Key Takeaways:

- American Bitcoin (ABTC), backed by Eric and Donald Trump Jr., debuted on Nasdaq on September 3, 2025, following its merger with Gryphon Digital Mining.

- American Bitcoin will adopt a hybrid strategy for mining and purchasing BTC, utilizing Hut 8’s infrastructure.

- The company also launched a $2.1 billion stock offering to fund BTC acquisitions and mining expansion.

Eric and Donald Trump Jr. backed American Bitcoin (ABTC), which debuted on Nasdaq on September 3rd, 2025, with ambitions of becoming the largest corporate Bitcoin (BTC) treasury.

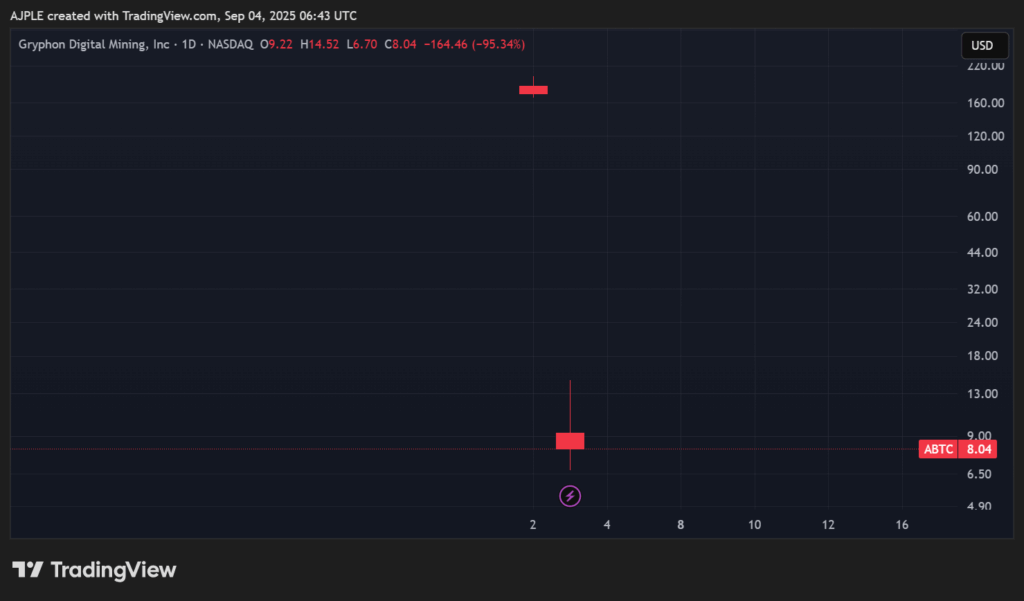

ABTC completed its stock merger with Gryphon Digital Mining, being listed at $184 and reaching highs of $200 before falling to $8.04, declining over 95%.

Eric Trump, co-founder and chief strategy officer of American Bitcoin, said the company’s vision was clear: “We’re going to win the race.”

Mining and Treasury Strategy

Unlike traditional corporate treasuries, such as MicroStrategy, which are primarily concerned with accumulating BTC, Eric Trump emphasized American Bitcoin’s hybrid approach of mining and purchasing BTC.

“We’re mining Bitcoin at roughly 50 cents on the dollar to the actual price of Bitcoin,” he told Bloomberg. “We’re mining a lot of it and using the Hut 8 infrastructure in order to do so.”

The American Bitcoin company, majority-owned by mining giant Hut 8, plans to both purchase BTC and expand mining operations to lower its average acquisition cost.

Trump framed this as a long-term strategy to cement American Bitcoin’s position as a leading corporate BTC holder. The Trump family holds several leadership roles and influence in the mining company Hut 8.

American Bitcoin’s Corporate Holdings

The American Bitcoin company holds 2,443 BTC as of the recent reports. Moreover, its mining partner, Hut 8, is the 12th largest corporate BTC holder with 10,667 BTC worth approximately $1.2 billion. Meanwhile, Trump Media and Technology Group Corp holds 15,000 BTC valued at $1.67 billion. These holdings depict a significant stake the Trump family owns in BTC.

Future Funding Plans of American Bitcoin

On Wednesday, American Bitcoin also disclosed a $2.1 billion stock offering arranged with Cantor Fitzgerald and Mizuho Securities. The proceeds will be directed toward BTC purchases and mining operations, reinforcing its dual growth strategy.

Trump Family’s Bigger Picture

Eric Trump mentioned the widespread global adoption by sovereign wealth funds, Fortune 500 companies, and even U.S. states like Texas.

He said:

I believe in Bitcoin, I’ve been a long-term owner … and the floodgates are just starting to open.

With ABTC’s Nasdaq debut, American Bitcoin positions itself as both a miner and treasury holder in the corporate BTC race, a space currently dominated by Strategy (formerly MicroStrategy). The coming quarters will determine whether the Trump-backed firm can turn political momentum and bold rhetoric into long-term dominance.