Key Takeaways

- Ethereum (ETH) is approaching a key support level at $3,750, a zone with a strong history of price reversals, suggesting that a 10% jump may be on the horizon.

- With a solid track record of reversals, whale accumulation and over-leveraged long positions among traders continue to rise.

- Ethereum’s bullish outlook can only be validated if the ETH price sustains above the $3,750 level.

Ethereum (ETH) is once again experiencing buying pressure as it approaches the key support level of $3,750 for the fourth time in the past three weeks. Previously, whenever the asset’s price reached this level, it witnessed a strong price reversal, a pattern that appears to be the key catalyst behind whale and institutional participation.

Whales and Institutional Activity

Today, on-chain analytics platforms Onchain Lens and Lookonchain shared a post on X highlighting recent whale and institutional activity.

According to the post, renowned whale Machi Big Brother continued to increase his 25x long bets on ETH. With today’s rise in long positions, Machi’s 25x ETH long has reached 1,901 ETH, worth $7.26 million, with a liquidation level at $3,726.5.

Additionally, a newly created wallet address 0x698 deposited 5.18 million USDC on Hyperliquid and opened a 25x long position on ETH. So far, whales’ total long bets on ETH have reached 7,929 ETH, worth $30.32 million, with liquidation levels around $3,280.

Besides millions worth of leveraged positions, an Ethereum whale withdrew 9,000 ETH, worth $34.66 million, from Bitget after being dormant for three months. With today’s potential accumulation, the whale’s total holdings have reached 15,127 ETH, valued at $58.4 million.

Ethereum (ETH) Whales’ Impact on Price

Considering today’s surge in leveraged long positions and millions worth of accumulation, Ethereum appears to be presenting an ideal buying opportunity. However, despite the heavy accumulation and significant leveraged exposure, these activities have yet to influence ETH’s price, which remains largely unchanged today.

According to the latest data from TradingView, ETH is currently trading around the $3,830 level, recording a modest 0.70% price uptick. However, market participation has declined compared to the previous day, as reflected in the 10% drop in trading volume, which now stands at $36.25 billion.

Technical Outlook and Key Levels to Watch

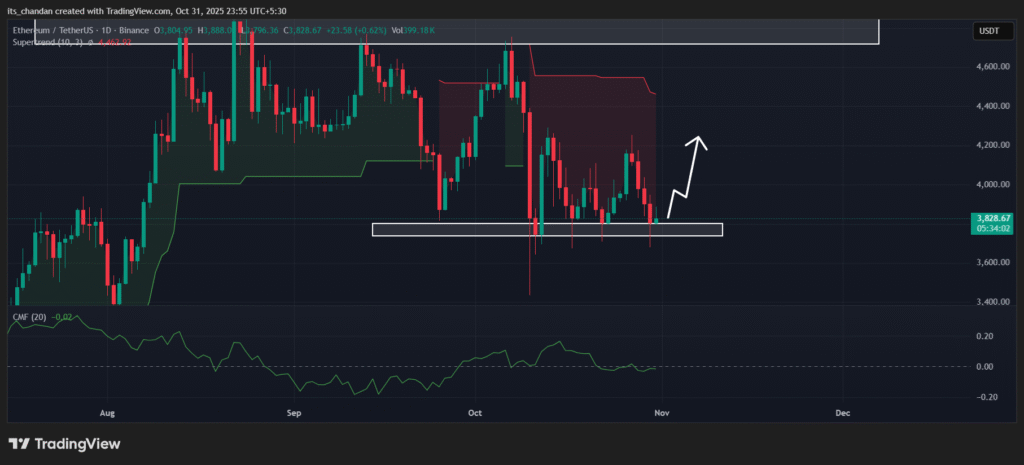

Technical analysis from TimesCrypto indicates that ETH is currently hovering around a crucial make-or-break level at $3,750, a zone known for triggering price reversals.

On the daily chart, since October 10, 2025, ETH has tested this support level more than three times, and each time, it has rebounded strongly, recording a notable price reversal and a significant uptick.

Based on the current price action, if ETH manages to hold and sustain above the $3,750 support level, there is a strong possibility that history could repeat itself, with the price potentially climbing toward the $4,200 level.

On the other hand, if the asset fails to maintain this support, it could experience a sharp decline, possibly dropping to $3,400 or even lower.

Besides the potential for a price reversal, ETH’s Supertrend indicator continues to flash a red trend and hovers above the asset’s price, indicating that ETH remains in a downtrend. Meanwhile, the Chaikin Money Flow (CMF) value stands at -0.02, suggesting weak buying pressure and showing that sellers still dominate the market.