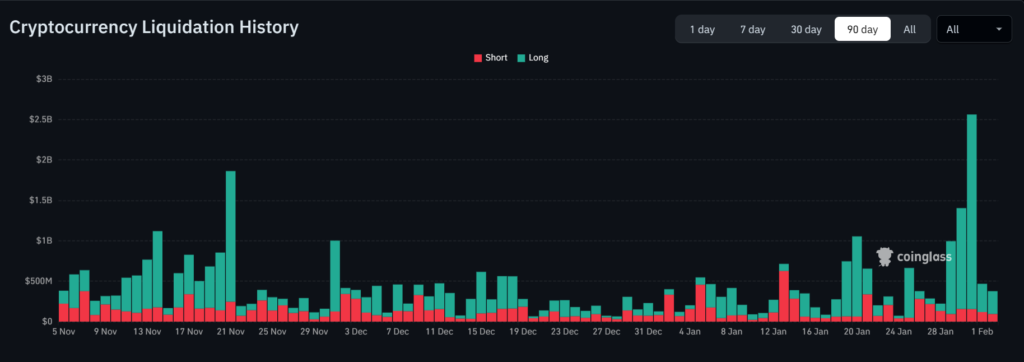

The whole cryptocurrency market had witnessed a significant drop on Saturday, which resulted in more than 2.56 billion dollars of forced liquidations from derivatives markets. The market shows price weakness, but investors must understand the present market decline because it will determine whether the current drop marks a short-term correction or begins a long-term market downturn. According to the liquidation data from Coinglass, in the past 24 hours, 202,603 traders were liquidated, and the total liquidations stand at $799.09 million.

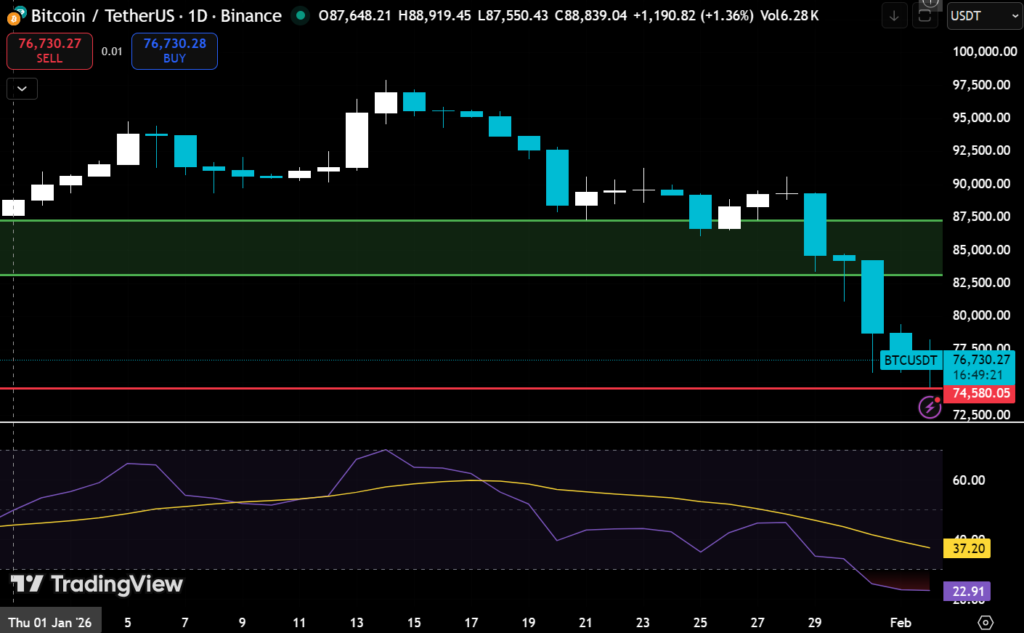

Year-to-date, Bitcoin has fallen about 14% to roughly $75,000, while most major and minor tokens are down 15%–25%. Revenue-generating tokens like AAVE have dropped 26%, though a few, such as Hyperliquid’s HYPE, have risen around 20%, bucking the broader trend. The persistence of BTC-led moves is supported by a large stablecoin supply, Bitcoin’s market dominance remaining above 50% since the launch of U.S. spot ETFs, and ongoing institutional flows, suggesting continued supremacy of the largest cryptocurrency and limited potential for meaningful altcoin decoupling.

Why Is Crypto Falling?

Excess Leverage Finally Unwound

Crypto prices did not fall because demand suddenly vanished. They fell because leverage reached unstable levels. In the months leading up to the decline, derivatives open interest remained elevated even as spot market momentum slowed. Many traders have been sticking to their leveraged buy positions. The main fuel for the trend was primarily due to comparatively low funding rates; they have been looking to price higher again.

When prices began to slip, these positions became vulnerable. Margin thresholds were breached, triggering automated liquidations. More than 93 percent of the liquidated positions were longs, confirming that the sell-off was driven by forced deleveraging rather than discretionary selling.

Liquidity Was Too Thin to Absorb Selling

The liquidations chart shows that the current liquidation event represents the biggest liquidation event that has occurred since the Oct 10 crash that resulted in a loss of over $19B within one day. The market did not have enough liquidity to handle the increasing liquidations because forced orders were being executed at an unsustainable rate. Order books showed limited depth, especially during times when trading volume decreased. The specific conditions that existed led to liquidation engines executing at successively decreasing price points, which resulted in greater market decline.

Crypto markets operate without circuit breakers or trading halts. Once the liquidation process started, there were no structural mechanisms to slow it down. Selling pressure therefore cascaded across assets and exchanges.

Macro Pressure Reduced Risk Appetite

The economic situation at the global level more powerful than all other factors brought about the economic downturn. The U.S. Bitcoin exchange-traded funds experience ongoing outflows which show a decreasing interest from institutional investors with the value standing at $509.70M. Investors showed less interest in putting their money in the riskier assets because the U.S. dollar gained strength and geopolitical tensions continued to cause uncertainty. Market participants showed no interest in buying cryptocurrencies which led to automated selling that caused their prices to drop.

Market Structure Magnified the Move

Derivatives markets play a central role in crypto price discovery. When leverage is heavily concentrated on one side of the market, price declines do not simply reflect sentiment shifts. They mechanically force additional selling. This structural feature explains why crypto often experiences rapid, nonlinear drawdowns.

The primary function of derivative markets creates the main method for determining cryptocurrency prices. The market shows price declines because traders use their leverage to control only one direction of trading. The system operates through automatic processes that generate mandatory selling requirements. Cryptocurrency markets have a structural feature where markets have extremely volatile price crashes during trading in a sudden and unpredictable way.

What Has Changed After the Sell-Off?

Following the liquidation event, open interest fell sharply and funding rates normalized. This indicates that excess speculative exposure has been removed from the system. Historically, such resets reduce short-term downside risk because fewer positions remain vulnerable to liquidation. However, reduced leverage also means that upside momentum tends to recover more slowly.

Crypto markets enter consolidation phases, which follow major liquidation events. The trading activity of market participants decreases since they require time to assess their risk status and their positions have become stable. This phase can feel directionless but is often a necessary precursor to a sustainable trend. As leverage decreases, the spot market becomes more influential in determining price changes. The market structure functions more effectively considering spot demand, which represents actual investment activities that the market participants make through funds instead of using borrowed money.

Will the crypto market rise again?

A successful recovery needs new investments to enter the market, which requires more than just better market perceptions. The market will experience this increase from renewed ETF investments, improved macroeconomic conditions, and higher spot market purchasing. The absence of new market demand will restrict price increases to temporary and weak recoveries. The current scenario requires less exposure to leverage; the main reason is that all weak hands have been flushed out of the market, which reduces the risk of immediate market declines. The wider macroeconomic conditions show that major liquidation events throughout history have preceded both extended market consolidation periods and the initial phases of market recovery.

The primary downside risk is a rapid return of aggressive leverage before spot demand recovers. If open interest climbs faster than liquidity, the market remains vulnerable to repeat drawdowns.