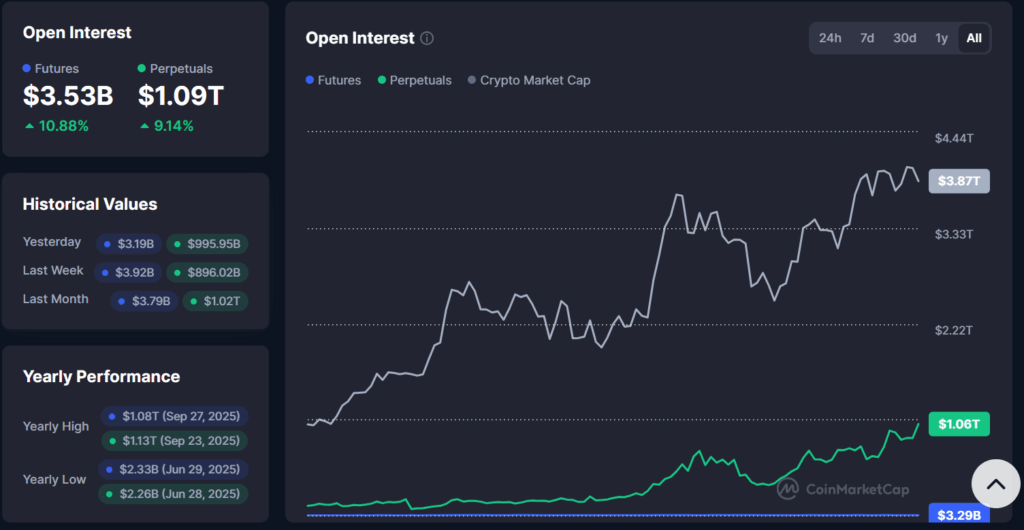

The CFTC approval comes at a time when the hype for derivative products has seen a steady rise in the States. The U.S. crypto derivatives market is gaining ample amount of traction, especially when it comes to margined products.

These trading instruments let investors take bigger positions than their initial investment, which means the potential for higher profits, but also bigger risks. That’s part of why they’ve become so popular with both retail investors and institutions, who are looking to capitalize on cryptocurrency price swings.

The buzz around margined crypto derivatives is being driven by a few key factors. Clearer regulations and licenses for trading platforms make investors feel safer. Growing institutional participation, especially from hedge funds to family offices, adds credibility and liquidity.

On top of that, advancements in technology, like faster trade execution, real-time clearing, and better risk management tools, make the market more accessible and secure. All of this has helped margined derivatives become a central part of the U.S. crypto landscape, bringing more sophistication, liquidity, and mainstream attention to the market.