Key Takeaways

- Japan’s FSA is mulling plans to allow a domestic fiat-pegged digital currency.

- The country is signalling a softer regulatory stance with plans for a Yen-Backed Stablecoin.

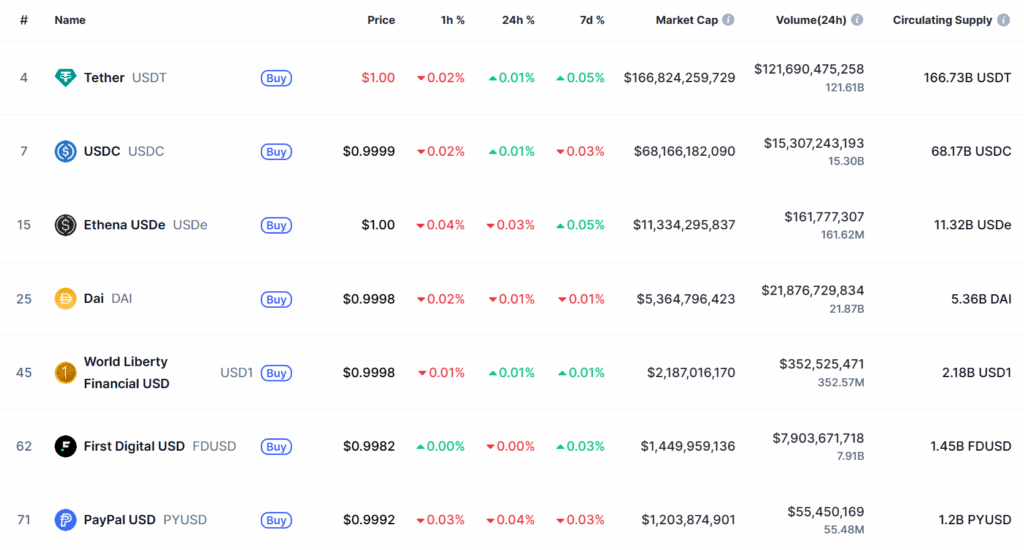

- Until now, most digital currency users in Japan have relied on these dollar-based stablecoins.

The Japanese stablecoin market takes a major step forward, with the Financial Services Agency (FSA) preparing to greenlight a yen-backed stablecoin later this year. According to a Nikkei report from Sunday, Japan’s FSA is mulling plans to allow a domestic fiat-pegged digital currency for the first time.

The regulation will underscore Japan’s strength as an international stablecoin market leader. The token will serve multiple purposes, from global remittances to corporate settlements. The implementation will be spearheaded by Tokyo-based fintech company JPYC, which will register as a money transfer company within the upcoming month.

The move would foster faster settlements, cheaper cross-border payments, easier integration with DeFi, and a push for local businesses to adopt blockchain payments. Japan will be competitive with global competitors like USDC, Tether, and China’s digital yuan.

Japan’s Stablecoin Issuance Signals Relaxed Take on Crypto

Japan has been quite restrictive on the crypto market following the painful lessons learnt from the 2014 Mt. Gox collapse.

The breach saw hundreds of BTC worth $460 million being taken away from the crypto exchange. Japan responded by enacting stringent registration regulations for cryptocurrency exchanges in 2017, making it one of the first nations to do so.

The Financial Services Agency (FSA) closely monitors the cryptocurrency market movements to ensure platforms adhere to strict security and consumer protection guidelines.

However, the launch of a Yen-backed stablecoin signals a relaxed take, with investors finding freedom to trade government-supported stablecoins.

The Yen-dominated currency would also fit within new regulations that came into effect in 2023 in Japan, allowing banks and trust companies to issue stablecoins under clear guidelines.

Further, a Yen-backed stablecoin could boost institutional support for crypto in the nation, indicating a general shift from crypto as speculative trading to mainstream financial infrastructure.

Japan To Compete on the Global Stablecoin Curve For Dominance: But There is a Twist

The possible issuance of Japan’s Yen-backed stablecoin comes with a strange warning from Hong Kong’s SFC.

Investors have been cautioned by Hong Kong’s financial watchdog, the SFC, to stay vigilant about Stablecoin scams. The warning follows the new Stablecoin Ordinance that came into existence on August 1.

According to the regulator, dangers such as fraud and scams are still possible even if the law increases control. The policymaker advised market participants to exercise caution while dealing with cryptocurrency and to avoid making hasty trades.

With Hong Kong struggling to keep scammers at bay, it will be interesting to see how Japan tackles the issue, especially after rolling out the Yen-backed stablecoin.

Yen-Dominated Issuance Comes as Stablecoin Market Sees Steady Rise

Japan is set to approve its first yen-backed stablecoin just as the global stablecoin market surpasses $286 billion, mostly dominated by dollar-pegged tokens like USDT and USDC.

Until now, most digital currency users in Japan have relied on these dollar-based stablecoins. The new yen option will give residents a homegrown alternative, making it easier to transact in local currency while staying within a regulated framework, and signaling Japan’s move to strengthen its presence in the rapidly growing digital asset space.

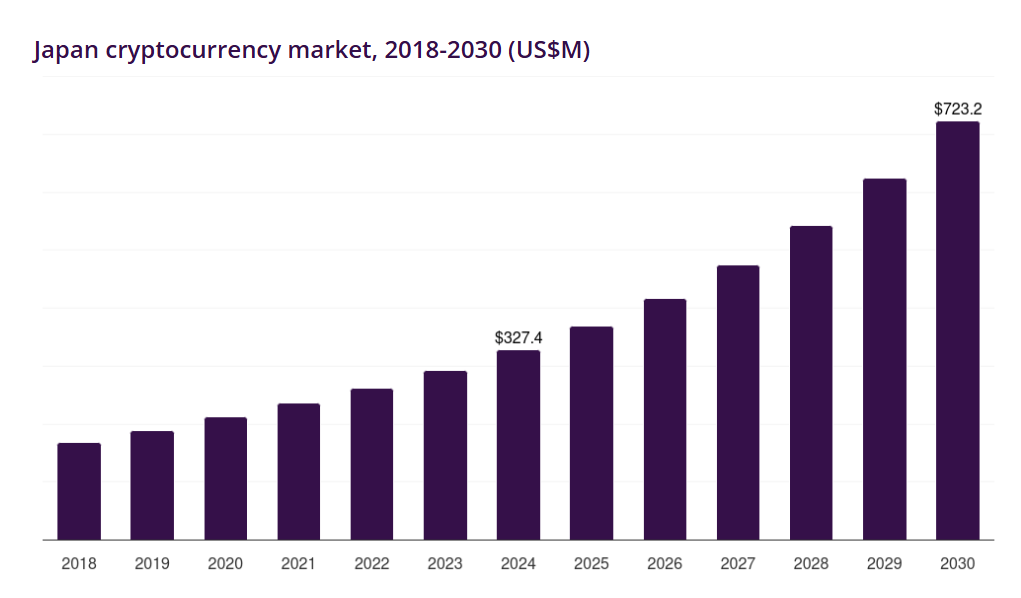

Additionally, the move also comes as Japan prepares itself for a rapid growth in the digital asset sector. According to Statista projections, the Japanese crypto market will expand at a 14.4% CAGR between 2025 and 2030. With a rise in market and userbase, it is likely that Japan’s stablecoin move will push the nation towards becoming a digital asset hub in Asia.