Key Takeaways

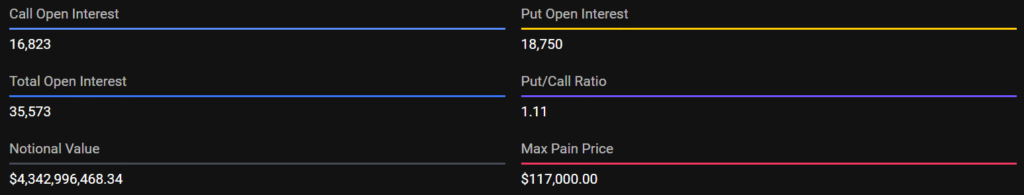

- Bitcoin options worth $4.3 billion are set to expire on Friday, which could lead to short-term volatility.

- The put/call ratio (PCR) of 1.11 signals a slightly bearish bias for the spot BTC price.

- The maximum pain level stands at $117,000, the expected strike price where maximum calls and puts option contacts expire worthless.

Bitcoin Might Face Short-term Volatility Below $120K

Bitcoin is exchanging hands near $122K, at the time of writing. Bitcoin hit its all-time high at $126.29 on October 6,2025. Over $4.3 billion in notional value is set to expire on Friday.

According to the data from Deribit, the total open interest is 35,573 contracts, out of which 16,823 contracts are call options and 18,750 contracts are put options.

The PCR of 1.11 indicates a bearish bias in the market.

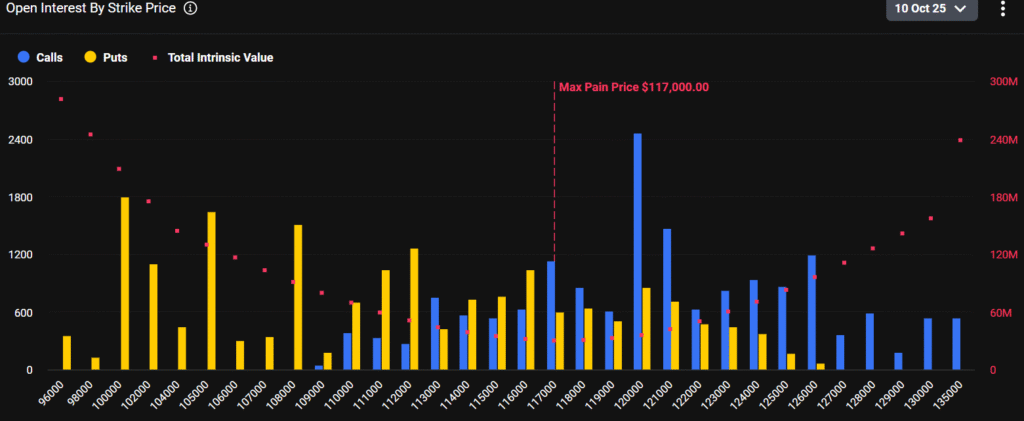

Calls Breakdown

- In-the-Money (ITM) Calls: The call options are at the strike price below the spot price. A total of 10,755 contracts with a total value of $1.313 billion, or 63.93% of the total call options.

- Out-of-the-Money (OTM) Calls: The call options above the spot price. A total of 6,068 contracts with a value of ~$740.84 million, or 36.07% of the total calls. These calls are clustered around the strike prices of $124,000–$130,000, showcasing the traders’ speculative bets for the upside in the near term.

Puts Breakdown

- Out-of-the-Money (OTM) Puts: The OTM puts with a total of 17,666 contracts worth $2,156,748,802 millions (94.22% of the total puts) are primarily concentrated between $108,000 and $114,000, that indicates a certain interest for protection against downside risk.

- In-the-Money (ITM) Puts: A total of 1,084.2 contracts valued at $132,365,760.46 millions or 5.78% of the overall puts indicates a modest degree of conviction in deep ITM positions.

A combined put value is of approximately ~$2.29 billion, with the bulk split around OTM options.

ITM vs OTM Split

The data reflect an overall majority of Out-of-the-Money (OTM) positions for both calls and puts, indicating volatility in the bitcoin price ahead of expiry.

- BTC OTM calls make up 36.07% of the total number of call contracts, indicating a slight upside momentum toward the $124K-$130K strike levels during expiry.

- BTC OTM put options, with 94.22% contracts, suggest a higher possibility that the price could swing lower.

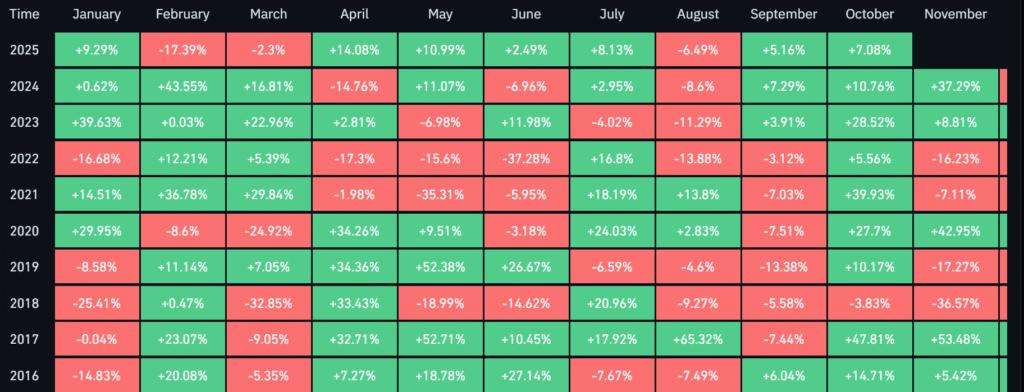

Market Sentiment, Seasonality and Traders Outlook

The $4.3 billion bitcoin options expiration might trigger volatility in the short term. Additionally, the put/call ratio is at 1.11, and the max pain level is at $117,000.

However, Bitcoin ETF’s inflow is increasing, $1.2 billion entering U.S. Bitcoin ETFs on Tuesday. Historically, October is one of Bitcoin’s strongest months, with an average gain of 18.8% nine times out of the last ten years.