Key Takeaways

- Bitcoin (BTC) has lost the key support level of $100,000; price action suggests another 7.5% dip may be on the horizon, potentially reaching the $92,000 level.

- A crypto whale dumped $290 million worth of BTC ahead of today’s major decline.

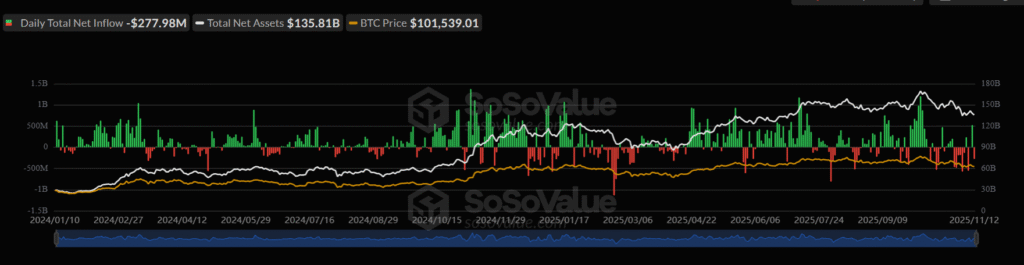

- Bitcoin Spot ETFs recorded a net outflow of $277.98 million, indicating that investors are pulling capital from these funds.

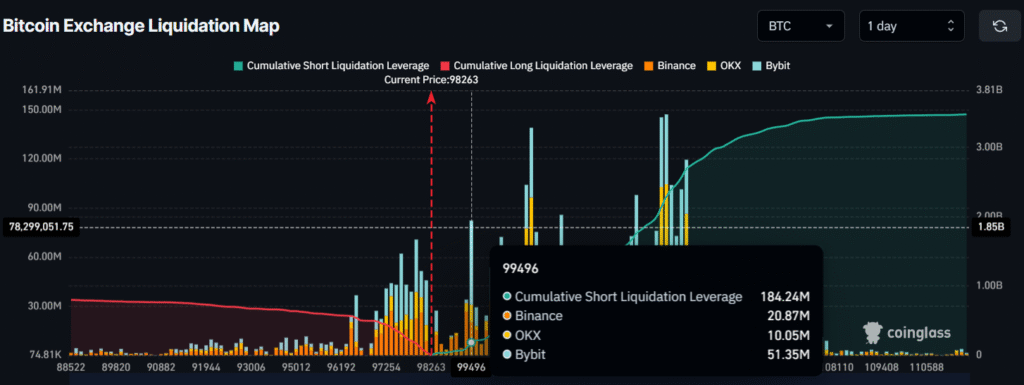

- Traders are heavily betting on short positions. Following the breakdown, the major liquidation levels stand at $97,962 and $99,496.

The risk of a Bitcoin (BTC) price crash has surged after today’s 2.3% dip, wiping out $2,300 in value. This decline comes as the asset’s bearish trend deepens, with whales and institutions showing fading interest and confidence.

Whales and BTC ETF Outflows Spark Fears of Major Dip

Today, the crypto analytics platform Onchain Lens shared multiple posts on X revealing significant whale activity. According to the post, a crypto whale known as Owen Gunden dumped 2,851 BTC worth $290 million ahead of today’s price dip.

Not just whales, but traditional American investors were also found withdrawing their capital from Spot Bitcoin ETFs. According to the on-chain analytics platform SoSoValue, on November 12, 2025, U.S. Bitcoin Spot ETFs recorded a net outflow of $277.98 million, indicating a withdrawal of capital from these listed funds. This suggests a strong bearish signal, as it occurred amid a bleeding market.

When such activity is observed from both whales and investors, it not only suggests an ideal selling opportunity but also indicates that a major decline may be on the horizon.

Bitcoin (BTC) Current Price Momentum

So far today, Bitcoin’s price has dropped by 3.05% and is currently trading at $98,500, according to TradingView data. Despite the decline, market participation has surged significantly, as evident from the 45% increase in trading volume to $88.05 billion.

Rising trading volume during a price decline suggests that market participants are interested in pushing the asset’s price further downward.

Also Read: Scammers Impersonating Police Target Australian Crypto Users in Sophisticated Scheme

Bitcoin Technical Outlook: Key Levels to Watch

TimesCrypto’s technical analysis reveals that Bitcoin’s broader market trend remains bearish, indicating that a major dip may be on the horizon.

On the four-hour chart, it is clear that BTC has formed a textbook descending channel pattern between its upper and lower boundaries. However, since reaching the upper boundary, it has continued to decline, creating a lower high and lower low structure.

Based on the current price action, if BTC fails to regain the $100,000 support level, it could see an additional 7.5% dip and may reach the $92,000 level in the coming days. However, if momentum shifts and the price recovers above the $100,000 level, BTC could rebound again.

As of press time, BTC’s Chaikin Money Flow (CMF) value reaches -0.25, indicating strong selling pressure in the market as capital continues to flow out of the asset.

BTC’s Major Liquidation Levels

Following the key support breakdown, trader sentiment has shifted notably, according to the derivatives analytics platform Coinglass. As per the latest data, traders are currently over-leveraged at $97,962 on the lower side and $99,496 on the upper side, with $142.02 million worth of long positions and $184.24 million worth of short positions built around these levels.

Combining data from derivatives tools with price action, whale activity, and negative ETF flows raises a red flag for the asset, hinting at strong bearish dominance in the market.