Key Takeaways:

- Dogecoin ETF has a 93% likelihood chance of approval according to Santiment, which is driving the positive momentum.

- Whale wallets with 1 million to 10 million DOGE now control 7.23% of supply (10.91 billion coins), a four-year-high.

- ETF approval could increase liquidity and institutional interest, but Santiment warns that much of the gain is of a speculative nature.

Dogecoin (DOGE) is presenting a highly bullish outlook, surging 18% in just one week and 4% in the last day. Moreover, the trading volume for Dogecoin has increased by 28% over the last 24 hours.

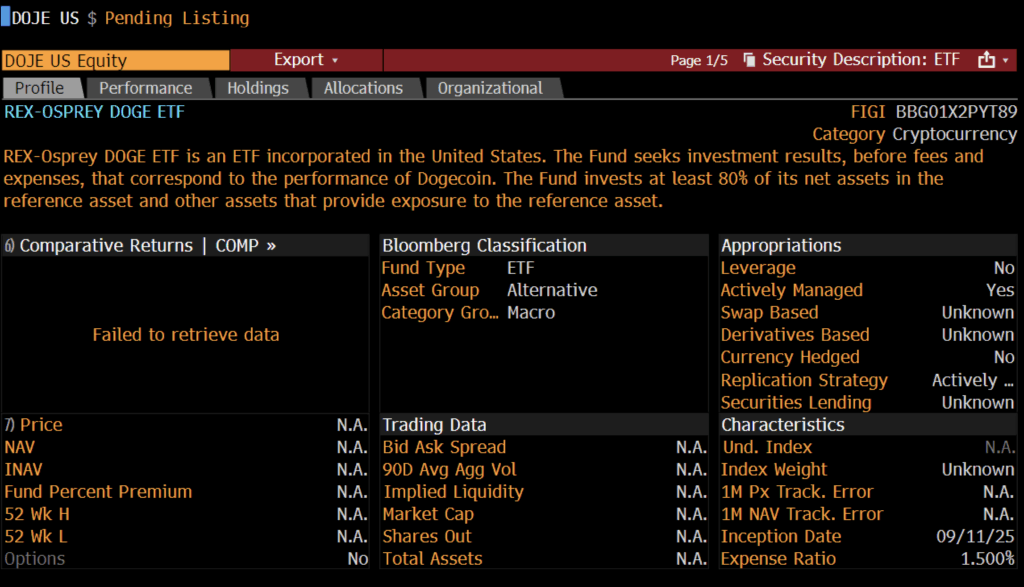

The reason for the sudden surge in Dogecoin’s price is due to speculation circling the Dogecoin’s first exchange-traded fund (ETF) on the verge of approval. According to Santiment’s Brian Quinlivan, the Rex-Osprey Dogecoin ETF ($DOJE), supported by REX Shares and Osprey Funds, is set to start this week and has a 93% chance of approval.

Upon approval, the ETF would allow US investors to gain exposure to Dogecoin through their brokerage accounts, potentially bringing in billions of dollars in liquidity. Entrusting a financial provider to hold Dogecoin through their brokerage accounts would eliminate the need to hold or store Dogecoin directly. This would be a significant milestone for meme currencies, propelling them closer to mainstream financial assets.

Whales Positioning Ahead of Dogecoin’s ETF

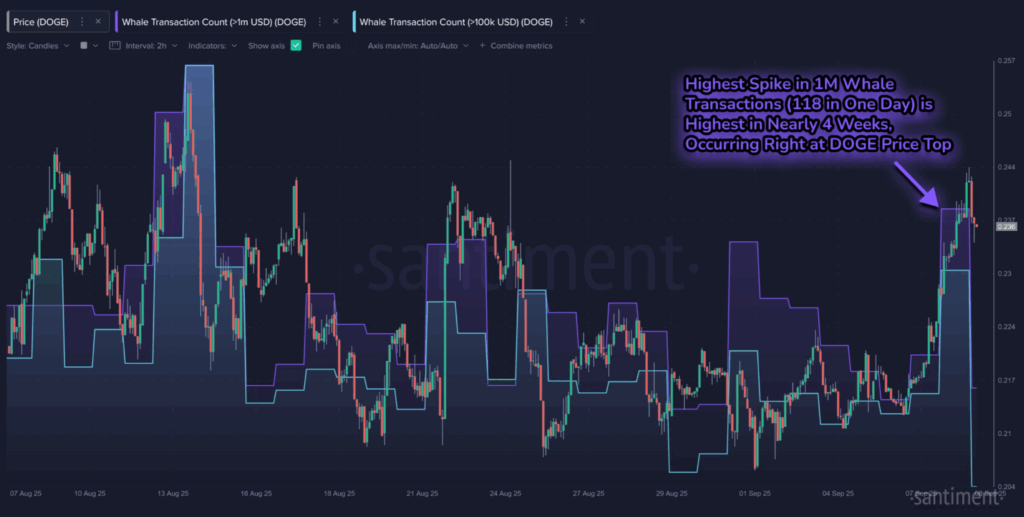

According to on-chain data from Santiment, a significant surge has been observed in Dogecoin transactions. Whale transactions have exceeded $1 million, reaching 118 transactions in one day, the highest in nearly four weeks.

The timing of the surge in transactions came at a time during the recent rally for Dogecoin, potentially indicating that some whales could have booked profits during the ETF-driven rally.

Based on the chart, the whale activity by Doge holders shows that they initially drove prices lower in mid-August, booking profits fueled by early ETF speculations.

The whales then strategically started accumulating during the market bottom right before September. But the recent data show they cut profits precisely before the latest recovery stalled.

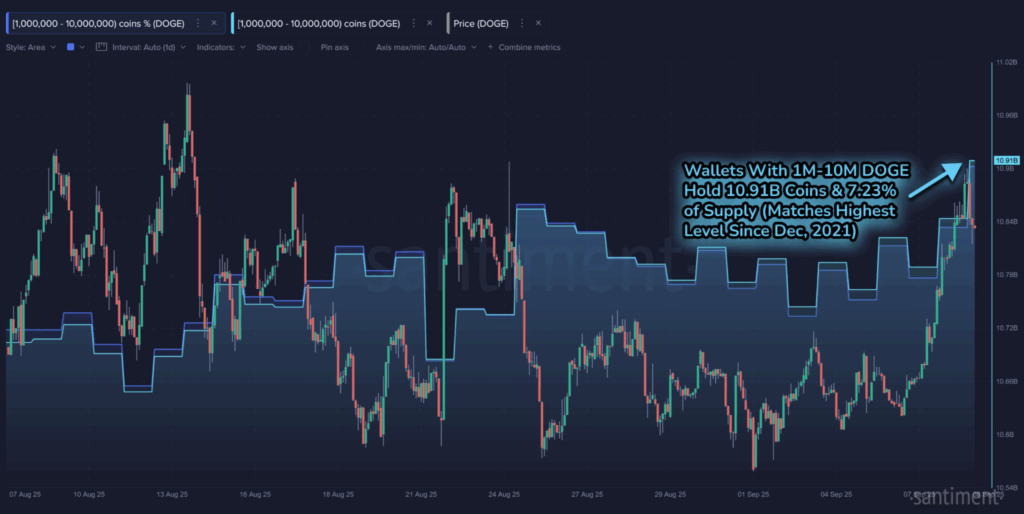

Moreover, to further understand the sentiment of whales, whale holdings are a good way to gauge a bullish or bearish sentiment. Based on Santiment’s data, wallets holding between 1 million and 10 million Dogecoins now control 7.23% of the market supply or 10.91 billion coins. Which is nearly a 4-year high, according to Santiment.

All of these factors point to a push-pull dynamic in the market: while whales are taking advantage of short-term volatility, their continued accumulation suggests rising confidence that DOGE’s ETF milestone will start a bigger, more lasting rally.

Dogecoin’s price surged in mid-August on prior ETF reports, but swiftly fell as whales took profits. Recent rallies have once again been linked to ETF discussion, with prices rising and trade volumes increasing. However, Santiment warns that much of the excitement is based on speculation and may not reflect long-term fundamentals.

What’s Next for Dogecoin?

If approved, the $DOJE ETF would lead to a humongous liquidity drive for Dogecoin, potentially attracting a larger investor base consisting of retail and institutional investors. The Dogecoin ETF could also pave the path for future meme-coin ETFs. However, whether Dogecoin can maintain momentum is dependent on adoption and development after the hype cycle.

For the time being, all eyes are on regulators and whales to see if Dogecoin moves beyond meme status and into mainstream ETF territory.