Key Takeaways

- Ming Shing will purchase the Bitcoins from the British Virgin Islands–registered Winning Mission Group.

- Under the deal, the Hong Kong-based firm will buy 4,250 BTC at an average price of $113,638 per coin.

- Ming Shing’s Bitcoin bet has further solidified the idea that the institutional demand for Bitcoin has been growing in the market.

Hong Kong’s Ming Shing Group is firming its bets on Bitcoin by agreeing to purchase 4,250 BTC worth $483 million. The move positions the company as one of the first in the construction sector to invest in Bitcoin.

Ming Shing has been holding Bitcoin since January 13, 2025. The firm currently holds 833 Bitcoins, valued at $94.93 million.

The Nasdaq-listed firm, active in wet trades, will purchase the Bitcoins from the British Virgin Islands–registered Winning Mission Group. Under the deal, the company will sell 4,250 BTC to Ming Shing at an average price of $113,638 per coin.

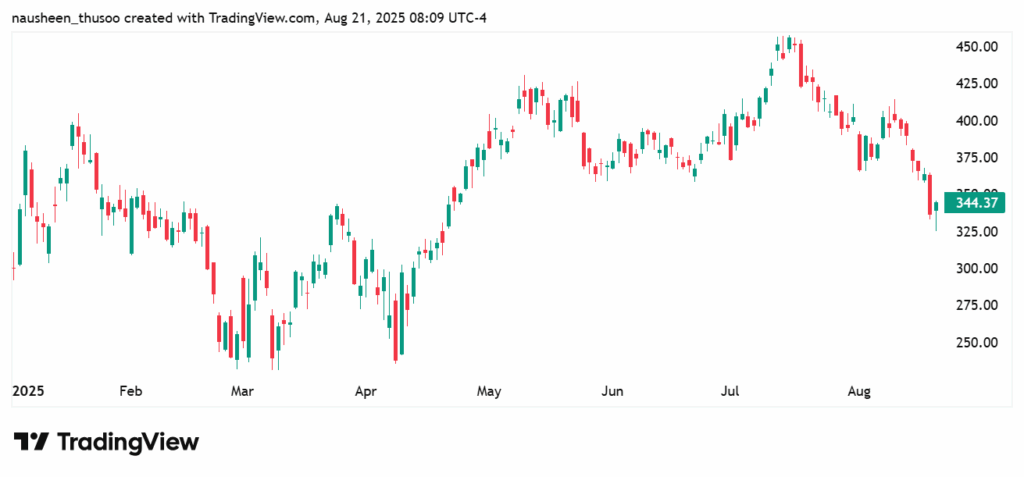

The initial market reaction to the news saw Ming Shing’s stock rise over 29%. The share price later closed the trading day up over 11%. The current market capitalization also stands at $21.409 million.

Hong Kong’s Ming Shing to Close Bitcoin Deal By Paying in Warrents and Convertible Promissory Notes

Ming Shing is choosing a different approach to the huge 4,250 Bitcoin buy rather than paying cash up front. The corporation will use convertible promissory notes and equity warrants.

In simple words, this implies that the seller is receiving more than just cash but rather may also be acquiring a share in Ming Shing’s future. Further warrants allow the seller to purchase stock at a predetermined price, and convertible notes can thereafter be exchanged for company shares.

This strategy locks in the Bitcoin purchase while assisting Ming Shing in keeping its funds. Additionally, if Ming Shing gets stronger and its value rises, it offers the seller an opportunity to profit.

Wenjin Li, Chief Executive Officer of Ming Shing, commented, “We believe the Bitcoin market is highly liquid and the investment can capture the potential appreciation of Bitcoin and increase the Company’s assets.”

Ming Shing’s Bitcoin Deal Cements Rise in Institutional Demand For Bitcoin

Ming Shing joins the list of industry behemoths like MicroStrategy, Metaplanet, and MARA Holdings, which have set a market trend of accumulating a large amount of Bitcoin in the company’s treasury.

Following their footsteps, other businesses have also started regularly purchasing the OG-cryptocurrency via different means, hoping for similar crypto profit returns as the big giants.

Bitcoin’s upward trajectory boosted investors’ confidence, surging the stock prices of these firms as well. Microstragy is currently trading at a premium of 14.75% YTD.

Ming Shing’s Bitcoin Accumulation Comes Amid Hong Kong’s Friendly Approach Towards Crypto

Ming Shing’s Bitcoin purchasing spree comes at a time when Hong Kong is growing its crypto user base. Hong Kong is rapidly becoming a key location for Bitcoin trading. Due to its open policies and the increasing interest from international investors, it has become a digital asset hotspot.

However, Hong Kong’s leniency in crypto laws is quite the opposite from mainland China. To reduce financial risks, China has imposed arguably the harshest crypto restrictions in the world, outlawing mining, trading, and initial coin offerings. As a state-controlled substitute, the government instead advertises its digital currency, known as the CBDC.

However, in Hong Kong, exchanges, investors, and companies are all actively involved in the city’s robust cryptocurrency ecosystem. Hong Kong’s cryptocurrency business is expected to generate over $171.5 million in revenue by 2025, per Statista projections.

Furthermore, this figure is anticipated to continue increasing, rising by about 4% annually. The overall revenue may amount to $178.4 million by 2026. Hong Kong’s consistent rise indicates that it is not just gaining attention at the moment but is also poised to become even more significant in the global cryptocurrency industry.