Key Takeaways

- Hyperliquid (HYPE) jumped 11%, defying the broader market trend; price action hints that another 25% rally is on the horizon, but only if certain conditions are met.

- The HYPE rally was potentially driven by a trendline and double-bottom breakout, along with strong whale bets on long positions.

- The only factors weakening HYPE’s bullish outlook are its weak fundamentals, with TVL and DEX volume continuing to decline.

The bullish sentiment around Hyperliquid (HYPE) is intensifying following a decisive breakout and strong whale activity in long positions. These developments have triggered a significant 11% price uptick in the asset today and opened the door for further upward momentum.

Market Sentiment and HYPE Price Momentum

Data from TradingView reveals that HYPE’s impressive price uptick has not only ended its bearish trend but also defied the overall market trend by outperforming Bitcoin (BTC) and Ethereum (ETH) in terms of gains.

As per the latest data, HYPE is trading at $40.30, registering a price gain of over 11.55%. Meanwhile, market participants have shown strong interest in the asset, as evident from the trading volume, which jumped 25% to $749 million during the same period.

Whale Aggressively Builds Long Positions on HYPE

Today’s HYPE rally was likely driven by massive whale long bets and a bullish breakout. Recently, crypto transaction tracker Lookonchain shared a post on X revealing that the whale wallet address 0x082e is aggressively building up HYPE long positions. So far, the whale has accumulated 1.017 million HYPE, worth $39.68 million, in long positions.

HYPE Technical Outlook: Upcoming Levels

This position was built when HYPE broke a prolonged descending trendline that the asset had been following since the beginning of October 2025. The four-hour chart reveals that HYPE not only broke the descending trendline but also confirmed a bullish double-bottom pattern.

Based on the current price action, if HYPE successfully closes a four-hour candle above the neckline at $39.90, it could soar by 25% and reach the $50 level. However, if momentum shifts and the price fails to close above the neckline, the asset’s bullish thesis will be invalidated.

Despite the impressive price rally, HYPE remains in a downtrend as it continues to trade below the 200-day Exponential Moving Average (EMA). Meanwhile, HYPE’s Chaikin Money Flow (CMF) currently stands at 0.01, indicating weak buying pressure and limited capital inflows into the asset.

Despite all these bullish developments, Hyperliquid still has weak fundamentals, which appear to be a red flag for HYPE holders.

Hyperliquid’s Fundamental Flashes Red Flag

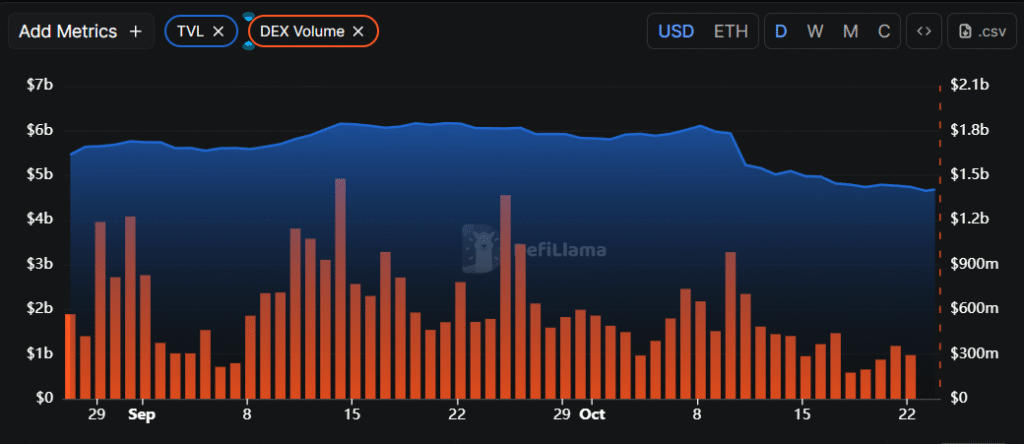

According to DeFi aggregator tool DeFiLlama, Hyperliquid’s Total Value Locked (TVL) on the protocol continues to decline.

TVL represents the total amount of assets locked in the protocol, including lending platforms, liquidity pools, or staking. A rising TVL indicates strong investor confidence, trust, and higher platform usage, whereas a declining TVL signals falling confidence and poor market conditions.

Data reveals that Hyperliquid’s TVL has been declining since October 10, 2025, dropping from $6.11 billion to $4.685 billion at press time. Similarly, DEX volume fell from $654.6 million to $292.73 million, signaling weakening fundamentals.