Key Takeaways

- As the Ethereum price continues to decline, whales have seized the opportunity to add $41 million worth of ETH.

- Price action suggests that Ethereum is on the verge of a potential reversal, provided it holds the $3,900 level.

- Experts say $3,900 is a key support level, and if ETH holds it, the price could rise to $5,000–$6,000.

As the Ethereum price continues to decline, a crypto whale is seizing the opportunity by purchasing $41 million worth of ETH. This recent whale accumulation gives hope to investors and market participants, suggesting not only that the asset could soon recover but also that this might be an ideal buying opportunity.

Whale Adds $41 Million of ETH

Today, on-chain analytics platform Onchain Lens revealed that a newly created crypto wallet address, “0x6d83,” withdrew 10,009 ETH worth $41 million from Binance, the world’s largest crypto exchange. The whale’s activity was recorded while ETH was consolidating within a tight range near the lower boundary of the $4,050 level.

However, the Ethereum price later broke below the lower boundary and is now approaching a major support level at $3,900.

Also Read: Ethereum Price News: ETH Trades below $4,200; Exit or Hold?

Current Price and Expert Insight

According to the latest TradingView data, Ethereum is currently trading near the $3,935 level, marking a 4.65% price decline. Meanwhile, investor and trader participation has decreased compared to the previous day, as reflected in the trading volume. Data from CoinMarketCap shows that ETH’s 24-hour trading volume has dropped by 27% to $52.6 billion.

Looking at the current price momentum, a well-followed crypto analyst shared a post on X noting that the $3,900 level is a major support for Ethereum. The analyst further stated that if ETH holds this level, there is a strong possibility the asset could move toward the $5,000 or even $6,000 level.

Ethereum Whales on Buying Spree

Yesterday, Lookonchain also reported that a newly created wallet purchased 26,199 ETH worth $108 million from FalconX. The analytics platform noted that this wallet might be linked to Tom Lee’s BitMine, which appears to be increasingly interested in accumulating Ethereum.

Recently, the firm also added 202,037 ETH worth $838 million to its holdings following the market crash last week.

With continuous accumulation, BitMine’s total ETH holdings have surpassed 3 million (3,032,188 ETH), worth $12.58 billion.

Looking at the current market sentiment and the ongoing accumulation by whales and institutions, it seems that Ethereum has strong potential.

Ethereum Price Action: Upcoming Levels

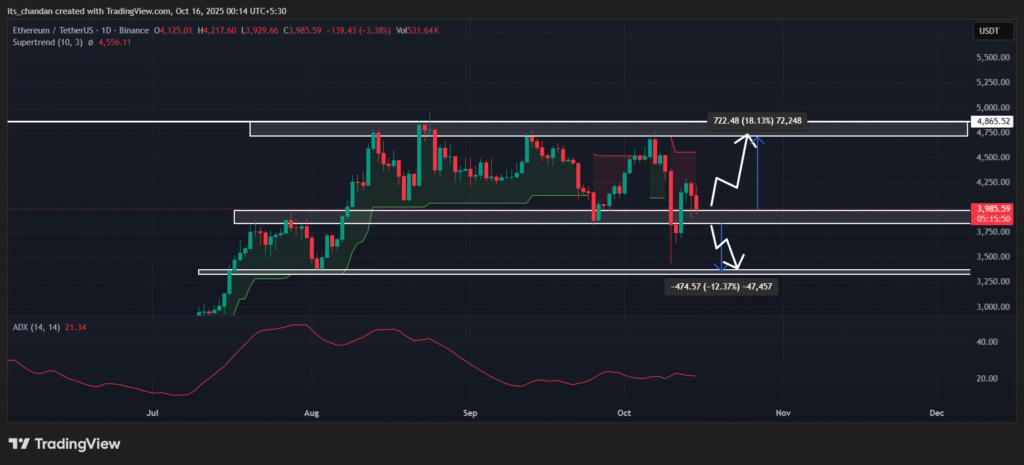

While examining Ethereum’s daily chart, it appears that the asset has been moving within a parallel channel pattern between the upper and lower boundaries since the beginning of August 2025. At press time, the asset is hovering near the lower boundary, which has a history of price reversals.

Based on the current price action, if Ethereum sustains the $3,900 level, it could experience an 18% price uptick and reach the $4,700 level or even higher.

On the other hand, if ETH fails to hold this support, it could see a sharp decline and drop to the next support level at $3,375.

The daily chart reveals that ETH’s Supertrend indicator continues to display a red trend and hovers above the asset’s price, indicating that it is in a downtrend. Meanwhile, the Average Directional Index (ADX) stands at 21, suggesting weak directional momentum.