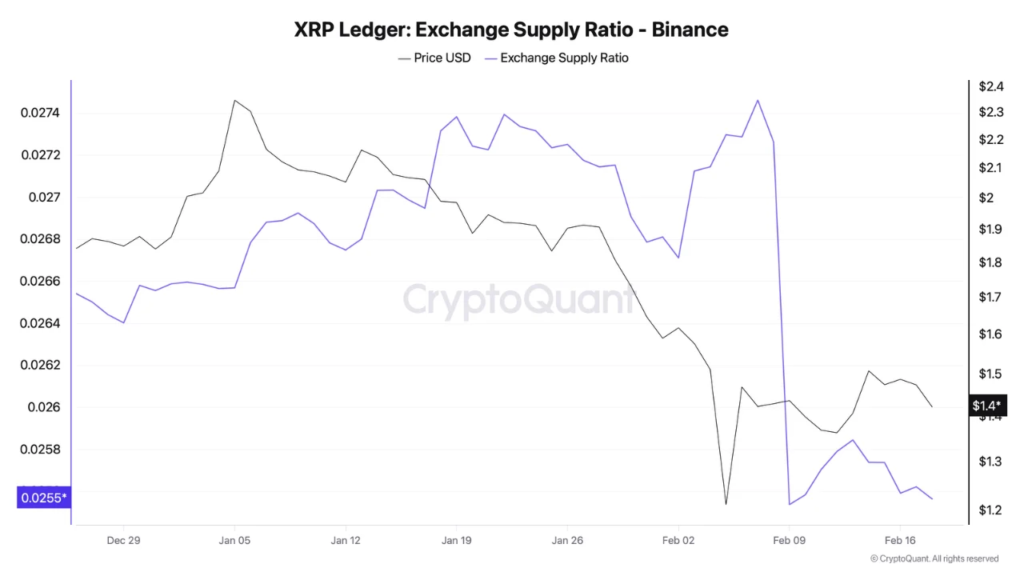

The most recent CryptoQuant chart indicates that XRP Ledger’s Exchange Supply Ratio on Binance is going through a clear downward trend. This ratio indicates the percentage of the XRP total supply that currently exists on the trading platform. The value slipped from 0.027 to 0.0255 during the past ten days. The cost of XRP experienced a decline that started at approximately $2.00 and reached about $1.40 by mid-February 2026.

The decreasing supply ratio indicates that Binance currently holds fewer XRP tokens than the total existing supply. The platform experienced a net outflow of about 200 million XRP during this particular timeframe. Exchanges sometimes move money around for business reasons, but Binance makes its custody addresses public. This transparency allows the individuals to distinguish between standard transactions and actual user withdrawals. The pattern indicates that capitalists drive the current market activity.

What Falling Exchange Reserves Mean for Investors

When tokens leave exchanges and go to private wallets, it usually means that the people who own them are doing something different. Investors are taking their assets off of trading platforms so they can hold them for a longer time. This makes the supply available for sale right away smaller. On the other hand, large inflows to exchanges usually mean that people are getting ready to sell.

The current outflow on Binance fits a pattern of accumulation. It looks like investors see current prices as good places to get in, so they are building positions instead of selling. XRP has already had a big drop this year, going down about 40% from its highs in January, which were around $2.30. Lower prices can attract buyers who plan to hold on through future market cycles instead of trading short-term swings after such a pullback.

This fits with how the crypto market works in general. During corrections, investors who are patient often move their coins to private storage. This takes the pressure off of selling from exchange order books and could lead to a stronger recovery when demand comes back.

Context From Recent Market Movements

XRP is now exchanging hands at nearly $1.41 at the time of writing, following the high volatility. Earlier this month, the asset dipped more swiftly, but it has lately stabilized around this level by making a liquidity sweep. The exchange supply ratio went up to 0.0258 for a short time prior to going back down.

The on-chain activities show that Binance experienced a significant decline in its XRP holdings because its current reserves reached their lowest point within the last several years. The exchange experiences continuous token outflows with the price decline, which demonstrates that investors now follow different investment patterns. The continuous drop in reserves at Binance, which processes most of the XRP market, results in decreased market liquidity for all trading activities. The platform now experiences an intense market reaction because its relative available assets have decreased from previous levels. The transfer of funds to private wallets demonstrates that investors now prioritize safeguarding their assets instead of making immediate profits through trading. The changes in storage methods will likely create long-term effects that determine how the XRP prices will react to changing market conditions.

Investors transferring XRP off exchanges are likely attempting to safeguard their assets from the risks linked with centralized platforms. This move reflects confidence in XRP’s long-term potential rather than short-term trading. The accumulation of XRP shows that people trust the network because it enables cost-efficient and rapid global transactions. The trend states that the participants expect upcoming regulatory guidance to help financial systems start using it. The holders are searching for ways to assess how their asset fits into the developing cryptocurrency market.

Possible Effects on the Direction of Prices

It is not guaranteed that the lower supply ratio will lead to upside price movement. The current asset’s prices are still influenced by how market participants feel about crypto in general, broader economic trends, and reports about Ripple. But the withdrawals that are still happening change the supply in a way that benefits buyers. If there are fewer tokens for sale on a major exchange, renewed demand could make prices go up more quickly. The recent drop has put holders’ resolve to the test. People who are still buying during this time are getting ready for a recovery. In the past, when fundamentals stayed positive, declining exchange balances often came before rallies.

In simple terms, the current trend reflects growing accumulation among market participants. Investors appear confident in the asset’s long-term potential and are moving tokens off exchanges, which reduces available supply for selling and lowers immediate sell-side pressure. Even though the price is going down, this on-chain trend shows that holders are still strong and see a chance to buy when the price goes down. Following the outflows and changes in user behavior will give us more information about XRP’s likely future.